Mercer County

Posted November 05, 2012 in Press Releases

State OverviewDownload PDFImpact of the 2012-13 state budget (HB 153)

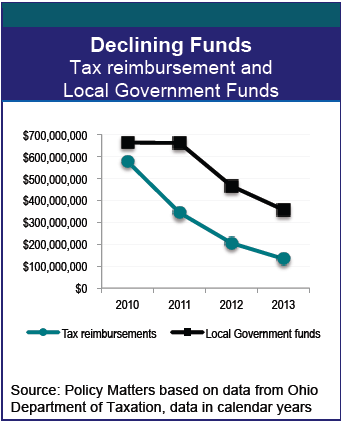

The state budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Mercer County?

The state budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Mercer County?

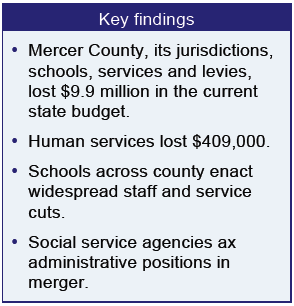

The state cut the Local Government Fund to the county, forcing Mercer County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund.................. -$78 thousand

- Schools................................. -$7.1 million

- County operations................... -$2.4 million (includes undivided fund)

- Granville................................ -$30 thousand

- Fort Recovery......................... -$39 thousand

- Celina................................... -$83 thousand

- Tri-county mental health........... -$147 thousand

Loss to health and human service levies

- County mental health/ Developmental disabilities......... -$364 thousand

- County seniors services.......................................... -$45 thousand

Notes and Quotes