Workforce and training

January 31, 2013

Workforce and training

January 31, 2013

Ohio’s economy has recovered somewhat since the official end of the 2007 recession, but job creation and job quality remain below what we expect from a healthy economy. Unemployment remains high at 6.7 percent. Too many Ohioans, 388,000 in December, are still looking for work. In 2011, the last year for which we have full-year data by demographic, young Ohioans had a 14.3 percent unemployment rate and African Americans faced a 17 percent rate.[49] Ohio median wages fell by 45 cents in 2011 and have been falling since 2006.[50]

Years of bad UC policy prove costly to state

Ohio’s unemployment compensation (UC) trust fund – the money that pays benefits to unemployed Ohioans – has been broke for more than four years. Ohio currently owes $1.77 billion to the federal government,[51] which was borrowed to pay UC benefits.[52] By this fall, the state will have paid more than $180 million in interest on that debt. At a time when the state has so many unmet needs, it is illogical for the state to be forking over tens of millions of dollars in such interest payments. We need to pay back the debt, and build a reserve for the next economic downturn, while protecting this critical support.

Ohio’s unemployment compensation system is paid for by employer taxes. Ohio underfunded its UC system for many years, so that the trust fund was ill-prepared for the 2007-2009 recession. The recession caused the number of unemployed to skyrocket, increasing the amount of benefits that was paid out. Ohio’s unemployment compensation benefits are not overly generous – they average about $300 a week, and relatively fewer unemployed Ohioans qualify for benefits than do jobless workers in most other states.[53]

The key problem is that employer contributions have not been sufficient, leaving the fund ill prepared when benefit levels increase. Ohio employers pay taxes on only the first $9,000 in each employee’s annual wages, or less than a quarter of wages paid. That amount, which is well below the national average, hasn’t been raised since 1995; if it had kept up with inflation since then, it would be more than $13,500. The state has not met generally accepted solvency standards for decades.[54]

While it’s not unreasonable that Ohio had to borrow during this period of high and long-term unemployment, it is clear that Ohio’s UC solvency problem is not so much a product of the poor economy as much as poor policy. After years of underfunding this crucial system, Ohio needs to face the need for more adequate financing and a higher taxable wage base, in particular.[55]

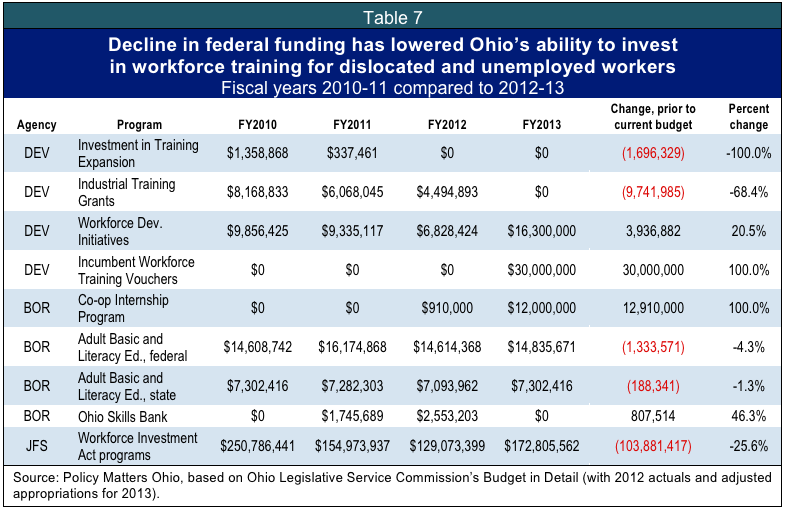

Focus on regional opportunities in workforce training

Ohio’s workforce training system is crucial for employers, helping them find well-qualified workers. The system is also important to communities, helping workers access and complete training, and linking all workers to new opportunities, but especially those at the bottom of the pay and skill ladder. Most of Ohio’s workforce funding comes from the federal Workforce Investment Act (WIA). WIA has traditionally helped unemployed and dislocated workers back into the labor market, often by offering training assistance. The budget of 2012-13 had far less federal funds for workforce training. New state funding was targeted to support college and graduate students move into internships and to train already employed (incumbent) workers. Table 6 shows these changes, along with key budget line items important to supporting the state workforce system.

WIA funding through the Ohio Department of Job and Family Services for traditional purposes of training adults, dislocated workers and youth, has steeply declined. At the same time, state investment in training increased, as casino licensing fees supported the new incumbent worker training voucher program, and state dollars funded the Co-Op Internship program.

The new budget should restore a focus on helping unemployed workers return to the labor force and helping low-skilled adults connect with family-supporting career pathways. Federal funding through WIA programs is not expected to increase. WIA programs are automatic spending cuts of the Budget Control Act of 2011 (“sequester”). Substantial cuts are expected between March and the end of December under current law.

State funding is needed to backfill for programs targeting low-skilled and low-wage workers. The new state initiatives do little to address the state’s dislocated workers and the low-skill, low-wage workforce, the very groups hardest hit by a slow economic recovery and declining federal workforce dollars.

Industry-driven sector partnerships are a proven solution to closing these workforce gaps. The National Governors Association estimates that there are 1,000 partnerships operating in the U.S., and more than half the states are implementing or exploring these strategies.[56] Pennsylvania alone has supported 76 partnerships, serving over 100,000 workers, and increasing wages and job retention rates.[57] Ohio has also produced some successful programs based on sector strategies. The Cincinnati region has supported sector partnerships in healthcare, advanced manufacturing, and construction, training more than 6,000 jobseekers and incumbent workers since 2008.[58] In northwest Ohio, the Skills for Life Marine Trades Training Initiative has been nationally recognized by the U.S. Department of Labor and has leveraged more than $1 million in private investment to train workers to use cutting edge technology and equipment.[59]

A sector partnership-training fund would bring these best practices to scale. Investments made in building regional partnerships will maximize state workforce training resources to help those most in need, and build regional infrastructure to address employer needs. The state should use a portion of its workforce training funds, enlarged now through casino revenues, to support regional sector partnerships. Such a program could provide competitive grants to regional consortia of workforce partners for the development and implementation of employer and worker responsive curriculum and training. Sector partnerships could help move Ohioans through quality, employer-driven, training programs for in-demand jobs.

Shared work

Ohio’s budget should also include a shared work, or Short-Time compensation program. Shared work is a proven layoff aversion tool. These programs increase the flexibility of the unemployment compensation (UC) system. The program allows employers to shorten the workweek of a larger number of employees instead of laying-off a smaller number entirely. The workers would make up some of their lost income with a partial payout of unemployment benefits.

Under a shared work plan, employees can retain their health insurance and keep accruing retirement benefits while avoiding the emotional hardship associated with layoffs. The stress of looking for a new job in a tough labor market is averted. Employers can retain skilled employees, avoid expensive retraining and rehiring, boost employee morale and be more easily able to gear up when demand recovers. Shared work also allows workers to participate in WIA training programs, training that help the worker and the employer become more productive while managing a down-turn. If Ohio had a short-time compensation program that gained as many participants as the average state program, there would have been more than 23,000 Ohioans participating in 2009, during the height of the recession, the number of layoffs prevented would have been a proportion of that but thousands of Ohioans who would have otherwise been laid off could have been working.[60]

Shared work is funded in the same fashion as regular unemployment compensation benefits: tax rates rise on employers based on payout of benefits to their laid-off employees. The Congressional Research Office has found that in states where short-time compensation is charged to the firm according to the experience rating rules of the regular unemployment program, the firm incurs no more in unemployment insurance tax costs by using shared work than it would through layoffs.[61]

The federal government is offering up to three years of 100 percent reimbursements of shared work benefits to states that enact and implement shared work programs.[62] Outreach and implementation grants are also available to states, but states must apply for this funding by Dec. 31, 2014.[63] More than twenty states and the District of Columbia have or have recently enacted shared work legislation. Ohio should join their ranks, and implement this important program.

Other sections:Executive summaryIntroductionBudget baselinePrivatizationLocal governmentK-12 educationHigher educationHealth and human servicesTax policySummary and recommendations

[49] Hanauer, Amy, “State of Working Ohio 2012,” Policy Matters Ohio, September 2012 at http://bit.ly/PQP8fM.

[50] Ibid.

[51] U.S. Department of Labor, Employment & Training Administration, Trust Fund Loans, available at http://workforcesecurity.doleta.gov/unemploy/budget.asp#tfloans.

[52] Zach Schiller, “Courting Crisis: Ohio Policy Has Undermined Unemployment Compensation Fund,” Policy Matters Ohio, October 2011, available at http://www.policymattersohio.org/courting-crisis-ohio-policy-has-undermined-unemployment-compensation-fund-3

[53] Zach Schiller, “Ohioans Face Tough Test to Receive Unemployment Benefits,” Policy Matters Ohio, January 2013,

[54] Ibid.

[55] Schiller, Zach, Courting Crisis: Ohio policy has undermined unemployment compensation fund,” Policy Matters Ohio, October 2011 at http://bit.ly/VlGi2z.

[56] National Governors Association, State Sector Strategies Coming of Age: Implications for State Workforce Policymakers, available at www.nationalskillscoalition.org/assets/reports/state_sector_strategies_coming_of_age.pdf.

[57] Pennsylvania Workforce Development, Industry Partnerships Fast Facts, available at http://bit.ly/WfvFN7.

[58] Ohio Workforce Coalitions, Sector Partnership Proposal, p. 3 available at http://bit.ly/129KWlZ. Includes information on sector strategies across the state.

[59] Ibid.

[60] Schiller, Zach, “Worksharing: A tool to avoid layoffs,” Policy Matters Ohio, April 2010, at http://bit.ly/WdLmo2.

[61] Shelton, Alison M., Congressional Research Service, “Unemployment Compensation: Short-Time Compensation and Compensated Work Sharing Arrangements,” July 2, 2009, available at http://1.usa.gov/WQz0zM.

[62] National Employment Law Project, “Seizing the Moment: A guide to adopting state work sharing legislation after the Layoff Prevention Act of 2012,” available at http://bit.ly/WfvWQ9.

[63] Ibid.

Photo Gallery

1 of 22