Budget Bite: Local Government

March 15, 2017

Budget Bite: Local Government

March 15, 2017

Kasich budget hits some local governments again

The Governor’s budget for 2018-19 again cuts state aid to many local governments, with a narrowing of the local sales tax base and redistribution of part of the state’s primary revenue sharing program, the Local Government Fund (LGF).

Since 2011, the state has cut revenue sharing, repealed the estate tax, and phased out reimbursements for other local taxes eliminated – also by the state – in earlier years. New revenues from casinos and other sources did not offset losses in many places. The cuts affected virtually all local governments. By 2017, Ohio’s counties, cities, villages and townships had $1 billion less than in 2010. In this budget, cuts continue – but not to all. Some of the state’s biggest cities, most urban counties and public transit agencies will be much poorer at the end of the 2018-19 budget because of changes proposed in the executive budget.

Narrowing the sales tax base

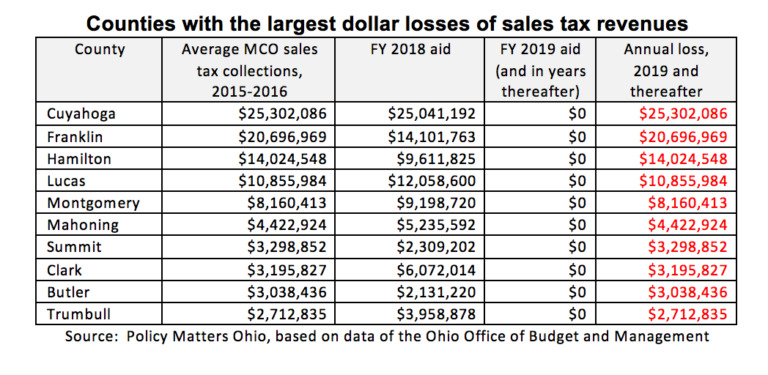

The state will reduce sales tax collections by eliminating the Medicaid managed care organizations (MCOs) from the sales tax base. The state will make itself whole by retaining the MCO tax in a different form outside of the sales tax. However, counties and transit agencies that levy a local sales tax on the state base are not made whole and lose significant revenues. MCO tax revenues were distributed on the basis of Medicaid enrollment, so low-income communities will be hurt the worst. The executive budget provides one year of “transitional” aid, and some local entities that lose would get enough to last for several years. Others face big losses.

Public transit loses close to $40 million a year. This means higher fares and route cuts unless the state – which provides inadequate funding for public transit – replaces the loss. Some counties lose millions of dollars, which means reductions in services like public health (clean water monitoring), seniors’ services (senior centers, Meals on Wheels), children’s services (protective services) and mental health and addiction services.

Redistributing local government funds

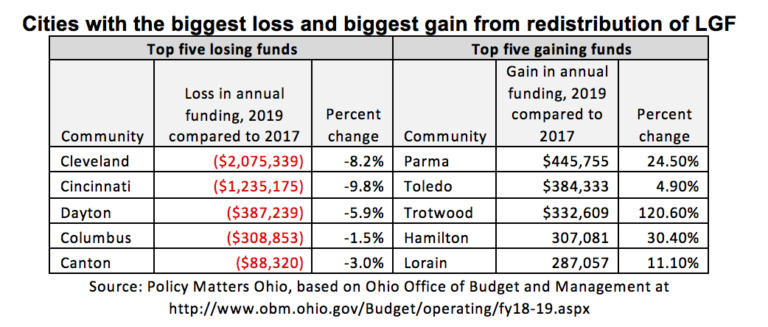

In this budget, the Administration eliminates one of the two funding streams in the Local Government Fund (LGF), the state’s primary revenue sharing program. The “municipal LGF” is eliminated. Those funds are combined with a small share of the main distribution, the “County Undivided LGF,” and redistributed among Ohio’s thousands of cities, villages, townships and counties on the basis of a new distribution formula. The new formula is based on tax capacity and population. The goal is to redistribute income from communities with more capacity to tax themselves to those with less, but the results can seem capricious. For example, the impoverished city of East Cleveland loses aid, while wealthy Upper Arlington gains. In calendar year (CY) 2018, $38 million will be redistributed under the new formula, and $69 million in CY 2019. By 2020, a full 20 percent of the LGF will be distributed under a new formula.

The five cities losing the most money: Cleveland, Cincinnati, Dayton, Columbus and Canton, represent 82 percent of total losses to cities under the new formula. All but one of Ohio’s 88 counties see some gain, although in most cases this gain does not offset the loss of MCO tax revenues. Forecasts predict that over the next two years, the taxpayer revenues that fund the LGF will grow. This growth means many local governments will not face absolute loss, although the new formula may slow growth for some and boost it for others. Regardless, the redistribution of LGF is not strong enough to make up for loss in MCO taxes in many counties.

Recommendations

Loss of MCO tax revenue, elimination of the municipal distribution of the LGF and redistribution of a share of the LGF, results in more cuts to many communities, adding to problems caused by enormous cuts over time to local government aid. The local government fund should be restored to what it was before being cut in half in the 2012-2103 budget. Losses due to change in the MCO tax should be made up. This could be funded by reversing recent income-tax reductions for the most affluent Ohioans and cutting unneeded tax breaks. If state lawmakers think the LGF fund should be redistributed, any change should take into account the economic condition of a local government’s residents and distinguish between tax capacity associated with business and tax capacity of the residents of a community.

Photo Gallery

1 of 22