Clinton County

November 01, 2012

Clinton County

November 01, 2012

Impact of Ohio’s 2012-13 state budget (HB 153)

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Clinton County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Clinton County?

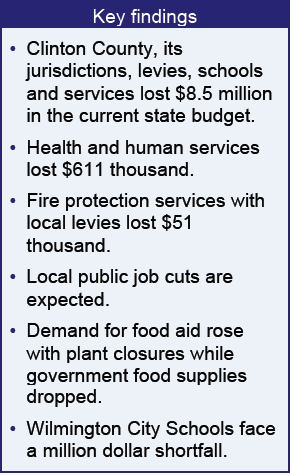

The state cut the Local Government Fund to the county, forcing Clinton County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- County operations................................ -$2.9 million (includes County Undivided Fund)

- Public Library Fund............................... -$64.0 thousand

- Schools.............................................. -$5.0 million

- Wilmington City................................... -$708.0 thousand

- Blanchester......................................... -$56.0 thousand (includes library levy)

- Clinton Highland Joint Fire..................... -$40.0 thousand

- S.S.R.J.F.D. #2................................... -$17.0 thousand

Loss to health and human service levies

- County health services....................... -$44.0 thousand

- County child services......................... -$126.0 thousand

- County mental health......................... -$322.0 thousand

- County senior services....................... -$120.0 thousand

Note and quotes

Staff positions face the ax with the budget shortfall: “The Human Resources position for city employees was not created in Wilmington until 2005, and given the city's current budget shortfall of $1.3 million, the spot "seemed like a luxury," City Council President Kirchner said. From Huffenberger, Gary. “Four city jobs may not survive budget cuts.” News Journal. August 3, 2012. http://tinyurl.com/bp2wrh3.

Staff positions face the ax with the budget shortfall: “The Human Resources position for city employees was not created in Wilmington until 2005, and given the city's current budget shortfall of $1.3 million, the spot "seemed like a luxury," City Council President Kirchner said. From Huffenberger, Gary. “Four city jobs may not survive budget cuts.” News Journal. August 3, 2012. http://tinyurl.com/bp2wrh3.

To balance the city of Wilmington’s budget, the county will need to cut expenditures by 14 to 15 percent on average for all departments. A current proposal is to abolish four administrative positions. From “City may have to cut back 14-15 percent.” News Journal. August 7, 2012. http://tinyurl.com/cvvelqe.

Cuts in government programs come from the federal government as well, compounding the difficulty of serving growing community needs:

The Blanchester Food Pantry will be one of the hardest hit…. According to treasurer LeRoy Addis, the supply it receives through the Freestore Food Bank in Cincinnati will be reduced by about 40 percent in the month of October. "The amount of USDA products we could order for August was less than the amount we could order when we were serving 350 people, but now we're serving 700," Addis said. "We'll have to tighten down, and with the down economy, people have less to give, so we get hit from both ends," he explained. "We're purchasing more and more to satisfy a growing need in the community," said (Brian) MacConnell (of the Freestore Food Bank). "We don't anticipate getting a significantly greater amount of food through the government in the near future. The money is just not there." “Food Pantry could face cuts” The News Journal, September 10, 2012. http://tinyurl.com/c3bn9l6.

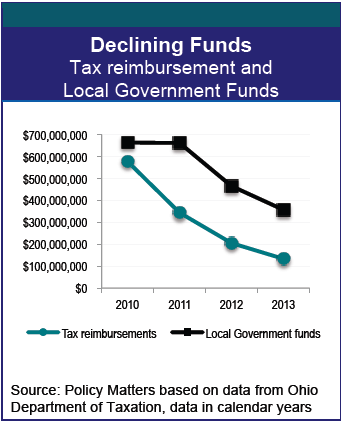

NOTES: The current state budget cuts the Local Government Fund to counties, municipalities and townships by 25 percent in the first year and by 50 percent in the second year. This 77-year old state revenue sharing program has, for generations, been essential to helping Ohio communities fund schools, provide services, and lift people out of poverty. The current state budget also phases out most of the tangible personal property tax and public utility property tax reimbursements, which were promised to local governments when the state cut taxes in recent years. These are not the only losses to local governments because of this budget. There are others in specific programs. Here we detail some of the bigger shifts. Change in revenues shown here include:

- Local Government Fund "County Undivided Fund," which counties share with their cities, townships and villages. We show how much less money the counties are receiving under the current 2-year state budget (for 2012 and 2013) compared to the two years under the prior state budget (which was for 2010 and 2011). Here the funds are shown on a calendar year basis because that is how the tax department forecasts and records their distribution to local governments, and it is how local governments budget. (The state budget is based on the fiscal year, July 1 through June 30.)

- Local Government “Municipal Direct” allocation from the Local Government Fund that the state gives directly to municipalities with an income tax. This is also shown in terms of funding provided in the calendar years 2012 and 2013 compared to 2010 and 2011.

- Property tax reimbursements promised to local governments during tax reductions enacted earlier in the decade. The loss of funding in calendar years 2012 and 2013 is compared to the level of funding provided in 2010 and 2011. The figures for changes in funding levels are based on data provided by and spreadsheets online at the Ohio Department of Taxation for local government funds and tax reimbursement distributions.

Photo Gallery

1 of 22