Budget Bite: Scrap the 'passthrough' tax break

February 22, 2017

Budget Bite: Scrap the 'passthrough' tax break

February 22, 2017

Ending the break could generate nearly $600 million to pay for essentials

Governor John Kasich told us Ohio’s state budget is tight. He proposed only a tiny increase for K-12 education that doesn’t cover inflation or provide an increase for most school districts. Other crucial services are similarly flat-lined. But there are obvious places to find the revenue we need to invest there and elsewhere. The first place to look: A giant tax break, first approved less than four years ago, that slashed Ohio’s income tax on business owners.

The 'Passthrough' Loophole

The break permits owners of “passthrough” businesses such as partnerships and S Corporations to avoid paying any income tax on the first $250,000 in profits from those businesses (they’re called “passthroughs” because their owners are taxed on the income when it passes through to them as individuals). Any additional profits are taxed at a flat 3 percent rate, well below the nearly 5 percent that would otherwise be paid if your income is over $210,600.

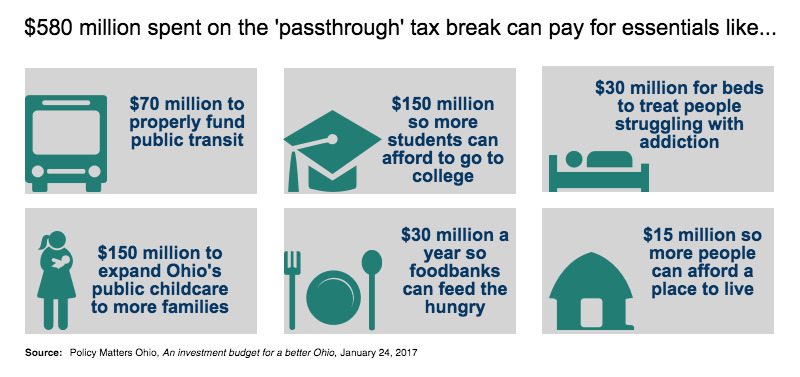

According to the most recent state report, issued just a few weeks ago, this tax break will cost $580 million in the year beginning next June, and almost $600 million the year after, Fiscal Year 2019. That makes it the third-largest break in the state tax code. And that’s an understatement, since the analysis doesn’t account for the low rate being paid on such income over $250,000.

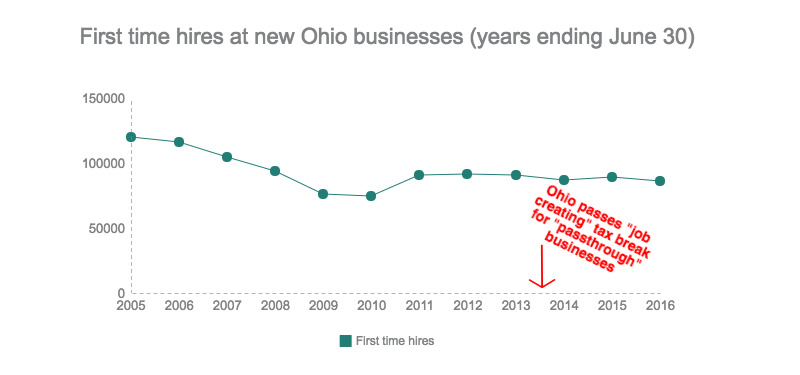

The General Assembly approved the tax break in June 2013 and since expanded it, supposedly to bolster small business. Problem is, while it has siphoned hundreds of millions of dollars in revenue, it hasn’t led to an increase in jobs at new businesses. The U.S. Bureau of Labor Statistics tracks new employment each quarter at businesses that have hired employees for the first time, and Ohio shows no improvement since this big new tax break was approved. In fact, the 86,072 employees added in the year ended last June was lower than the number three years earlier, just before the tax break was approved, and far below the 115,583 added a decade ago. Ohio’s employment at such new businesses also has dipped compared to the nation’s.

Big Breaks, Small Growth

It’s no wonder that this tax break hasn’t brought a host of new jobs. Business owners expand when there is greater demand for their products or services, not just because they have more moneyin their wallets. And though this overall tax break is big, most recipients don’t get enough to pay a new hire: the 476,508 owners filing in 2014 got an average of about $1,315 each. Moreover, a large share of those eligible for the exemption don’t employ anyone. The break doesn’t go just to small business owners, but to partners in big law firms and owners of much larger firms. It also means that a person being paid wages as an employee pays Ohio income tax, but someone doing the identical job but who sets up a limited liability company and becomes a business owner pays nothing.

Recommendations

Ohio should learn a lesson from Kansas: This kind of tax giveaway is not productive. The Kansas state legislature passed a similar, even more expansive tax break for passthrough business income. That helped create a budget hole legislators have struggled to fill. It failed to deliver the shot of adrenaline to the Sunflower State’s economy Governor Sam Brownback predicted. Both chambers of the Kansas legislature, including Republicans and Democrats, voted in mid-February to end the tax break. Brownback vetoed the measure, but its passage shows bipartisan recognition of the failure of this tax policy.

Ohio should repeal our version of this tax break. This would free up much-needed revenue to really make our economy work long-term: To invest in education from cradle to career including pre-K, K-12 and affordable college; to improve public transit, where Ohio woefully underinvests; and to help children affected by the drug epidemic, among other key needs. Let’s learn from Kansas legislators.

Photo Gallery

1 of 22