Keys for Collateral (executive summary)

Posted December 18, 2012 in Press Releases

Download summaryBack to full reportHow auto-title loans have become another vehicle for payday lending in Ohio

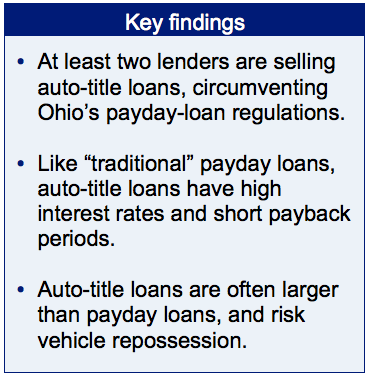

Beginning in 2012, Policy Matters and other observers around Ohio began tracking auto-title lending as a troubling development in payday lending. Our subsequent investigation reveals that at least two companies are making payday  loans in Ohio using vehicle titles as collateral.

loans in Ohio using vehicle titles as collateral.

Like storefront payday lending, auto-title lending carries a triple-digit annual percentage rate (APR), has a short payback schedule, and relies on few underwriting standards. But the new loans may be even more dangerous for struggling families than the more established storefront payday loans