Hospitals would owe tens of millions if exempt properties were taxed, study finds

Posted December 09, 2013 in Press Releases

For immediate releaseContact Zach Schiller, 216.361.9801 Download press release (1 pg)Full report Cuyahoga County’s two largest private nonprofit hospital systems, the Cleveland Clinic and University Hospitals, together would owe tens of millions of dollars a year in additional property tax if their exempt properties in Cleveland were subject to taxation, according to a new study by Policy Matters Ohio.

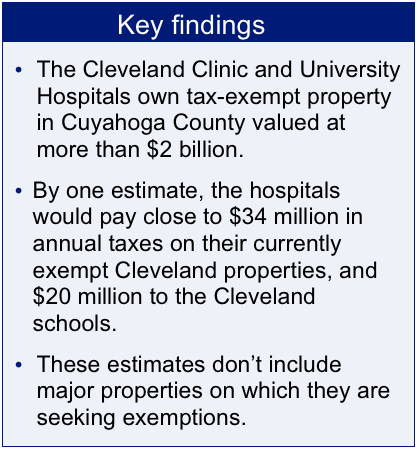

Cuyahoga County’s two largest private nonprofit hospital systems, the Cleveland Clinic and University Hospitals, together would owe tens of millions of dollars a year in additional property tax if their exempt properties in Cleveland were subject to taxation, according to a new study by Policy Matters Ohio.

“By one estimate, the additional property tax for the two institutions together would amount to close to $34 million a year, and more than $20 million annually for the Cleveland school district,” said Zach Schiller, co-author of the report and Policy Matters research director.

Those figures are based on an analysis of county property tax records. Policy Matters calculated the tax that would be due, and then reduced it by 40 percent to account for overvaluation that may occur with properties of nonprofits. The figures do not include the substantial properties for which the Clinic, in particular, is seeking exemptions. Altogether, the two hospitals have more than $2 billion in tax-exempt real property in Cuyahoga County, $1.6 billion in such property in the city of Cleveland, and hundreds of millions of dollars’ worth of additional property on which they are seeking exemptions.

Policy Matters analyzed the size of the property holdings of Cuyahoga County’s two major private nonprofit hospital systems nine years ago (see www.policymattersohio.org/valuing-the-tax-exempt-property-of-private-nonprofit-hospitals). We updated our analysis at the request of Common Good Ohio and the Cleveland Teachers Union. The analysis covered the bulk of the hospitals’ properties, but is not comprehensive.

###