Frackers should pay public costs of growing industry

Posted on 06/10/15 by Wendy Patton in Revenue & Budget

As the Ohio Senate rolls out its version of the budget for 2016 and 2017, Senate President Keith Faber tells us that the severance tax on oil and gas production they hoped to include is not yet done. “The governor’s office has been willing to negotiate and the industry has been willing to show up… and sometimes negotiate,” he said.

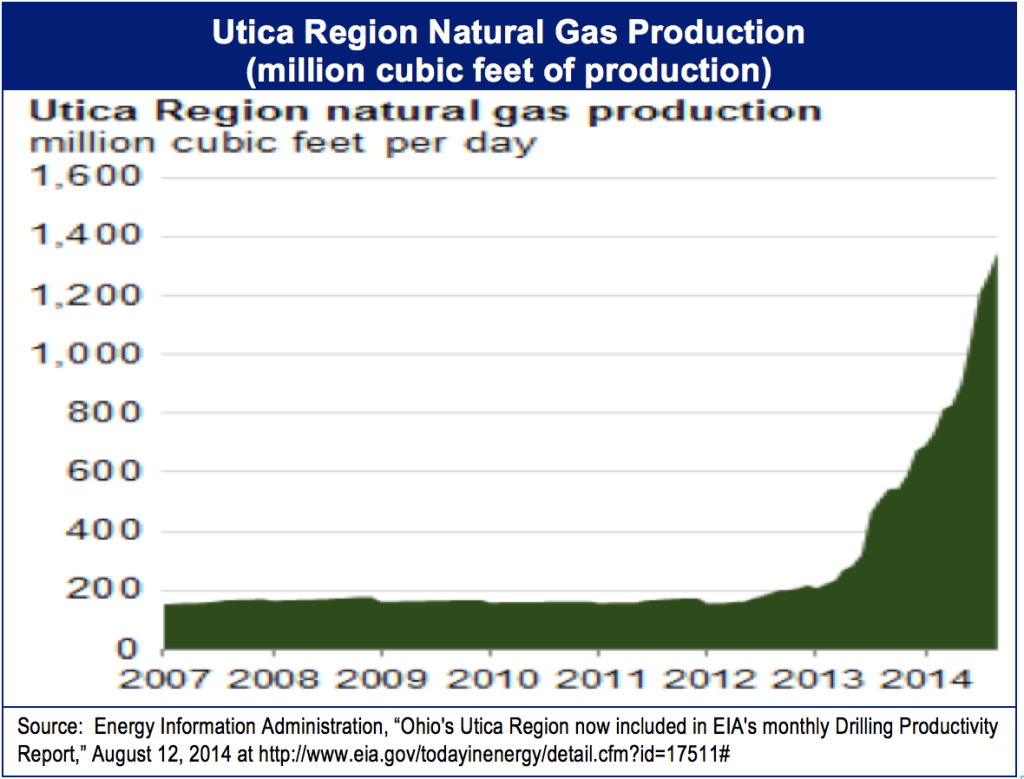

Shale drilling is growing in Ohio, as the chart below from the United States Energy Information Administration shows. But Ohio hasn’t been able to hammer out a reasonable tax level, even though other heavy fracking states have a much higher tax on the resources that are permanently removed from the state when drilling takes place. Just look at North Dakota (11.5 percent of the value of oil), Oklahoma (7 percent on gas and oil) and Texas (7.5 percent of value of natural gas).

Governor Kasich has proposed a 4.5 percent tax on the value of processed natural gas and liquids and 6.5 percent on unprocessed oil and natural gas at the wellhead. We think that’s a good start, though we’d like to see a 5 percent severance tax on oil and gas production, and an additional 2.5 percent fee for a permanent fund to underwrite future development, when the natural resources are gone.

We think that’s a good start, though we’d like to see a 5 percent severance tax on oil and gas production, and an additional 2.5 percent fee for a permanent fund to underwrite future development, when the natural resources are gone.

We need the money that a frack tax would bring in, because fracking is costly to communities. Roads need widening and strengthening to carry tankers of brine used in drilling. Rent rises as work crews move in and affordable housing becomes scarce. In some Pennsylvania counties where drilling has grown, homeless shelters have been established for the first time. Some communities have seen an increase in crime and public health problems. A recent study even found, alarmingly, that babies born near fracking have lower birthweights. If we’re not going to regulate this dangerous industry, then addressing these problems takes money.

Ohio’s severance tax on oil (two dimes per barrel) and natural gas (three cents per thousand cubic feet) supports Ohio Department of Natural Resources activities for the industry, but little else. Revenues are far too small to help affected communities with the external costs of drilling, let alone help strengthen the state’s economy for after the resources are gone.

The Associated Press reported production of both oil and gas in Ohio more than doubled from a year ago. Gongwer Ohio reports the Kasich administration, which included a good proposal for a severance tax in the executive budget for FY 2016-17, shared the news of growing production with reporters.

The industry puts up a lot of strawman arguments, but production is growing and as production rises, so do costs in communities where the drilling takes place.

Long-term prices for natural gas are projected to rise. Pipeline capacity is expanding. More Ohio natural gas is being sold to markets beyond the Appalachian basin. It is time to allow the industry to be a good partner to the state and the affected communities by paying its fair share of the costs imposed by drilling and to help build for a future when the natural gas is all gone.

-- Wendy Patton