Jackson County

Posted November 02, 2012 in Press Releases

Impact of Ohio’s 2012-13 state budget (HB 153)

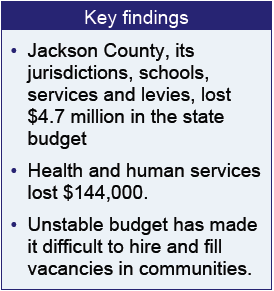

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Jackson County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Jackson County?

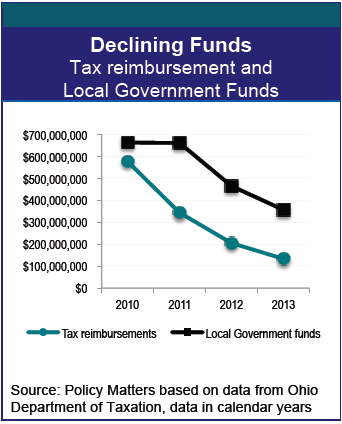

The state cut the Local Government Fund to the county, forcing Jackson County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund.............................. -$57 thousand

- Schools............................................ -$2.9 million

- County operations................................ -$1.4 million (includes county undivided fund)

- Jackson City...................................... -$112.0 thousand

- Wellston............................................ -$66.0 thousand

- Madison- Jefferson Joint Fire................. -$13 thousand

Losses to health and human service levies

- County mental health/developmental disabilities............. -$97 thousand

- County health services............................................... -$22 thousand

- County senior services............................................... -$26 thousand

Notes and quotes

Expectations were for the 2012 budget to at least be no worse than the 2010 budget, but what was put forth was an 8 percent reduction from 2010 levels, according to Jackson County Commissioner Jim Riepenhoff. Riepenhoff also explained that the Commissioner’s office will have to limit the hours of their employees to seven hours per day. From “County budget for 2012 will make for a tough year.” Jackson County Daily, December 16, 2011. http://tinyurl.com/8lx7h7p.

Expectations were for the 2012 budget to at least be no worse than the 2010 budget, but what was put forth was an 8 percent reduction from 2010 levels, according to Jackson County Commissioner Jim Riepenhoff. Riepenhoff also explained that the Commissioner’s office will have to limit the hours of their employees to seven hours per day. From “County budget for 2012 will make for a tough year.” Jackson County Daily, December 16, 2011. http://tinyurl.com/8lx7h7p.

“When someone talks about cutting costs, are we talking about making our community as cost efficient and cost effective as possible, or just making it as cheap and trashy as we can, as long as it doesn’t cost anything?”