Knox County

Posted November 05, 2012 in Press Releases

State OverviewDownload PDFImpact of Ohio’s 2012-13 state budget (HB 153)

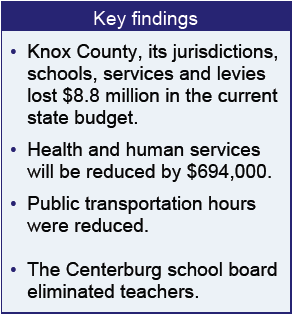

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Knox County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Knox County?

The state cut the Local Government Fund to the county, forcing Knox County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund................................ -$74 thousand

- Schools............................................... -$5.3 million

- County operations................................. -$2.3 million (includes LFG for parks and townships)

- Clinton Township................................. -$45 thousand

- Fredrick town...................................... -$82 thousand

- Mt. Vernon........................................... -$557 thousand

- Eastern Knox County Fire District............. -$25 thousand

Losses to health and human service levies

- County mental health/developmental disabilities........... -$456 thousand

- County children services.......................................... -$104 thousand

- County health services............................................ -$41 thousand

- County senior services............................................ -$91 thousand

Notes and quotes

“Due to our reaction to the fiscal crisis….we have managed to make some cuts and should end up the year just about breaking even. It’s not going to continue that way. We’re still in deficit spending, but we do have a balance at this time.”

“Due to our reaction to the fiscal crisis….we have managed to make some cuts and should end up the year just about breaking even. It’s not going to continue that way. We’re still in deficit spending, but we do have a balance at this time.”