Income-tax cut would favor affluent Ohioans: Middle-income residents on average would get $51 a year

April 22, 2013

Income-tax cut would favor affluent Ohioans: Middle-income residents on average would get $51 a year

April 22, 2013

Download analysis (2 pp)Press releaseSince the 21-percent reduction in state income taxes approved in 2005, Ohio’s economy has underperformed the nation. There is little reason to believe that another round of income-tax cuts will produce a different result.

The Ohio House of Representatives has approved a permanent cut to the state income tax of 7 percent. This would siphon more than $1.4 billion from public services over the next two years, while further cutting support to local governments and public libraries that have previously sustained major reductions.

The Ohio House of Representatives has approved a permanent cut to the state income tax of 7 percent. This would siphon more than $1.4 billion from public services over the next two years, while further cutting support to local governments and public libraries that have previously sustained major reductions.

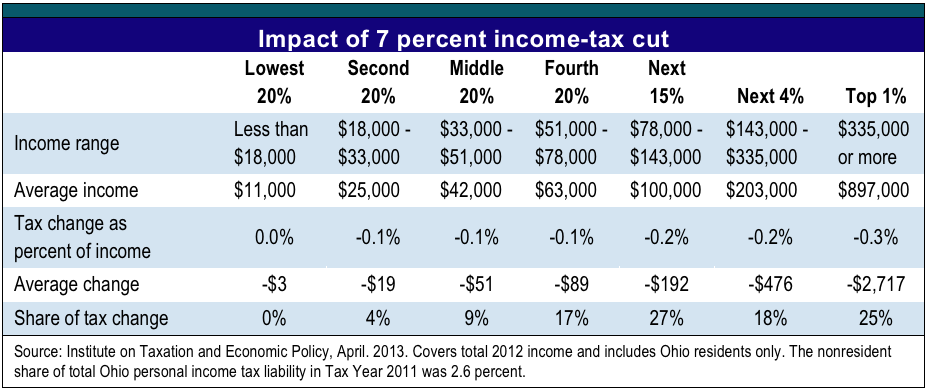

According to an analysis done for Policy Matters Ohio by the Institute on Taxation and Economic Policy (ITEP), Ohioans in the top 1 percent of the income spectrum earning at least $335,000 a year would receive an average reduction in taxes of $2,717 a year. The middle fifth of Ohio residents, making between $33,000 and $51,000 a year, would get an average of $51. Those in the bottom fifth, making less than $18,000, would see an average reduction of $3.

“Poor and middle-income Ohioans would get little out of this income-tax cut, while the highest-income Ohioans would see reductions in the thousands of dollars,” said Zach Schiller, Policy Matters Ohio research director. The estimates in the table below are based on an across-the-board 7-percent reduction in rates.

The analysis shows that the 60 percent of Ohioans with income below $51,000 a year would receive less than one dollar out of every seven cut in taxes. Nearly twice that amount, or one out of every four dollars cut in taxes, would go to the top 1 percent, whose average income is nearly $900,000 a year. Overall, more than 40 percent of the cut would go to the top 5 percent, those Ohioans making more than $143,000.

Ohio has a graduated income tax, so people pay more on higher levels of earnings. Because of that, across-the-board tax cuts give much more money to the wealthiest Ohioans. This reinforces inequality and adds to the unfairness of the state and local tax system, which is weighted in favor of upper-income taxpayers when all state and local taxes are taken into account.[1]

The 7 percent reduction approved by the House as part of the biennial budget is a smaller cut than the 20 percent originally proposed by Gov. John Kasich. As shown in a previous ITEP analysis, that cut would also go mostly to affluent Ohioans.[2] Under that much larger cut, those in the top 1 percent on average would get $7,777, while those in the middle fifth of the income spectrum would see $144 and those in the bottom fifth just $7.[3] Increasing the size of the cut would further heighten inequality while reducing revenue needed for schools, local governments and human services.

The Ohio Senate will consider restoring Gov. Kasich’s proposal to give a tax break to those owners of Ohio businesses who pay taxes on their interests in such firms through the individual income tax. Policy Matters has described separately how such a tax break is unlikely to create jobs.[4] Most qualifying taxpayers don’t employ anyone besides their owner now, and are unlikely to hire new workers merely because they get a tax cut. The much smaller number of fast-growing small businesses isn’t likely to receive a meaningful tax cut because they are busy investing in research, marketing and other expansion efforts, and have little or no income.[5] A thorough study commissioned by the U.S. Small Business Administration said, “We find no evidence of an economically significant effect of state tax portfolios on entrepreneurial activity.”[6]

Since the 21 percent reduction in state income taxes approved in 2005, Ohio’s economy has underperformed the nation, and so have small businesses, whose owners often benefited from that tax reduction.[7] “There is little reason to believe that another round of income-tax cuts, either an across-the board cut or the business-income tax break, will produce a different result,” said Schiller.

Policy Matters Ohio is a nonprofit, nonpartisan research organization with offices in Cleveland and Columbus. The Institute on Taxation and Economic Policy is a nonprofit, nonpartisan research group in Washington, D.C. ITEP’s Microsimulation Tax Model allows it to measure the distributional consequences of federal and state tax laws and proposed changes in them, both nationally and on a state-by-state basis.

[1] “Ohio’s state and local taxes hit poor and middle class much harder than wealthy,” Policy Matters Ohio, Jan.30, 2013, at www.policymattersohio.org/income-tax-jan2013.

[2] “Kasich tax proposal would further tilt tax system in favor of Ohio’s affluent,” Policy Matters Ohio, Feb. 7, 2013, www.policymattersohio.org/tax-policy-feb2013.

[3] These figures include just 20 per cent rate cut proposed by Gov. Kasich, not other elements of his tax plan.

[4] See “Tax break for business owners won’t help Ohio economy,” Policy Matters Ohio, Apr. 2, 2013, at www.policymattersohio.org/tax-break-apr2013.

[5] See Mazerov, Michael, “Testimony to House Finance and Appropriations Committee on HB 59 Income Tax Plan,” Center on Budget & Policy Priorities, March 19, 2013, at www.policymattersohio.org/mazerov-mar2013.

[6] Quoted in Ibid, p. 2.

[7] “Tax break for business owners won’t help Ohio economy,” Policy Matters Ohio, April 2, 2013, at www.policymattersohio.org/tax-break-apr2013.

Tags

2013Revenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22