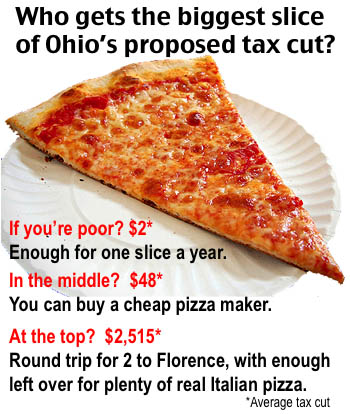

Proposed income-tax cuts would favor wealthy

Posted February 13, 2014 in Press Releases

For immediate releaseContact Zach Schiller, 216.361.9801Full reportDownload press release (1 pg)Poor and middle class would get little benefit, analysis finds

New income-tax cuts of the sort favored by Gov. John Kasich would heavily benefit Ohio’s most affluent taxpayers. An across-the-board cut that would reduce the top rate below 5 percent

New income-tax cuts of the sort favored by Gov. John Kasich would heavily benefit Ohio’s most affluent taxpayers. An across-the-board cut that would reduce the top rate below 5 percent