Damage from the sequester

February 27, 2013

Damage from the sequester

February 27, 2013

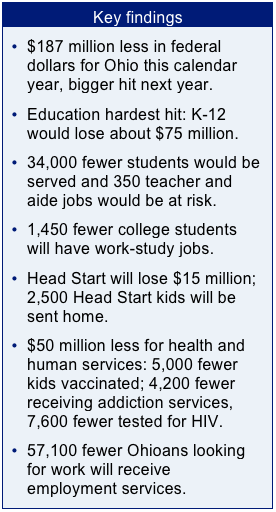

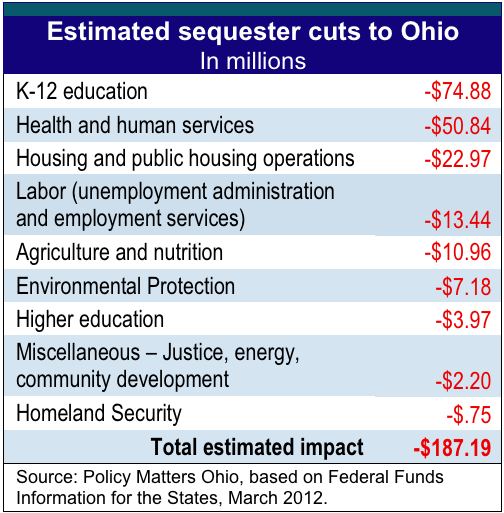

Download briefThe sequester will now cost Ohio about $187 million in federal funds this year.

New Year negotiations pushed back the date big federal cuts were to hit the states to March 1, 2013. That day has arrived.

New Year negotiations pushed back the date big federal cuts were to hit the states to March 1, 2013. That day has arrived.

As the economy staggered out of the worst recession since the Great Depression, employment and recovery should have been first in the mind of elected leaders. Instead, legislators focused on deficit reduction and tax cuts. Legislators put in place across-the-board budget cuts, called a sequester, which they thought would be so draconian that a deal would be reached before they were implemented. However, no deal has been reached and the automatic, across-the-board cuts start Friday.

Last year, Policy Matters Ohio estimated that the cost of the sequester to Ohio’s economy would be $312 million. The scheduled implementation of sequester cuts was since delayed from January 1 to March 1, reducing the cuts to domestic discretionary spending in 2013 from 8.8 percent to 5.2 percent.[1] The sequester will now cost Ohio about $187 million in federal funds this year. The cuts in key programs and some anticipated impacts are listed below.

Many of Ohio’s health and human service agencies get more than half of their funding from the federal government. Cuts this year, and nine years into the future, threaten to erode public services, already badly cut by the current state budget and by the fiscal crisis in Ohio communities. Yet Ohio legislators are in the process of considering income tax cuts of unprecedented size – $415 million this year, as money put in the rainy day fund exceeds 5 percent and is placed in the Income tax Reduction Fund, and $1.4 billion over the next three years, as a result of income tax changes proposed in the 2014-15 budget. Because of Ohio’s progressive income tax, the lion’s share of an income tax cut goes to top earners. Yet sequester cuts will impact families of moderate and low income the most.

Instead of further tax cuts for top earners, Ohio’s elected leaders should be working to figure out how to make sure the sequester cuts do not hurt our economy and communities. The next page provides a snapshot of services that will be affected by the sequester.[2]

K-12 schools – As a result of the sequester, Ohio schools could lose around 350 teacher and aide jobs. Approximately 100 fewer schools would receive funding. Up to 270 teachers, aides, and staff who help children with disabilities could face layoffs.

Higher education – College students will also feel the impact. Around 3,320 fewer low-income students in Ohio would receive aid for college costs and some 1,450 fewer students would get work-study jobs that help pay for college.

Higher education – College students will also feel the impact. Around 3,320 fewer low-income students in Ohio would receive aid for college costs and some 1,450 fewer students would get work-study jobs that help pay for college.

Early childhood – Head Start and Early Head Start services would take a big hit: $15 million this year, and hits of a similar size for the next nine years if a sequester-style mechanism remains in place. Head Start programs would be eliminated for approximately 2,500 children in Ohio, reducing access to critical early education and hurting the economy in the long-term as underserved children need more remedial help.

Clean water, air, wildlife protection – The environment will be damaged by the cuts: Ohio would lose about $6,865,000 in environmental funding to ensure clean water and air quality, as well as prevent pollution from pesticides and hazardous waste. Also at risk is $981,000 in grants for fish and wildlife protection.

Justice – The sequester could eliminate about $455,000 in Justice Assistance Grants that support law enforcement, prosecution and courts, crime prevention and education, corrections and community corrections, drug treatment and enforcement, and crime victim and witness initiatives.

Employment support – Ohio will lose about $1,786,000 in funding for job search assistance, referral, and placement, meaning around 57,100 fewer people will get the help and skills they need to find employment. Up to 800 children of low-income workers could lose access to child care, which helps working parents hold down a job. If some are forced to leave their jobs, there will be long-term costs to the economy.

Health – Programming to protect the health of kids is also at risk. For example, sequester cuts could mean that 5,040 fewer Ohio children will receive vaccines for diseases such as measles, mumps, rubella, tetanus, whooping cough, influenza, and Hepatitis B due to reduced funding for vaccinations of about $344,000. If some later get these diseases, long-term financial and public health costs will increase.

Aging – Seniors are also helped by public programs: the sequester could take approximately $823,000 in funds that provide meals for seniors.

[1] The 8.8 percent figure was calculated using data from the Federal Funds Information for the States database, March 2012. The 5.2 percent figure is from the Center on Budget and Policy Priorities, February 2013.

[2] Estimates are from Federal Funds Information for the States database, Center on Budget and Policy Priorities, and the White House www.whitehouse.gov/sites/default/files/docs/sequester-factsheets/Ohio.pdf.

Tags

2013Budget PolicyHigher EducationK-12 EducationMedicaidRevenue & BudgetWendy PattonPhoto Gallery

1 of 22