Sales-tax credit would help low-income Ohioans

April 08, 2013

Sales-tax credit would help low-income Ohioans

April 08, 2013

Press releaseDownload summary (2 pp)Download full report (5pp)Gov. John Kasich’s proposal to broaden the sales tax may not survive, or it could be scaled back. Legislators should consider a sales-tax credit anyway, because the existing sales tax helps slant our current state and local tax system against low- and moderate-income taxpayers.

Gov. John Kasich has proposed major changes in Ohio’s tax system, including broadening the sales tax to cover most services and cutting the state rate from 5.5 percent to 5 percent. This would produce significant needed revenue and make the sales tax more viable long-term, since more and more of the Ohio economy is based on services. The problem: Low- and moderate-income Ohioans would be most affected, as they would pay the most as a share of their income.

Gov. John Kasich has proposed major changes in Ohio’s tax system, including broadening the sales tax to cover most services and cutting the state rate from 5.5 percent to 5 percent. This would produce significant needed revenue and make the sales tax more viable long-term, since more and more of the Ohio economy is based on services. The problem: Low- and moderate-income Ohioans would be most affected, as they would pay the most as a share of their income.

One way to blunt the impact of sales tax broadening on low- and moderate-income Ohioans is to adopt a sales-tax credit. These credits, which five states currently offer, provide a set amount for each member of a family to offset some of the cost of a sales or similar tax.[1] If the governor’s sales-tax proposal does not go forward, such a credit is still worth consideration because it would provide a targeted way to offset the regressivity of the existing sales tax.

One such credit its New Mexico’s Low Income Comprehensive Tax Rebate (LICTR), approved in the early 1970s when the state adopted a very broad gross receipts tax that covered food, health services and other purchases.[2] The credit is available to filers with income below $22,000 a year, is biggest for large, low-income families and gradually phases out as income grows.[3] Amounts range from $10 for a single individual with annual income over $21,001 to $450 for a family of six with income between $1,501 and $5,000.[4] A family of three at the federal poverty level this year, meaning they have income of $19,530 or below, would receive $40; a family of two at the poverty level of $15,510 or less would receive $55. The tax is refundable, meaning the value of the credit does not depend on the amount of income tax owed.

The Institute on Taxation and Economic Policy, a Washington, D.C., research group with a sophisticated model of the state and local tax system, examined how the implementation of a New Mexico-style credit would affect taxpayers of different income groups in Ohio. The analysis assumed that half of those eligible for the credit would receive it, since one has to apply for it.[5] Under that assumption, such a credit would cost the state about $70 million a year. Table 1 shows the results of ITEP’s analysis:

Nearly half of Ohioans in the bottom fifth of the income spectrum, with earnings of less than $18,000 in 2012, would benefit from such a credit. On average, those qualifying in this income group would receive $106 a year, or more than the average of $71 that ITEP calculates will be owed by members of this group in additional sales tax under the Kasich proposal.[6] These are averages; not everyone will get this benefit. The amount of the credit would vary according to the number of dependents, and some would pay more or less in additional sales tax. However, overall, a New Mexico-style sales-tax credit would protect almost half of the lowest-income Ohio taxpayers from the proposed broader sales tax.

Such a credit would go to about one in every six of those in the next higher income group, the fifth of Ohio taxpayers who made between $18,000 and $33,000 last year. On average, those in that group receiving the credit would get $35, just over a quarter of the $134 average additional sales tax that would be paid by this group under the governor’s proposal.

New Mexico’s rebate is just a beginning template for such a credit in Ohio. Some states have credits that cover a higher income than the $22,000 limit in New Mexico; Hawaii, for instance, whose General Excise Tax covers a very broad set of goods and services, extends its credit to those with incomes under $50,000, with declining amounts as income rises.[7] Oklahoma provides a $40 credit for each taxpayer with income up to $20,000; taxpayers with at least one dependent and income up to $50,000 get an additional $40 per dependent.[8]

The New Mexico LICTR can definitely be improved upon. Despite inflation, it hasn’t been increased since 1998, and the income cut-off of $22,000 leaves many out. Still, fully 271,421 tax filers received it in 2005, the last year for which data are readily available.[9] In that state, the credit is also complemented with a 10 percent refundable state earned income tax credit (EITC).

Twenty-four states and the District of Colombia have enacted their own state-level EITC programs. Most state EITCs are refundable, and the credit is based on a percentage of the federal program, ranging from 3.5 percent to 50 percent. A state EITC provides additional support to low-income families by helping them purchase essentials and save for future emergencies. A state EITC funded at 10 percent of the federal credit would provide the average qualifying Ohio family $224 a year.[10]

The federal and state EITC can only be claimed by people who earn income and goes mostly to those with children. The EITC makes it easier for low-income working families to provide for basic needs. A recent wave of research finds that families claiming the EITC see better social and economic results.[11]

As beneficial as an EITC would be, it would only cover a third of the poorest Ohio taxpayers, those in the bottom fifth of the income spectrum. The enactment of a New Mexico-style sales-tax credit along with it would double that number, compared to an EITC alone. This would allow more than 700,000 low-income Ohioans – those who made less than $18,000 in 2012 – to receive protection.

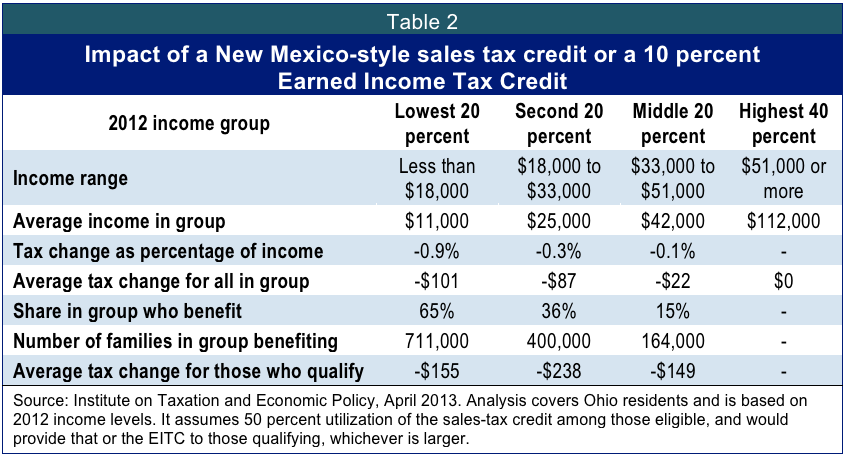

Table 2 shows how a combination of the two credits would affect Ohioans in different income groups. It examines the impact of an EITC, set at 10 percent of the federal level, and a sales tax credit that is received by half of those who are eligible for it. Qualified tax filers would receive either one credit or the other, whichever worked out to more for them. In all, more than 1.2 million Ohioans would receive the sales tax credit or the EITC. That would cost about $230 million a year, less than one tenth of the additional revenue the Kasich administration estimates from the sales-tax broadening.[12]

As Table 2 makes clear, a combination of these two credits would help offset much of the impact of a sales-tax base-broadening on low-income Ohioans. Those qualifying taxpayers in the lowest fifth of the income spectrum on average would get $155, or more than the additional sales tax they would pay under the Kasich proposal. As noted above, the exact pattern would be uneven.

Strong promotion needed

The enactment of both of these credits as outlined in this report would not fully protect low- and moderate-income Ohioans from the proposed expansion of the sales tax. A robust promotional campaign would be needed to ensure participation in both credits, especially the sales-tax credit. Otherwise, eligible taxpayers may not learn about the credit, and those who do not have to file income tax forms might not claim it. The sales-tax credit also would require more of an outreach effort than a state EITC because of the existing federal EITC program, which benefited more than 950,000 Ohioans in tax year 2011. The sales-tax credit would need to be expanded beyond the New Mexico-style credit, to increase the amounts and the phase-out threshold. This would offset more sales-tax payments and allow more Ohioans to benefit.

Kasich’s proposal to broaden the sales tax may not survive, or it could be drastically scaled back. Legislators should keep a sales tax credit in mind in any event. Though Ohio’s constitution prohibits taxing groceries and other food consumed off the premises,[13] our state and local tax system is still weighted against low- and moderate-income taxpayers.

Those nonelderly Ohioans in the bottom fifth of the income scale (making under $17,000 in 2010) on average pay 11.6 percent of their income in state and local taxes, compared to just 8.1 percent for those in the top 1 percent, who each made more than $324,000 that year.[14] Much of this difference is because the existing sales tax falls most heavily on low- and moderate-income Ohioans. A sales-tax credit is a targeted way to address this ongoing problem, which would be intensified by the Kasich administration proposal to apply the sales tax broadly to services.

The author thanks Gerard Bradley of New Mexico Voices for Childrenfor providing information for this report[1] Other states offering a sales-tax credit are Arizona, Hawaii, Idaho, New Mexico and Oklahoma. Some are provided as a way to counter the impact of taxes on groceries.

[2] The state subsequently stopped applying the tax to food and some other purchases

[3] To be eligible, a claimant must be a resident of the state during the tax year, be physically present in New Mexico during at least six months of the year, be neither eligible to be claimed or actually claimed as a dependent of another taxpayer, and not been an inmate of a public institution for more than six months during the year. See Instructions for 2012 PIT-RC, New Mexico Rebate and Credit Schedule, at http://bit.ly/ZIPRUq. New Mexico bases the credit on a filer’s modified gross income, which is all income from all sources for all household members. Exclusions are listed on p. 3 of the Instructions.

[4] For more details on how much families at different income levels may receive, see Ibid, p. 5.

[5] ITEP modeled a credit that is slightly simpler than the existing New Mexico rebate, in which the rebate increases by the same amount for each additional dependent.

[6] For estimates of the effects of the Kasich tax plan and its major elements on Ohioans in different income groups, see “Kasich Tax Proposal Would Further Tilt Tax System in Favor of Ohio’s Affluent,” Policy Matters Ohio, Feb. 7, 2013, at www.policymattersohio.org/tax-policy-feb2013.

[7] State of Hawaii – Department of Taxation, Hawaii Resident Income Tax Forms and Instructions, 2012 N-11, at www6.hawaii.gov/tax/2012/n11ins.pdf .

[8] Oklahoma also uses the $50,000 eligibility threshold for those 65 and over and those with disabilities that are a substantial handicap to employment. See State of Oklahoma, Claim for Credit/Refund of Sales Tax, Form 538-S 2012, at www.tax.ok.gov/IT2012/538-S.pdf.

[9] Tax Research Office, New Mexico Taxation and Revenue Department, Personal Income Tax Facts, Statistical Summary, 2005 Tax Year, December 2006, p. 16. A total of $24.6 million was paid in rebates that year. See http://bit.ly/Z2YSMj.

[10] “Small Investment, Big Difference: How an Ohio Earned Income Tax Credit would help working families,” Policy Matters Ohio, March 13, 2013, at http://www.policymattersohio.org/eitc-mar2013

[11] Ibid.

[12] The administration seeks to use this revenue for income-tax cuts, which would go mostly to affluent Ohioans. Despite a previous round of income-tax cuts that proponents said would bring jobs and economic gains to the state, Ohio has underperformed the nation since they were approved in 2005. See “Schiller testifies before House Ways & Means subcommittee on HB 59 income-tax plan,” Policy Matters Ohio, March 12, 2013, at http://bit.ly/10HTkt5.

[13] Ohio Constitution, Section 12.03(C), at http://www.legislature.state.oh.us/constitution.cfm?Part=12&Section=03

[14] “Ohio’s state and local taxes hit poor and middle class much harder than wealthy,” Policy Matters Ohio, Jan. 30, 2013, at www.policymattersohio.org/income-tax-jan2013. This release, based on a 50-state report, is not directly comparable to the other numbers in this report, as it covers incomes from an earlier period and excludes elderly taxpayers.

Tags

2013EITCOhio Income TaxRevenue & BudgetTax PolicyPhoto Gallery

1 of 22