Local government cuts affected all communities

Posted January 31, 2013 in Press Releases

Ohio is a home rule state where many services, including some delivered by state government elsewhere, are provided by local government. Revenue sharing in Ohio has supported local government while allowing for diversity in local public finance. House Bill 153 reduced revenue sharing by reclaiming tax reimbursements promised for local taxes eliminated in earlier state legislation and by cutting the local government fund in half. These cuts totaled $1.086 billion dollars when compared with the two-year, prior biennium.[18]

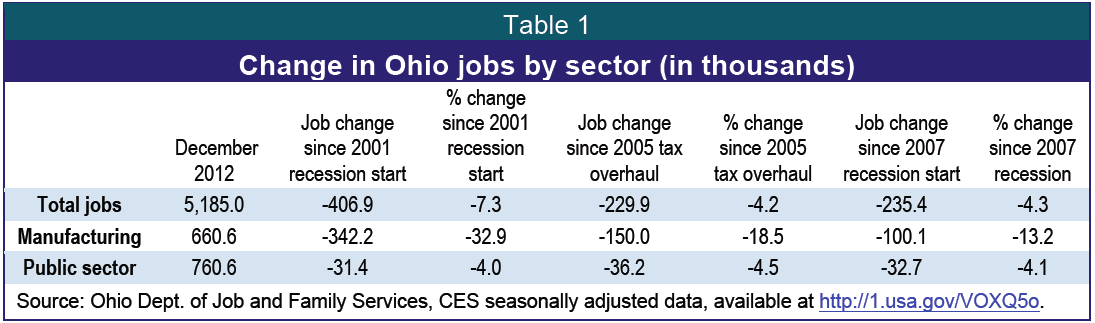

Communities in 2013 will get 60.5 percent less from the state then they got in 2010, the last year of full funding before the current budget took effect. (See Table 1.)

Local health and human services levies are big losers

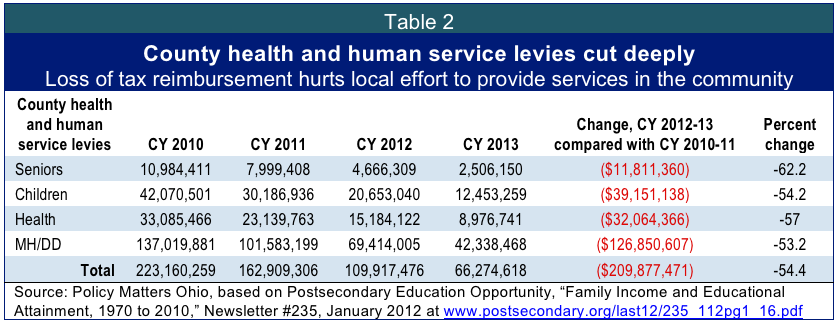

An under-reported aspect of cuts to local government was the toll it took on local health and human service levies. Under Ohio’s hybrid system of state-local financing, some critical functions, like some of the Medicaid match required for some services to the developmentally disabled, are funded at the local level through property tax levies. The loss of tax reimbursements took an estimated $210 million from local levies for children, seniors, public health and mental health/developmental disabilities (Table 2). It was generally touted that health and human services were not cut as badly in the current state budget as areas like K-12 education, but the cuts were deeper when the impact of local government cuts is considered.

Local governments struggle with budget shortfalls

Local governments are pursuing a variety of strategies to fill emerging budget shortfalls. Privatization is one way to get short-term cash (although with long-term risk): The city of Cincinnati, facing a budget shortfall of $39 million, is considering privatized parking over the protests of some neighborhoods.[19] Ohio State University sold its parking functions to a private contractor. A team at the Cincinnati Enquirer recently looked at the budget strategies of local governments in Southwest Ohio and found slashed services and new local fees and levies.[20] Similar scenarios can be found everywhere in the state. Policy Matters Ohio collected news accounts and spoke to local officials in every county of the state in the summer of 2012. County factsheets about the impact of the state budget on quality of life issues in communities