New plan would cut taxes $6,000 a year on average for Ohio’s most affluent

June 25, 2013

New plan would cut taxes $6,000 a year on average for Ohio’s most affluent

June 25, 2013

The new tax plan proposed by House and Senate Republicans will reward Ohio’s most affluent with average annual tax cuts of more than $6,000 a year, while low- and moderate-income Ohioans will pay slightly more.

Note: A more recent analysis of the General Assembly's tax changes can be found at policymattersohio.org/itep2-jun2013

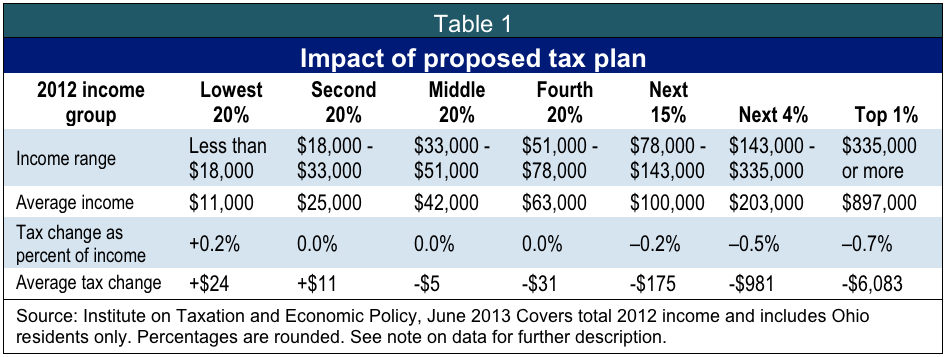

Download brief (2 pp)An analysis for Policy Matters Ohio by the Institute on Taxation and Economic Policy (ITEP) found that Ohio residents in the top 1 percent of the income spectrum, who earned at least $335,000 in 2012, on average would receive a $6,083 a year tax cut from the proposal. The middle fifth, who earned between $33,000 and $51,000 last year, on average would see just a $5 annual tax cut if the changes go ahead as outlined. Those in the bottom two-fifths, with income below $33,000, as a group would see an increase; for the bottom fifth, it would average $24 a year. The analysis is based on the announced plan prior to today’s meeting of the conference committee, which could make further changes.

The tax plan includes an across-the-board 10 percent income-tax cut phased in over three years, and an income-tax exemption for certain business income. ITEP reviewed these two income-tax cuts, an increase in the state sales tax from 5.5 percent to 5.75 per cent, and other key elements of the plan, including a new state Earned Income Tax Credit. Among other things, the plan also would wipe out other income-tax credits, including the credit that eliminates income-tax liability for those with income of $10,000 or below and a $20 credit that each taxpayer receives for themselves and each dependent. For a full description of the elements covered in the ITEP analysis, see data note below.

ITEP found that on average, income tax cuts for many low- and middle-income Ohioans would be small or nonexistent, and much or all of such gains would be balanced by the impact of sales and Commercial Activity Tax increases, which fall relatively more heavily on such taxpayers.

Table 1 below details how the tax plan would affect Ohio residents at different income levels.

Income tax cuts are unlikely to spark the state’s economy. A 21 percent cut that was approved in 2005 has not kept Ohio’s job market from underperforming that of the country as a whole during and after the last recession. A report last week from the Center on Budget and Policy Priorities examining the academic literature noted “there is no clear research evidence that lower taxes help state economies grow” (see Michael Mazerov, “Academic Research Lacks Consensus on the Impact of State Tax Cuts on Economic Growth,” Center on Budget and Policy Priorities, June 17, 2013, at www.cbpp.org/cms/index.cfm?fa=view&id=3975).

“Rather than approving a tax plan that will further shift Ohio’s tax load from the most affluent to low- and middle-income residents, we should direct those dollars into needed public services,” said Zach Schiller, Policy Matters Ohio research director. “That includes restoring support for local governments and schools, and bolstering human services, from foodbanks to child care.”

A note on the data: The ITEP analysis covers Ohio residents and is based on 2012 income levels. It includes the following components of the tax proposal: The 10 percent income tax rate cut; the business-income tax exemption; the increase in the state sales tax from 5.5 percent to 5.75 percent; the reduced exclusion under the Commercial Activity Tax from $1 million to $500,000; the elimination of the $20 personal exemption credit; the elimination of the low-income credit; the repeal of the income-tax deduction for gambling losses, and the new Earned Income Tax Credit, set at 5 percent of the federal credit limited to 50 percent of liability for Ohio Taxable Income above $20,000. The analysis does not include five other changes in sales or income taxes, and two property-tax changes that will affect taxpayers in future. These are either quite small or not easily modeled.

Policy Matters Ohio is a nonprofit, nonpartisan research organization with offices in Cleveland and Columbus. The Institute on Taxation and Economic Policy is a nonprofit, nonpartisan research group in Washington, D.C. ITEP’s Microsimulation Tax Model allows it to measure the distributional consequences of federal and state tax laws and proposed changes in them, both nationally and on a state-by-state basis.

Tags

2013Revenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22