Bolster the income tax to meet Ohio’s needs

February 06, 2012

Bolster the income tax to meet Ohio’s needs

February 06, 2012

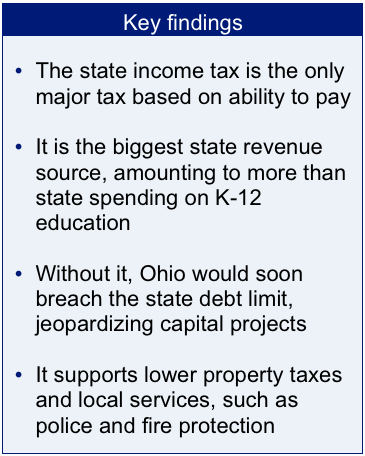

Download PDFPress releaseRelated brief: Ohio needs a strong income taxPublic services, though sometimes invisible, are a crucial element in a thriving economy. To restore critical services and invest in the future, Ohio should boost income-tax rates on its highest earners.

What higher rates on top earners would mean

State budget cuts are hitting Ohio’s schools and communities hard. More than a quarter of the respondents to a recent Policy Matters Ohio survey of Ohio school districts anticipated being in official fiscal distress in the coming year. They have been cutting hundreds of teaching positions, and many anticipate growing class sizes, cuts in spending for materials and reductions in course offerings.[1] Ohio’s public colleges and universities, already less affordable than those in all but a handful of other states, are seeing cutbacks in state support.[2] Reduction in eligibility for state subsidies makes it harder for low-income working families to get child care. Senior centers across the state struggle to stay open.[3] Libraries, their state funding chopped 27 percent over the last decade, are going to the ballot far more often for property-tax levies.[4]

State budget cuts are hitting Ohio’s schools and communities hard. More than a quarter of the respondents to a recent Policy Matters Ohio survey of Ohio school districts anticipated being in official fiscal distress in the coming year. They have been cutting hundreds of teaching positions, and many anticipate growing class sizes, cuts in spending for materials and reductions in course offerings.[1] Ohio’s public colleges and universities, already less affordable than those in all but a handful of other states, are seeing cutbacks in state support.[2] Reduction in eligibility for state subsidies makes it harder for low-income working families to get child care. Senior centers across the state struggle to stay open.[3] Libraries, their state funding chopped 27 percent over the last decade, are going to the ballot far more often for property-tax levies.[4]

Gov. John Kasich soon will propose changes in state programs and policies as part of a review of Ohio’s two-year budget, approved last June. Tax Commissioner Joe Testa has asked staffers at the Department of Taxation to ask how they would rewrite the tax code and has forwarded recommendations as part of that review process.[5]

Income-tax proposal

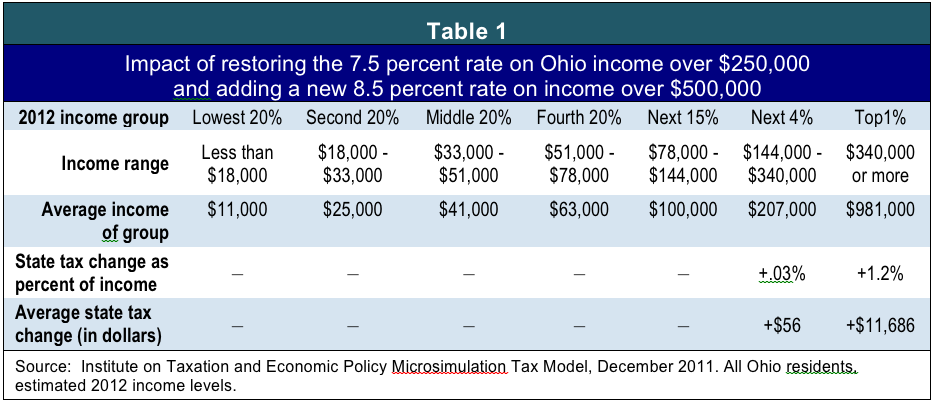

Here’s a proposal that ought to be considered to restore services and invest in Ohio’s future: Reinstituting the tax rate of 7.5 percent on income over $250,000, the rate that existed on income over $200,000 prior to the major state tax cuts enacted in 2005. According to an analysis by the Institute on Taxation and Economic Policy (ITEP), a national research institute with a sophisticated model of state and federal taxation systems, just 1.3 percent of Ohio’s taxpayers would be affected by such a step.

In addition, the General Assembly should consider creating a new 8.5 percent bracket for income over $500,000. This analysis uses ITEP’s model to examine the effects of those two steps together.

As Table 1 below shows, the combination of the two changes – restoring the 7.5 percent rate on income over $250,000 and creating the new bracket – would generate about $650 million annually. The analysis breaks Ohio residents into five income groups, or quintiles, and then subdivides the top quintile into three groups – the top 1 percent, the next 4 percent, and the remaining 15 percent. The vast bulk of the increase would be paid by taxpayers in the top 1 percent of the income spectrum, who are expected to make more than $340,000 this year.[6] On average, they would pay an additional $11,686 a year before taking into account any reduction in federal taxes. This amounts to just 1.2 percent of the group’s average income of $981,000.

Moreover, almost one dollar in five of the added state taxes would come back to Ohioans paying the higher state rates in the form of lower federal taxes. That’s because taxpayers may deduct their state income taxes when they pay their U.S. taxes.

In short, this proposal would not change the amount of taxes paid by nearly 99 percent of Ohio taxpayers. It would affect only the most affluent, who can most afford to pay, and the increases for them would be relatively small. Yet it would allow the state to make up nearly half the cuts made to public schools and local governments in the current two-year budget.

As previous studies by Policy Matters Ohio and ITEP have shown, Ohio’s state and local tax system is stacked in favor of high-income Ohioans, who pay a smaller share of their income in such taxes than low- and middle-income families do.[7] Even after the proposed changes, taxpayers making more than $340,000 on average would pay a smaller share of their income in state and local taxes than those earning a tenth as much.

More than six years of experience with the 2005 state tax overhaul has shown that income-tax cuts are no prescription for economic rejuvenation. Ohio has lost a greater proportion of its jobs – 5.8 percent – than the 1.3 percent for the United States as a whole since then. Ohio and other states in the region have benefited lately from gains in manufacturing, a long overdue and positive development. But while our unemployment rate has fallen, the recent decline has unfortunately come not so much because new jobs are being created as because workers are leaving the labor force, so they are no longer counted as unemployed.[8]

Conversely, a move to raise income taxes on the richest Ohioans won’t squash the economy. Ohio experienced strong job growth in in the 1980s and 1990s after income-tax increases under governors from both political parties.[9] Paul W. Bauer and Mark E. Schweitzer of the Federal Reserve Bank of Cleveland in a 2006 report found no statistically significant relationship between average tax rates and state income growth across the country since 1960.[10]

However a continuing underinvestment in education and infrastructure will damage Ohio’s long-term economic prospects. That includes, for instance, the need for good schools and universities to provide the educated workforce crucial for economic growth. Instead, the state is cutting aid to both K-12 schools and higher education.[11] A strong, growing Ohio depends on a healthy population and robust safety forces, yet anti-smoking efforts have been curtailed[12] and some local governments are struggling to maintain their police levels.[13]

Public services, though sometimes invisible, are a crucial element in a thriving economy. To restore critical services and invest in the future, Ohio should boost income-tax rates on its highest earners.

Policy Matters Ohio (www.policymattersohio.org) is a nonprofit, nonpartisan research organization with offices in Cleveland and Columbus. The Institute on Taxation and Economic Policy is a nonprofit, nonpartisan research group in Washington, D.C. ITEP’s Microsimulation Tax Model allows it to measure the distributional consequences of federal and state tax laws and proposed changes in them, both nationally and on a state-by-state basis.

[1] Patton, Wendy, Piet van Lier and Elizabeth Ginther, The state budget and Ohio’s schools, Policy Matters Ohio, Jan. 19, 2012, available at http://www.policymattersohio.org/wp-content/uploads/2012/01/SchoolFinanceJan2012.pdf

[2] According the National Center for Higher Education Management Systems, Ohio ranked 3d among the 50 states in 2009 (the most recent year available) for share of family income needed to send someone to a 4-year public institution and 5th among the 50 states in terms of 2-year schools. See http://bit.ly/wQaFZj. (At http://www.higheredinfo.org.)

[3] Truong, Quan, “Senior Centers Struggle for Funding as Use Grows,” The Columbus Dispatch, Jan. 16, 2012, see http://www.dispatch.com/content/stories/local/2012/01/16/senior-centers-struggle-for-funding-as-use-grows.html

[4] Since 2000, the number of Ohio’s 251 library systems with levies has more than doubled, to at least 168. Ohio Library Council and State Library of Ohio, Public Library Statistics, available at http://library.ohio.gov/LPD/LibraryStats

[5] The Hannah Report, “Tax Commissioner Says Kasich Administration Working to Simplify Tax Laws,” Jan. 24, 2012.

[6] ITEP’s projections for 2012 data are based on a combination of sources including the latest available Statistics of Income data from the Internal Revenue Service, the Congressional Budget Office and state-by-state income forecasts by Moody’s Economy.com, a nationally known economics firm. ITEP’s forecasts are based on the same information Congress has at its disposal for estimating federal revenues. For more on the ITEP microsimulation model and the income projections used see: http://itepnet.org/. ITEP estimates in this report are for total income-tax collections, not only those going to the General Revenue Fund.

[7] Institute on Taxation & Economic Policy, Who Pays? A Distributional Analysis of Tax Systems in all 50 States, Released in Ohio by Policy Matters Ohio, Nov. 19, 2009, available at www.policymattersohio.org/?p=1576.

[8] Policy Matters Ohio, “Where are the jobs? Continued declines in the labor force, minimal job growth undercut unemployment rate good news,” Jan. 20, 2012, available at http://www.policymattersohio.org/job-watch-jan2012.

[9] Honeck, Jon, “A Balanced Approach Promoted Ohio Recovery after Previous Recessions,” The Center for Community Solutions, Oct. 29, 2009, available at http://bit.ly/Anccn7 (At www.communitysolutions.com.)

[10] Bauer, Paul W. and Mark E. Schweitzer, “Paths to Prosperity: Knowledge is Key for Fourth District States,” Economic Commentary, Federal Reserve Bank of Cleveland, August 15, 2006. Available at http://bit.ly/wgRIt5. See also: http://bit.ly/A1h60a. Federal Reserve Bank of Cleveland, Annual Report 2005, “Altered States: A Perspective on 75 Years of State Income Growth.” (At www.clevelandfed.org.)

[11] Patton, Wendy, “We Deserve a Better Business Plan: An Assessment of Ohio’s New Biennial Budget,” Policy Matters Ohio, Aug. 1, 2011, available at http://www.policymattersohio.org/?p=2248.

[12] Gongwer News Service, “Ohio Ranks Last in Tobacco Use Prevention Funding,” Volume #80, Report #230, Article #7, Wednesday, November 30, 2011.

[13] Coolidge, Sharon, “Townships may not have any police presence when they lose sheriff patrols,” The Cincinnati Enquirer, Feb. 2, 2012, available at http://news.cincinnati.com/article/20120201/NEWS/302010186

Photo Gallery

1 of 22