Pickaway County

Posted November 08, 2012 in Press Releases

State OverviewDownload PDFImpact of the 2012-13 state budget (HB 153)

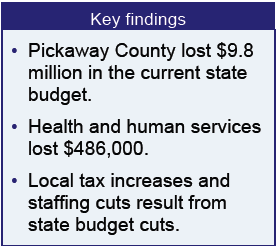

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Pickaway County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Pickaway County?

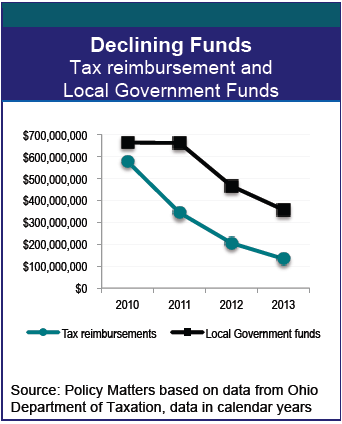

The state cut the Local Government Fund to the county, forcing Pickaway County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund................ -$82.0 thousand

- Schools (K-12)...................... -$6.3 million

- County operations.................. -$1.8 million (includes LGF for townships)

- Ashville................................. -$57.0 thousand

- Circleville.............................. -$741.0 thousand

Loss to health and human service levies

- County mental health............... -$431.0 thousand

- County senior services............. -$55.0 thousand

Notes and Quotes

“Staff was not laid off because of the cuts but employees have not been given a raise in the last four years. They are unable to have any real adjustments in living standards…. We are able to maintain the building but there has been no new renovation to buildings and we are strapped for space. This is one of the negative impacts of the budget cuts, no improvements to our infrastructure”

“Staff was not laid off because of the cuts but employees have not been given a raise in the last four years. They are unable to have any real adjustments in living standards…. We are able to maintain the building but there has been no new renovation to buildings and we are strapped for space. This is one of the negative impacts of the budget cuts, no improvements to our infrastructure”