Mahoning County

Posted November 05, 2012 in Press Releases

State OverviewDownload PDFImpact of the 2012-13 state budget (HB 153)

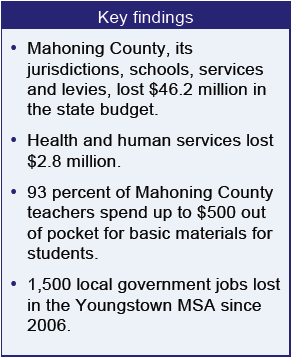

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Mahoning County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Mahoning County?

The state cut the Local Government Fund to the county, forcing Mahoning County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund............................ -$592.0 thousand

- Schools........................................... -$28.5 million

- County operations.............................. -$8.8 million (includes LGF for townships and parks)

- Boardman Township......................... -$1.3 million

- Youngstown City............................. -$2.4 million

- Mill Creek Metro Park........................ -$743.0 thousand

- Western Reserve Transit District.......... -$570.0 thousand

Loss to health and human service levies

- County mental health/Developmental disabilities......... -$2.1 million

- County Child Services............................................ -$683.0 thousand

Notes and Quotes

“So many people don’t fully understand the sacrifices teachers make every day to provide our children with the best education, and many times at their own expense. We hope to change that, by providing the materials classrooms desperately need but schools no longer provide and teachers can’t afford.”

“So many people don’t fully understand the sacrifices teachers make every day to provide our children with the best education, and many times at their own expense. We hope to change that, by providing the materials classrooms desperately need but schools no longer provide and teachers can’t afford.”