People move across state lines for jobs, housing, family, not taxes, new report finds

Posted March 20, 2013 in Press Releases

For immediate releaseContact Amy Hanauer, 216.361.9801 Download press releaseBack to full report Very few Americans move across state lines each year, but those who do make those moves based on employment, unemployment, income, housing affordability and higher education opportunity, not taxes, according to a new analysis by Policy Matters Ohio.

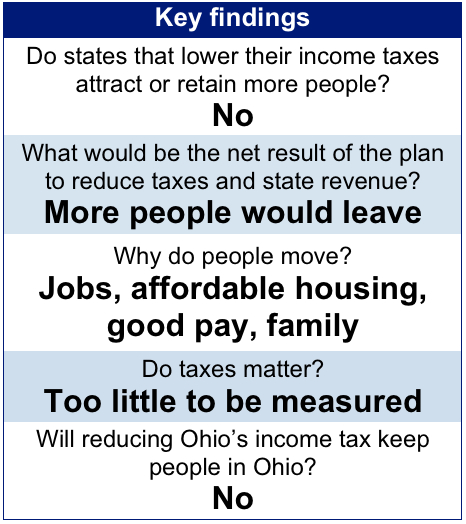

Very few Americans move across state lines each year, but those who do make those moves based on employment, unemployment, income, housing affordability and higher education opportunity, not taxes, according to a new analysis by Policy Matters Ohio.

“Even large increases in income taxes do not lead to changes in migration,” said Amy Hanauer, Policy Matters executive director and a study author. “But adequate revenue is essential to creating a state economy with excellent schools, universities, worker training and infrastructure.”

Gov. John Kasich’s proposed tax changes would reduce state revenue, substantially cut the taxes of the wealthiest and slightly increase the taxes of Ohio middle-income and poor households. The Kasich administration cited a belief that personal income taxes “encourage out-migration from a state” as a rationale for reducing income taxes.

Our study, “The Tax Flight Myth,” examined the relationship between taxes, other economic issues, and interstate movement for Ohio and surrounding states. We found that even a large across-the-board tax increase would not have a statistically significant effect on movement between states in the Ohio region. By contrast, similarly sized changes in unemployment insurance claims, housing affordability, or property crime have statistically significant effects on migration patterns.

The study also found that a loss of revenue for the state would result in people leaving the state, especially if the public sector reduced employment or did not hire when it otherwise would have. Even more might leave if property crime were to increase as a result jobs lost in law enforcement or other public-safety sectors, according to the study.

Other findings include:

- Just 1.6 percent of households moved from one state to another in 2010;

- Households are most likely to move if they are unemployed, in their 20s, at the beginning of their careers, and don’t have children. Married adults, home-owners, and those over age 40 are much less likely to move;

- The four main reasons Americans between the ages of 30 and 64 cited for moving were job (36 percent), family (22 percent), housing (28 percent), and quality of life (8 percent). Some 93 percent of Americans cite at least one of these variables. Americans also cite college, retirement, and natural disasters more frequently than taxes;

- The seven states to which Ohio lost the most households in 2011