Crawford County

November 01, 2012

Crawford County

November 01, 2012

Impact of Ohio’s 2012-13 state budget (HB 153)

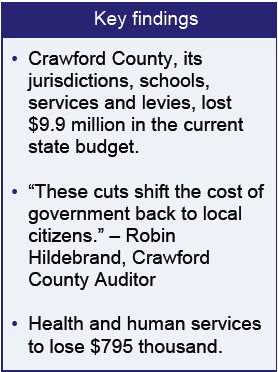

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Crawford County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Crawford County?

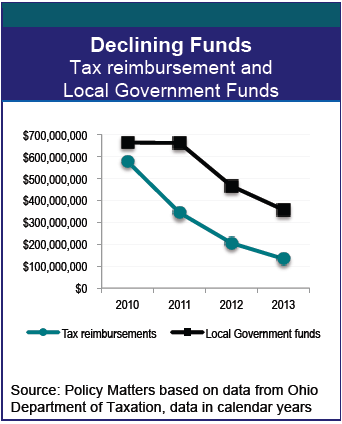

The state cut the Local Government Fund to the county, forcing Crawford County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund.................. -$105 thousand

- Schools................................... -$6.8 million

- County.................................... -$2.9 million (includes LGF undivided fund)

- Polk Township........................ -$33 thousand

- Bucyrus.................................. -$186 thousand

- Galion.................................... -$97 thousand

Loss to health and human service levies

- County children’s services........ -$25 thousand

- County mental health.............. -$716 thousand

- County seniors’ services........... -$53 thousand

Notes and quotes

“These cuts shift the cost of government back to local citizens.” – Robin Hildebrand, Crawford County Auditor. From personal interview, summer 2012.

“These cuts shift the cost of government back to local citizens.” – Robin Hildebrand, Crawford County Auditor. From personal interview, summer 2012.

State budget cuts to reduce the park district's local government funds by approximately 28 percent next year and 44 percent in 2013, when compared against the current 2011 funding levels. From “Levy would Guarantee Funding for Park District.” WFMD.com. http://tinyurl.com/cdlnmxq.

NOTES: The current state budget cuts the Local Government Fund to counties, municipalities and townships by 25 percent in the first year and by 50 percent in the second year. This 77-year old state revenue sharing program has, for generations, been essential to helping Ohio communities fund schools, provide services, and lift people out of poverty. The current state budget also phases out most of the tangible personal property tax and public utility property tax reimbursements, which were promised to local governments when the state cut taxes in recent years. These are not the only losses to local governments because of this budget. There are others in specific programs. Here we detail some of the bigger shifts.

Change in revenues shown here include:

- Local Government Fund "County Undivided Fund," which counties share with their cities, townships and villages. We show how much less money the counties are receiving under the current 2-year state budget (for 2012 and 2013) compared to the two years under the prior state budget (which was for 2010 and 2011). Here the funds are shown on a calendar year basis because that is how the tax department forecasts and records their distribution to local governments, and it is how local governments budget. (The state budget is based on the fiscal year, July 1 through June 30.)

- Local Government “Municipal Direct” allocation from the Local Government Fund that the state gives directly to municipalities with an income tax. This is also shown in terms of funding provided in the calendar years 2012 and 2013 compared to 2010 and 2011.

- Property tax reimbursements promised to local governments during tax reductions enacted earlier in the decade. The loss of funding in calendar years 2012 and 2013 is compared to the level of funding provided in 2010 and 2011.

The figures for changes in funding levels are based on data provided by and spreadsheets online at the Ohio Department of Taxation for local government funds and tax reimbursement distributions.

Photo Gallery

1 of 22