Foreclosures continue to plague Ohio: More than 70,000 new filings reported in 2012

Posted May 09, 2013 in Press Releases

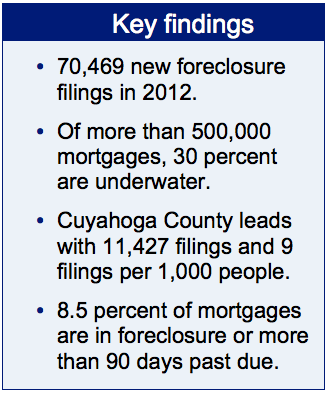

Download press release (1 pg)Read the full report Ohio foreclosures remain at crisis levels, with 70,469 new filings in 2012, according to the annual foreclosure report released today by Policy Matters Ohio.

Ohio foreclosures remain at crisis levels, with 70,469 new filings in 2012, according to the annual foreclosure report released today by Policy Matters Ohio.

The study, based on Ohio Supreme Court data, found that the number of new foreclosure filings dropped only slightly from 2011, by about 1.5 percent, while the number of filings in 2012 remained more than four times higher than it was in the mid 1990s. Ohio filings peaked in 2009 at 89,061.

“These numbers make it clear that the foreclosure crisis continues to wreak havoc in Ohio,” said David Rothstein, project director for asset building at Policy Matters Ohio. “Troubled mortgages continue to drag down Ohio’s economy.”

Cuyahoga County continues to lead Ohio with 11,427 new foreclosure filings