Wayne County

Posted November 09, 2012 in Press Releases

State OverviewDownload PDFImpact of the 2012-13 state budget (HB 153)

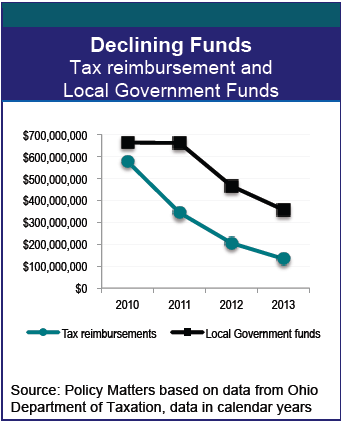

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Wayne County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Wayne County?

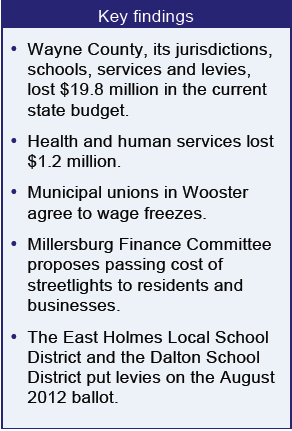

The state cut the Local Government Fund to the county, forcing Wayne County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund..................... -$211.0 thousand

- Schools.................................... -$11.1 million

- County operations....................... -$4.7 million (includes township LGF)

- Orrville...................................... -$396.0 thousand

- Rittman..................................... -$440.0 thousand

- Wooster.................................... -$1.5 million

Loss to health and human service levies

- County Mental Health/ Developmental disabilities.............. -$732.0 thousand

- County Children Services.............................................. -$474.0 thousand

- County senior services................................................. -$24.0 thousand

- Wayne and Holmes Mental health district......................... -$285.0 thousand

Notes and Quotes

The Wooster Employee Association and the police union agreed to wage freezes at the 2012 level through the end of 2013. The firefighters union agreed to wage freezes through 2014. From Haught, Sharon. “City of Wooster and Wooster Employees Association agree to multiyear wage freeze.” Wooster Weekly News. January 25, 2012. http://bit.ly/NIxVqy.

The Wooster Employee Association and the police union agreed to wage freezes at the 2012 level through the end of 2013. The firefighters union agreed to wage freezes through 2014. From Haught, Sharon. “City of Wooster and Wooster Employees Association agree to multiyear wage freeze.” Wooster Weekly News. January 25, 2012. http://bit.ly/NIxVqy.

“We'll make it through 2013 without major cuts, but unless something is done to change revenue in 2014, there will be major cuts to the police and other departments. We might only have one officer on per shift, and that is not safe. It seems like when something happens, it happens all at the same time. If we consolidate dispatch (services), then there won't be anyone to watch the jail, and there will be major delays (on police calls). That's a big difference to people who need that service.”