Testimony to House Finance Subcommittee on Transportation

March 21, 2017

Testimony to House Finance Subcommittee on Transportation

March 21, 2017

Policy Matters calls increased public transit funding in the operating budget

Good afternoon Chairman McColley, ranking member Reece and members of the Committee. I am Wendy Patton of Policy Matters Ohio, a non-partisan, not-for-profit research organization with a mission of contributing to a more vibrant, equitable, inclusive and sustainable Ohio. In our testimony today we encourage the General Assembly to find a sustainable source of revenue to replace sales tax revenues lost to public transit agencies with the change of the MCO tax, and to restore GRF funding for public transit to earlier levels.

In 2015, the Governor’s Workgroup to Reduce Reliance on Public Assistance noted that lack of transportation was one of the major barriers to employment in the state of Ohio.[1] No one knows better than you — members of Ohio’s General Assembly — that nearly 30 percent of state dollars are invested in health and human services, to underpin community and family budgets across Ohio. These funds support struggling families in the low-wage economy. The recent assessment of the Medicaid expansion population found that more than three quarters of enrollees were working or searching for work, and that the benefits helped many stay at work.[2] We also know — from the workgroup report referenced here - that one of the biggest barriers job-seekers face is lack of transit. The Ohio Department of Transportation’s recent Transit Needs study[3] found that about half of transit riders have no car. This is especially acute for workers with serious vision problems or other disabilities.

Policy Matters is a member of Ohioans for Transportation Equity, a coalition representing seniors, people with disabilities, transit riders and many others. This coalition argues Ohio needs a 21st century transportation system that includes roads and highways but also includes public transit, passenger and freight rail, and walk-able, bike-able streets. Funding that could make this possible has been eroded over time, and is further reduced by the end of this biennium.

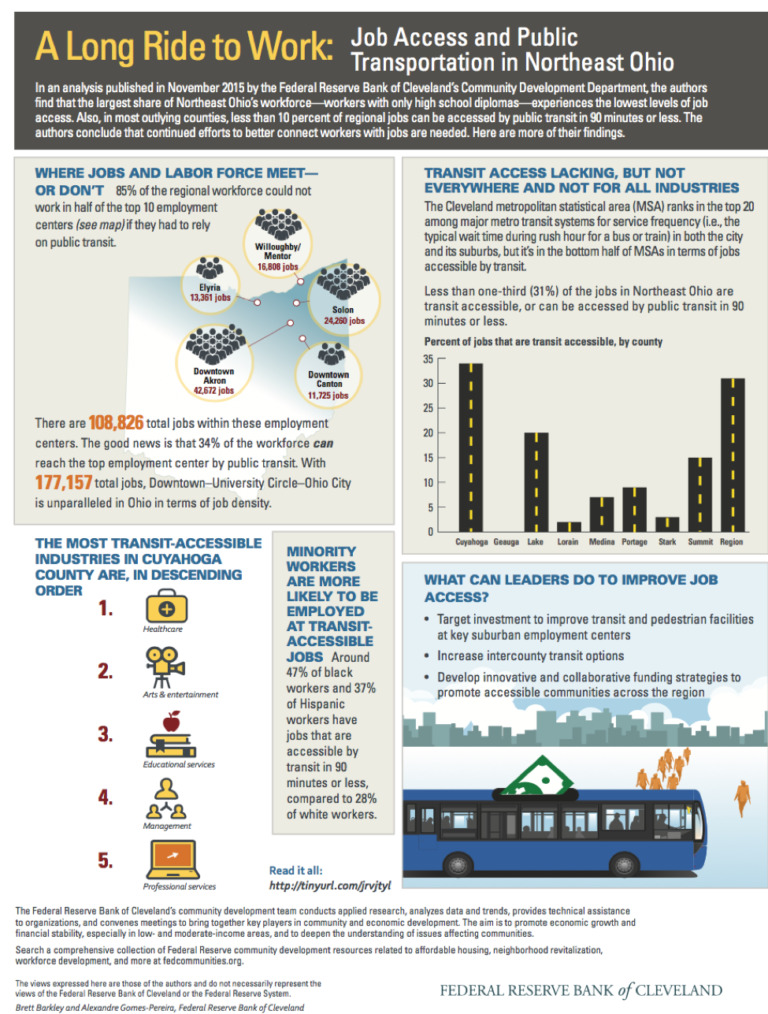

As Ohio has reduced public transit funding since 2000, more than a third of the fleet of transit vehicles has become obsolete, fares have gone up and service lines in many cities have been cut.[4] This hurts workers and employers. According to Fund for Our Economic Future, an alliance of funders promoting economic development and opportunity in northeast Ohio, job growth has happened on the urban fringes, while unemployment is concentrated at the urban core. The Federal Reserve Bank of Cleveland highlighted findings from a Brookings Institution report that the Cleveland metropolitan area experienced the largest drop (27 percent) in the number of jobs near the average resident from 2000 to 2012 among the nation’s 96 largest metropolitan statistical areas.[5] See the attached infographic for details.

President Trump’s new federal budget proposal looms as a new factor for you to consider. The proposal cuts Federal Transit Authority capital investments, eliminates competitive grant programs, and reduces federal dollars for transportation by $2.4 billion. Federal budget cuts are likely to squeeze the states, taking funding from key program areas and diverting them to new federal priorities.

We respectfully suggest that one thing you could do is ensure more people can access a ride to work, one that allows them to arrive within a reasonable amount of time. Brookings looked at public transit in 100 of the nation’s large metropolitan areas in 2011: Youngstown ranked third worst because just 36 percent of percent of working-age residents lived near a transit stop, the median wait for rush hour transit was 27 minutes, and only 14 percent of jobs were reachable via transit in 90 minutes.[6] The Youngstown area has experienced substantial job loss and many still seek adequate employment. Better public transit could help. But diminished federal and state funding may mean express services to outlying areas in the Mahoning Valley face new cuts.

The 2015 Transit Needs Study produced by the Ohio Department of Transportation found a gap between public transit funding and the needs of Ohio’s 61 public transit entities of $650.6 million in 2015, rising to $1.03 billion in 2025. As of 2015, $273.5 million was also needed to address deferred maintenance and repair Ohio’s transit fleet.[7] The study proposed Ohio start funding public transit at $120 million a year, and to $185 million a year by 2025. We support those recommendations.

But the governor’s budget lets the public transit system fall further behind during this biennium. The removal of the Medicaid Managed Care Organizations (MCOs) from the sales tax base takes $40 million a year out of the system by 2019. While the governor’s budget provides funding in FY 2018 to mitigate this loss, in FY 2019, transitional aid vanishes. The operating budget should address this loss, through local tax authority that holds counties and transit agencies harmless or through providing general revenue funding (GRF) to make up the loss.

The General Assembly should also appropriate significantly more GRF funding than the $7.3 million per year proposed by the Governor. An additional $25 million in GRF funding could allow rural transit agencies and those in smaller cities and towns to apply for federal capital dollars to restore and expand their fleets and services.

Funding for public transit could come from closing tax breaks in Ohio’s $9 billion tax expenditure budget. We attach a description of Governor Kasich’s recommendations from the current budget proposal, and also from his budget proposal for 2016-17. These tax breaks total far more than the $120 million we request for annual public transit funding. State officials have admonished local governments to stretch their budget resources to deal with state cuts. Today, the state will need to more carefully examine its use of resources as the federal government slashes funding to the states. Reducing expenditures on questionable tax breaks is a good place to start, and using those funds for public transit to help more people get to work is a good use. Thank you for this opportunity to testify. I would be glad to answer questions.

Tax expenditures that could be eliminated to fund transit and other services

In the executive budget last year, Gov. Kasich proposed limiting or repealing a variety of tax breaks that were not accepted by the General Assembly. For instance, he proposed: [8]

- Eliminating the tax credit and discount that sellers of beer, wine and mixed beverages get for paying their alcoholic beverage tax a few weeks in advance;

- Limiting the amounts retailers can receive for collecting the sales tax, known as the vendor discount — expected to cost the State an estimated $29 million in the 2016-17 executive budget proposal. Most states either have no discount at all or cap the amount, ensuring that big retailers do not reap a windfall. Tax Commissioner Joe Testa said in testimony that Ohio’s 0.75 percent discount “essentially functions as a profit center” for big-volume retailers.

- Cutting the sales-tax exemption for trade-ins of used cars and boats in half, and

- Repealing the 2.5 percent discount that distributors of cigars, chewing tobacco and other tobacco products get for timely payment of their taxes. “It shouldn’t be necessary to reward businesses for paying their tax on time,” as Testa noted. Together those changes would have generated more than $130 million in extra state revenue by 2017.

The Governor’s budget proposal also takes some measures to rein in unneeded tax expenditures.[9]

- One is to institute a minimum on the Commercial Activity Tax due from suppliers to certain big distribution centers. This break allows suppliers to distribution centers that buy at least $500 million a year of goods, and ship at least half of them outside Ohio, to avoid paying the CAT on what is sent outside the state. As Commissioner Testa has testified, the value of this exemption will balloon from $25 million FY 2008 to an estimated $174.4 million in FY 2019. Gov. Kasich’s proposal to require at least a 10 percent payment is a good idea.

- One little-noticed feature of the Governor’s proposal would require that future budget bills include detailed estimates of business incentive tax credits, including how much may be authorized each year, the expected amount to be claimed, and the amount of credits expected to be outstanding at the end of the biennium. This move toward transparency is a good one. Gov. Kasich also included estimates of these amounts for seven different credits. The bill estimates that more than $386 million in such credits will be claimed during the upcoming biennium, and a total of $1.5 billion of them will be outstanding by the end of Fiscal 2019.

These large sums reinforce the need to examine Ohio’s $9 billion-plus in annual tax breaks. HB 9 in the last General Assembly called for a joint committee to be established by next month to examine the state’s 129 tax breaks over an eight-year period. Lawmakers should get an early start. Many tax expenditures are special-interest provisions that should be subject to immediate scrutiny and possible repeal or limitation. Beyond those mentioned above, these include:

- The sales-tax cap for fractional aircraft, a special-interest break worth $15.8 million;

- Ending the net operating loss write-off against the Commercial Activity Tax, which allows companies that experienced large losses — but not small companies — to keep reducing their CAT based on corporate-franchise tax losses. These were experienced more than a decade ago against a tax that no longer exists. Value: $4.6 million.

These are just a handful of those that should be considered; many more deserve a careful look. Limiting these unneeded expenditures would allow the state to make needed investments.

Sources

[1] “When individuals are impacted by infrastructure limitations, such as jobs that do not pay a sustainable wage in their community or the inability to access reliable transportation to and from work, we need to collectively work to eliminate those barriers.” Cover letter to the report from the Governor’s Workgroup to Reduce Reliance on Public Assistance, April 15, 2015. http://humanservices.ohio.gov/PDF/041415-Report_FINALBOOK.stm

[2] Ohio Group VIII Assessment: A report to the General Assembly at http://medicaid.ohio.gov/portals/0/resources/reports/annual/group-viii-assessment.pdf

[3] Ohio Department of Transportation Transit Needs study at http://www.dot.state.oh.us/Divisions/Planning/Transit/TransitNeedsStudy/Pages/StudyHome.aspx

[4] February 9, 2017 Testimony of Kirt Conrad, president of the Ohio Pubic Transit Association, to House Finance Subcommittee on Transportation, at http://www.ohiohouse.gov/committee/finance-subcommittee-on-transportation; see also Ginger Christ, “RTA fare hikes and route cuts to begin Sunday,” August 11, 2016 at “http://www.cleveland.com/metro/index.ssf/2016/08/rta_fare_hikes_and_route_cuts.html

[5] This finding holds whether constricting the analysis to the city, suburbs, or entire metro and is even more pronounced in areas of high poverty (where the drop was 35 percent).

[6] https://www.brookings.edu/research/missed-opportunity-transit-and-jobs-in-metropolitan-america/

[7] Ohio Department of Transportation Transit Needs Study and Findings Snapshot at http://www.dot.state.oh.us/divisions/planning/transit/transitneedsstudy/Pages/StudyHome.asp

[8] Policy Matters Ohio, Spending Through the Tax Code, 2015

[9] Policy Matters Ohio, Testimony to House Ways & Means Committee, March 22, 2017.

Photo Gallery

1 of 22