Overview of Ohio budget proposal

March 28, 2013

Overview of Ohio budget proposal

March 28, 2013

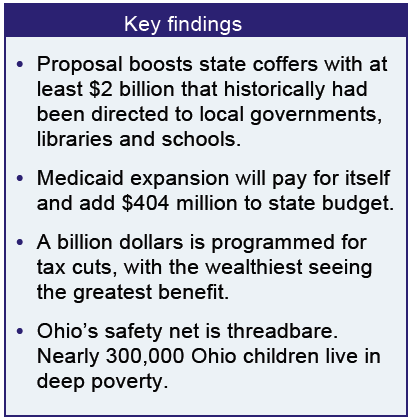

Press releaseDownload report (PDF)Download summary (PDF)Next sectionThe windfall from Medicaid expansion, the slightly improved economy, and the state’s continued use of funds historically shared with local governments and schools all help fund a modest restoration under this proposal. But too much of the new money is being directed to income tax cuts that go primarily to the wealthiest.

Medicaid expansion, K-12 education and tax cuts

Executive summary

The Kasich administration’s budget proposal for fiscal years 2014-15 continues trends started with the current budget, including tax cuts and pressure on local government revenues. It also offers new initiatives, most notably investment in health care through Medicaid expansion.

This year, state revenues are projected to grow in part because revenue that should go to local governments and schools is instead being used at the state level. Medicaid expansion would pay for itself and free up hundreds of millions of dollars for other uses.

This year, state revenues are projected to grow in part because revenue that should go to local governments and schools is instead being used at the state level. Medicaid expansion would pay for itself and free up hundreds of millions of dollars for other uses.

Some services slashed in previous budgets will see modest restoration this time, because of the windfall from Medicaid expansion, the slightly improved economy, and the state taking money that usually goes to localities. But too much of the new money is being directed to income tax cuts that go primarily to the wealthiest. Surplus from the current budget is headed for the Rainy Day fund, which is expected to meet its 5 percent statutory limit and overflow into the “Income Tax Relief Fund,” triggering a 4 percent income tax cut this year. The administration has also proposed slashing the income tax, which collects most from those most able to pay, and increasing the sales tax which falls more heavily on low- and middle-income families who have to spend more of what they earn.. The sales tax rate would be lowered, but the tax base would be broadened to include many previously untaxed services: legal, accounting and architectural services, manicures and haircuts, bowling and coin laundries.

Broadening the sales tax base is a sound way of strengthening and stabilizing the tax in a more service-based economy, but the move is still regressive, hurting low-income families more. The simultaneous income tax cut and sales tax base broadening means that Ohio’s top 1 percent of earners would get a net cut of more than $10,000 annually, on average, but earners in the bottom quintile would see a tax hike of about $63 per year, on average. This is all on top of a previous big income tax cut in 2005.

The Kasich administration’s tax proposals would take about a billion dollars out of state revenues while making the state tax structure less equitable. This is bad tax policy. We recommend retaining or even increasing the top income tax level and adding a state earned income tax credit and a sales tax credit, to offset the tax hike for low- and middle-income households.

Expansion of Medicaid to cover working adults without children is part of national health reforms going into effect in 2014. Medicaid expansion promises better lives for hundreds of thousands of Ohioans and would bring billions of federal dollars into the state, as the federal government picks up the costs of new entrants. The administration estimates that these federal dollars will free up $404 million of state money for other uses over the course of the fiscal year 2014-15 budget. Over time, the federal share of these new entrants drops to 90 percent, but the system still breaks even. If the state doesn’t expand, the federal benefits – financial and medical – will simply go to other states, and Ohio will lose.

K-12 education, cut drastically in the current budget bill, would see a $1.2 billion increase. But the administration’s plan would leave most districts with no new money, and leaves low-wealth districts with less money. At the same time, charter schools, with an overall track record of poor performance and little accountability, would get more funding at the expense of school districts; the administration also proposes two new school voucher programs. The targeted and potentially temporary nature of more than a billion dollars included in the plan also undercuts its effectiveness in building a stronger system. Higher education would get a modest increase, but not enough to restore the deep damage of recent years. Tuition at Ohio’s four-year public schools was 6.2 percent higher than the national average in 2012, and community colleges were almost 22 percent higher. Yet Ohio’s need-based financial aid has dropped by 38 percent since 2005. Comparatively, the recommended increase of 13 percent for need-based aid proposed in the executive budget is a drop in the bucket.

Revenues historically provided to local governments, schools, libraries and health and human service levies were cut deeply in the current budget. Those cuts and a lack of restoration in the proposed budget add up to a drop in local aid of nearly 50 percent by 2015, compared to historic levels. As a result, cuts made in local services – the dimmed streetlights, unrepaired roads, eliminated programs in violence prevention, recreation, senior services – cannot be restored, and will continue to impact the daily lives of million of Ohioans.

There is new investment proposed in this budget, but not enough to restore services. Instead, the administration proposes more new tax cuts, targeted to the wealthiest, that will deprive the state of essential revenue. This approach will force cuts of public services and layoffs of public workers, which will in turn force private sector layoffs. We’ve tried slashing taxes before, with similar promises that job growth would result, and instead Ohio lost 4 percent of the jobs in its employment base since the last income tax cuts were signed into law in 2005, while the nation has gained, adding 1 percent to the national employment base. This proposed round of tax cuts will also weaken the economy. Policymakers should be restoring investment in education, workforce training, parks, roads, recreation centers and senior services. Such investment would enhance quality of life in Ohio, boost property values, and restore our communities to a condition that benefits existing residents and businesses and invites new ones.

Other sections:IntroductionExpendituresMedicaid expansionOther health and human servicesK-12 educationHigher educationLocal governmentTax policyConclusion

Tags

2013Photo Gallery

1 of 22