Budget baseline

January 31, 2013

Budget baseline

January 31, 2013

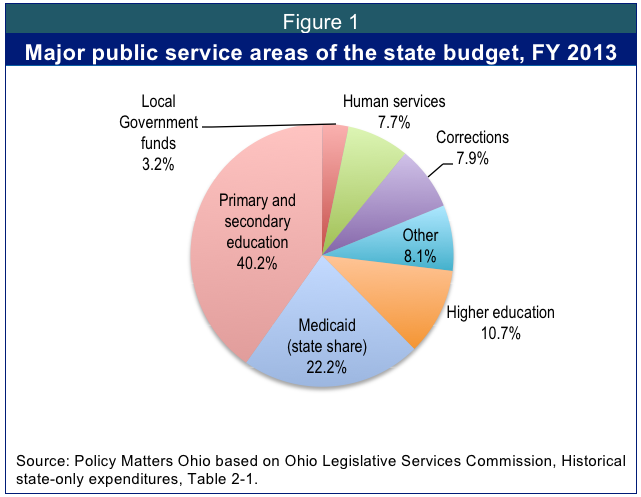

The General Revenue Fund (GRF) represents allocation of tax revenues by elected officials. The major functions supported in Ohio’s GRF in 2013 were education (K-12 received 40.2 percent and higher education, 10.7 percent, for a total of 51 percent of the budget); health (state-only Medicaid expenditures account for 22.2 percent of the budget); corrections (7.9 percent), human services (7.7 percent) and local government (3.2 percent). All the other functions – commerce, insurance, economic development, agriculture, natural resources, the judiciary, and so forth – account for just 8.1 percent. (Figure 1)

The current budget, for Fiscal Years 2012-13, slashed many programs, seized funds from local government and schools, and sold off important state assets. The state took a billion dollars from localities, cutting the Local Government Fund in half and cutting tax reimbursements, promised when the state eliminated local taxes earlier in the decade, by nearly two-thirds. Another billion in tax reimbursements was taken from schools. Libraries, which saw their funds slashed in the previous budget, were trimmed further. Howard Fleeter of the Education Tax Policy Institute has calculated the amount of state tax revenue added to state coffers as a result of these policy changes (Figure 2). Altogether, Fleeter calculated, the GRF was $870 million higher in FY12 and will be an estimated $1.55 billion higher in FY13 because of the revenue diversions.[10]

Fleeter’s calculations show that without the resources redirected from schools and local governments, state tax revenue has not recovered from the recession and the tax cuts of 2005. Yet the current budget reduced taxes further and expanded tax expenditures.

- Tax cuts from 2005 are costing the state about $2.5 billion a year – nearly a dime out of every budget dollar;

- These cuts went mostly to businesses, which no longer pay a tax on corporate profits, and affluent individuals, who got most of a 21 percent income-tax cut;

- The estate tax was eliminated in HB 153, effective in 2013; the local share of the estate tax brought $302.1 million to local governments in FY2011.[11]

- Other new tax breaks, such as a new personal income tax credit on investments in small business enterprises, will reduce state revenue in the upcoming budget.

In Ohio, years of prioritizing tax cuts over public services have caused long-term, inadequate funding for critical services. The tax cuts of 2005 were supported by governors regardless of party affiliation. The legislature has turned to one-time revenues and spending cuts instead of sustaining services and investments. Increasingly, the state is choosing to privatize public services and sell public assets, whether in economic development, primary and secondary education, higher education, corrections, or local governments.

Other sections:Executive summaryIntroductionPrivatizationLocal governmentK-12 educationHigher educationHealth and human servicesWorkforce and trainingTax policySummary and recommendations

[10] Education Tax Policy Institute, “FY2012 Tax Revenues Come in $373 Million Above Estimates,” Facts & Figures, Summer 2012, at http://www.etpi-ohio.org/assets/ETPIsummer-news-2012FNLPQ.pdf

[11] Ohio Department of Taxation, Tax Data Series, Estate Tax, at http://1.usa.gov/WMnLbI.

Photo Gallery

1 of 22