The state budget and Ohio’s schools

January 19, 2012

The state budget and Ohio’s schools

January 19, 2012

Press releaseExecutive summaryFull reportThis survey of local school finance officials reveals alarming levels of fiscal distress at districts across the state, whether they are poor, wealthy or in between. The cuts being discussed – to staffing levels, course offerings, arts and extracurriculars – will hurt Ohio students for years to come. Representatives from 172 K-12 districts in Ohio responded to our survey about how state budget cuts are affecting their schools.

Big cuts, hard choices, local impacts

Executive summary

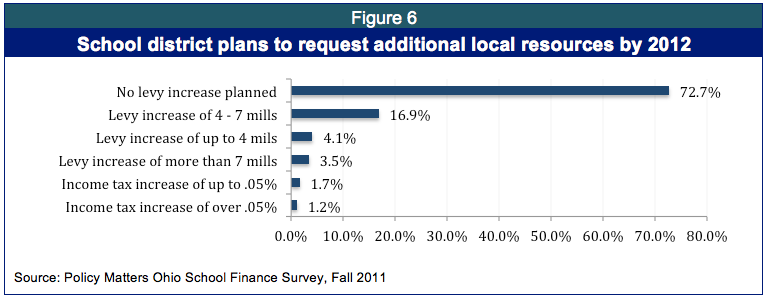

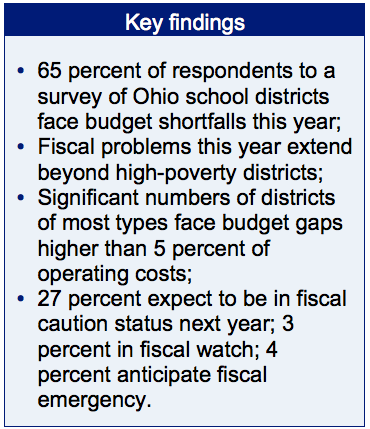

The state budget, House Bill 153, will provide $1.8 billion less in funding for Ohio’s elementary and secondary schools this school year and next, compared to the prior two years. Respondents to a 2011 Policy Matters Ohio survey to Ohio’s school districts anticipate rough times ahead. However, they are not going to the community for local resources: 73 percent did not plan to go to the polls through November 2012. Instead, survey respondents said they are cutting teachers and programs, boosting class size, and requiring students to pay to participate in extracurricular activities. More than a quarter of respondents anticipate being in official fiscal distress in the coming year.

The state budget, House Bill 153, will provide $1.8 billion less in funding for Ohio’s elementary and secondary schools this school year and next, compared to the prior two years. Respondents to a 2011 Policy Matters Ohio survey to Ohio’s school districts anticipate rough times ahead. However, they are not going to the community for local resources: 73 percent did not plan to go to the polls through November 2012. Instead, survey respondents said they are cutting teachers and programs, boosting class size, and requiring students to pay to participate in extracurricular activities. More than a quarter of respondents anticipate being in official fiscal distress in the coming year.

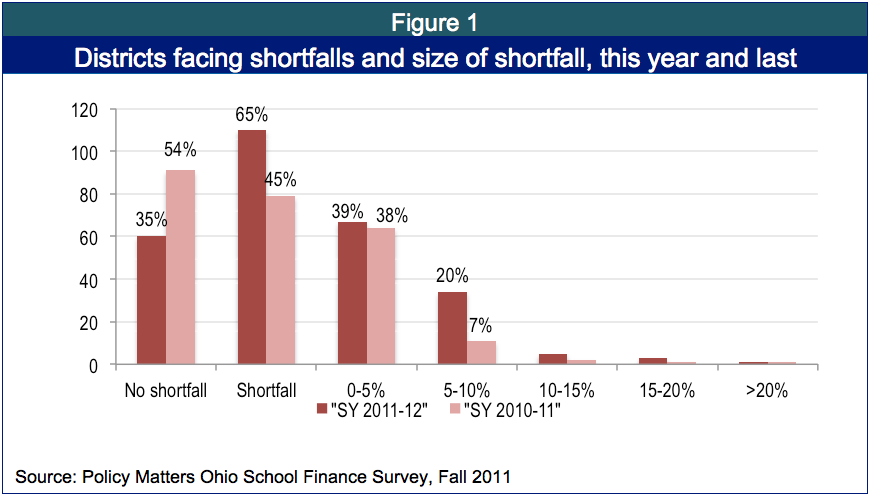

The share of districts that said they faced a budget gap rose from less than half last year (45 percent) to almost two-thirds (65 percent) this year. Of those districts anticipating a shortfall, the number expecting a gap of between 5 and 10 percent almost tripled, from 7 percent to 20 percent. Survey responses indicate that this year, fiscal distress is far more widely distributed than in the past. Districts with budget shortfalls in excess of 5 percent are no longer concentrated in poor rural areas but are now found in urban areas and suburban areas too, some with median or high income.

Most respondents said they will manage budget shortfalls through labor cost containment. Slightly more than two thirds plan to reduce the workforce through attrition while 60 percent reported they would institute pay freezes and 8 percent said they will use pay cuts. Forty-six percent reported that they will reduce the costs of benefits; 45 percent said they plan to institute reductions in force.

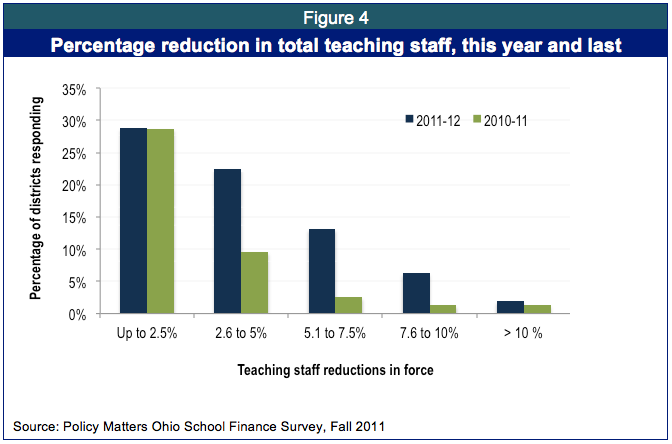

Reductions in teaching staff impact both students and staff, affecting daily operations and student learning. With fewer teachers in the classroom, administrators are forced to consolidate, leading to larger class sizes. This can make it more difficult to provide strong classroom management, high-quality teaching and individual attention. This year, almost a quarter of school districts said they anticipate reducing teaching staff by 2.5 to 5 percent, more than double last year’s share. The share of districts planning a reduction of between 5 and 7.5 percent quadrupled between last year and this. In fact, respondents reported that they have already reduced staff, through attrition or layoff, by 700 positions, more than twice as many as the 331 RIF’s they reported for the last school year. If this rate of personnel reduction occurs across other districts that did not respond to the survey, then up to 2,500 teaching jobs may already have been eliminated in Ohio’s schools in the current year.

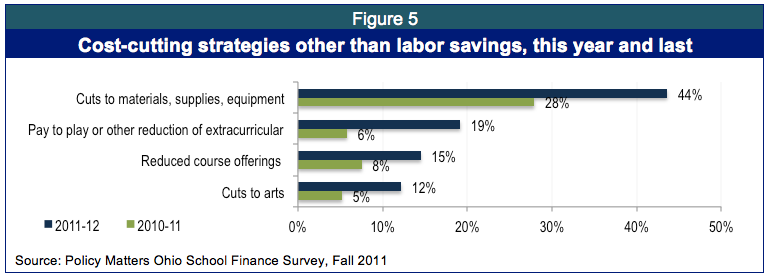

Students will feel a direct impact. For example, 44 percent of respondents said they plan to reduce expenditures on materials, supplies and equipment; 38 percent reported that they will allow class size to grow; 15 percent reported that they plan to reduce course offerings (double the share last year) and 12 percent plan to reduce instruction in the arts. Almost 19 percent said that they will employ pay-to-play strategies in extracurricular activities such as athletics. This means that some or all students who can’t afford the new fees will be excluded from activities. Across all school districts, a 19 percent rate of ‘pay-to-play’ means 116 districts would charge students to participate in athletics.

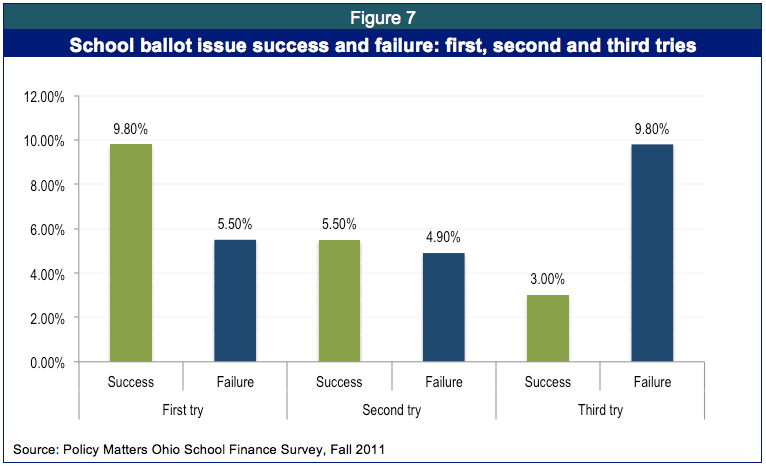

School districts are not seeking local relief. At the time of the survey, almost three quarters of respondents had no plans to float a levy before November 2012 elections; 62 percent had not gone to the ballot since 2008. Survey responses indicate that going to the polls is risky: Levies often pass on the first try but the odds get worse with subsequent attempts. Weighing the mood of the voters is an important consideration. Local election results in 2011 may be reflective of this. Despite the historic reduction in state aid to schools, there were fewer school issues on local ballots in 2011 than in 2005.

Slightly more than a quarter (27 percent) of the districts participating in the survey indicated that they anticipate being in some level of fiscal distress in school year 2011-12: either fiscal caution, fiscal watch or fiscal emergency. If these results are extrapolated across Ohio’s 613 school districts, it would mean that almost 20 percent – about 120 – would be in the status of ‘fiscal caution,’ compared to the 21 districts identified by the Ohio Department of Education as of January 2012. Seven percent – 43 schools if survey results are extrapolated across all districts – could be in fiscal watch or fiscal emergency, compared to 14 districts listed that way on the ODE website.

Long-term investment in education remains the best way to build opportunity for Ohioans. Ohio can restore investment in schools by reducing tax expenditures, restoring top income tax levels and restoring taxes on corporations. In addition, emerging and growing parts of our economy should be taxed appropriately so that they contribute their fair share to Ohio's infrastructure. These include oil and gas production as well the collection of taxes on internet sales by out-of-state retailers.

It’s time to restore investment in our children’s education and other services that support Ohio’s people, families and communities.

Introduction

Data collected from a Policy Matters Ohio survey of the state’s school districts last fall show that despite the economic recovery, almost two thirds of respondents face budget shortfalls in the current school year compared to less than half last year. Almost three quarters had no plans to put a levy on the local ballots before November 2012. Strategies for managing the shortfall range from pay cuts and freezes, benefit reductions and reductions in force to increased class size and pay-to-play extracurriculars. Slightly more than a quarter of respondents expect to be under official scrutiny for fiscal problems next year, and about 7 percent anticipate being in fiscal watch or fiscal emergency.

Fiscal outlook poor

The fortunes of local and regional economies depend to a great extent on the educational level of the people who live and work in them. In Ohio, however, funding to primary and secondary education was reduced by $1.8 billion dollars in the current biennium compared to the last.[1] Media attention since that time has focused less on the impact to children and more on the cost of school personnel. Most of the money in education supports jobs: in Ohio, 83 percent of K-12 education funding goes to payroll.[2] Because of this, cost-cutting largely focuses on reducing the costs of staff. The most contentious issue in Ohio last year, Senate Bill 5/Issue 2, would have severely curtailed collective bargaining for teachers and other public employees. It was presented as a tool for reducing compensation for these workers.

In this report, Policy Matters Ohio looks at how elementary and secondary schools plan to deal with the unprecedented loss of funding.

Policy Matters developed and distributed a survey to school business officials from Ohio’s 613 school districts to learn how districts are attempting to meet the challenge of accomplishing more educationally with less money. At the request of Policy Matters, the Ohio Association of School Business Officials (OASBO) included a link in its October 2011 newsletter to our online survey and sent the link by email through the Ohio Education Computer Network treasurer list, which reaches all Ohio school district treasurers, even those who are not members of OASBO. Of Ohio’s 613 K-12 school districts, 172 (28 percent) responded.[3]

More than half of districts anticipate the same (31 percent) or increasing (24 percent) enrollment in the next year; 45 percent anticipate fewer students.

As Figure 1 shows, the share of respondents reporting budget shortfalls (as a percentage of total operating budget), and the size of the shortfalls, increased significantly this school year (2011-2012) compared with last, regardless of improving economic conditions. The share of districts that said they faced a budget gap rose from less than half last year (45 percent) to almost two-thirds (65 percent) this year. Of those districts anticipating a shortfall, the number anticipating a gap of between 5 and 10 percent almost tripled, from 7 percent to 20 percent.

Shortfalls across district types

Each school district in the state is assigned a typology by the Ohio Department of Education.[4] The typologies are as follows:

- 0: Island district or College Corner;[5]

- 1: Rural/agricultural – high poverty, low median income;

- 2: Rural/agricultural – small student population, low poverty, low to moderate median income;

- 3: Rural/Small town – moderate to high median income;

- 4: Urban – low median income, high poverty;

- 5: Major Urban – very high poverty;

- 6: Urban/Suburban – high median income;

- 7: Urban/Suburban – very high median income, very low poverty.

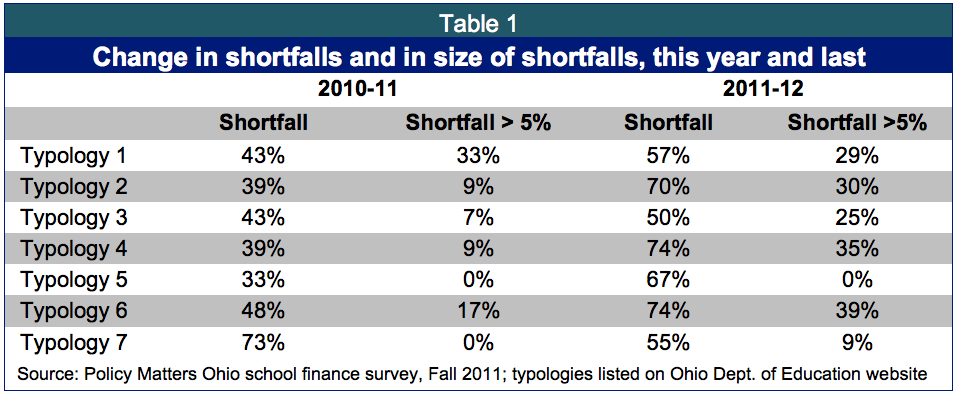

Table 1 shows that last year, districts with the largest reported budget shortfalls (greater than 5 percent) were concentrated in Typology 1, which includes districts in rural/agricultural areas characterized by high poverty and low median income. Survey responses indicate that this year, fiscal distress is far more widely distributed, with dramatic increase in shortfalls of greater than 5 percent in responding districts in typologies 2, 3, 4 and 6. This range of districts includes school systems from rural/agricultural areas, urban areas with high poverty and low median income as well as those from urban/suburban areas with high or median income. (The sample did not include enough responses from major urban districts to give meaningful information about the size of shortfalls in those districts).

What is being done?

Figure 2 shows how districts report they are planning to address shortfalls, including through reductions in staffing and compensation, reductions in course offerings, larger classrooms and pay-to-play strategies. Slightly more than two thirds said they will reduce the workforce through attrition while 60 percent reported they would institute pay freezes and 8 percent said they will use pay cuts to balance their budgets. Forty-six percent reported that they will reduce the costs of benefits; 45 percent said they plan to institute reductions in force (RIFs). Students will also feel the impact directly. For example, 44 percent of respondents said they plan to reduce expenditures on materials, supplies and equipment; 38 percent reported that they will allow class size to grow; 19 percent said they will employ pay-to-play strategies in extracurricular activities such as athletics. Fifteen percent reported that they plan to reduce course offerings. Twelve percent plan to reduce instruction in the arts.

Appendix 1 includes comments outside of the categories offered by the surveys: common responses included cash management strategies (refinancing debt); reducing transportation; going to the ballot for expanded levies; reducing facilities (limiting maintenance or closing schools); insourcing purchased services and renegotiating purchased service contracts.

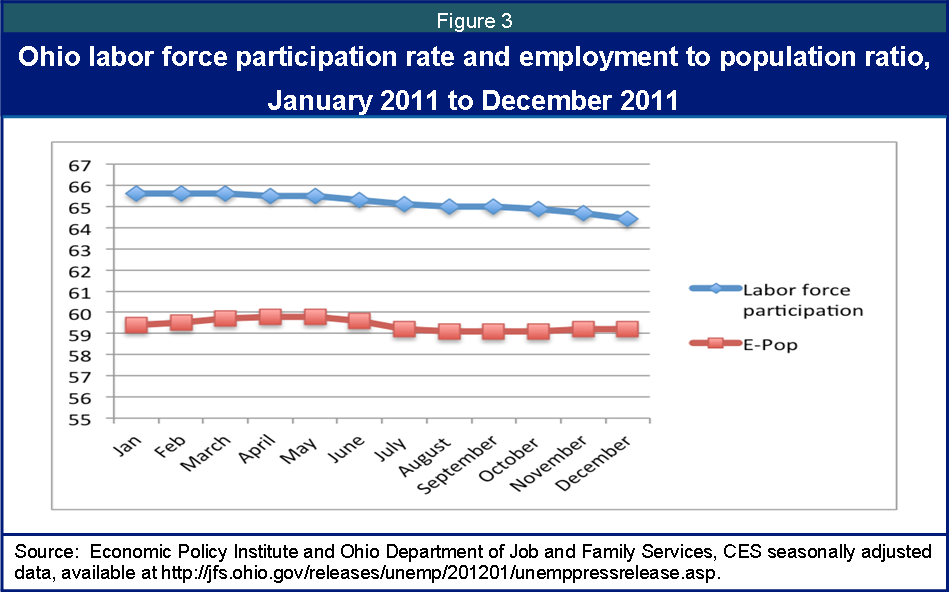

Many cost-cutting strategies focus on labor costs, since education is a labor-intensive sector with most revenue going directly to payroll. Figure 3 shows that the share of respondents reporting lowering costs through reduction in force increased substantially for the current school year.

Reductions in teaching staff impact both students and staff, affecting daily operations and student learning. With fewer teachers in the classroom, administrators are forced to consolidate, leading to larger class sizes. This can make managing a classroom for quality and individualized attention a challenge, which is detrimental to learning for many students. Figure 4 shows the share of districts forecasting cuts to teaching positions due to budget shortfalls this year compared to last school year.

In the current year, we see more districts making bigger cuts to their teaching staff. While the same share of districts plan to trim the teaching staff with reduction of up to 2.5 percent, this year, almost a quarter of respondents - 23 percent - said they anticipate reducing teaching staff by 2.6 to 5 percent, a jump of 134 percent compared to last year. The share of districts anticipating a reduction of between 5 percent and 7.5 percent quadrupled between last year and this. In fact, respondents reported that they have already reduced staff, through attrition or layoff, by 700 positions, more than twice as many as the 331 reductions in force they reported for the last school year. If this rate of personnel reduction is applicable across districts, then up to 2,500 teaching jobs may already have been eliminated in Ohio’s schools in the current school year.[6]

Figure 5 shows that other strategies for reducing budget shortfalls will also rise sharply this year. For example, the number of respondents who said they anticipate instituting ‘pay-to-play’ extracurriculars will triple in the current year as compared to last. This means that some or all students who can’t afford the new fees will be excluded from activities. Extrapolated across all school districts, a 19 percent rate of pay-to-play would mean 116 districts would charge students to participate in athletics. The share of respondents who said they will reduce course offerings doubled in this year compared to last.

Districts not asking for levies

Last fall, the great majority of school districts did not plan to turn to local voters for relief. At the time of the survey, almost three quarters of respondents (73 percent) had no plans to float a levy before the end of 2012 (Figure 6). The largest share of those seeking an increase in property taxes said they would seek between 4 and 7 mills.

Going to the polls is a risky proposition. Although more respondents indicated their last levy had passed on the first try as compared to those who reported failure, the odds get worse with subsequent iterations (Figure 7). Weighing the mood of the voters is an important consideration.

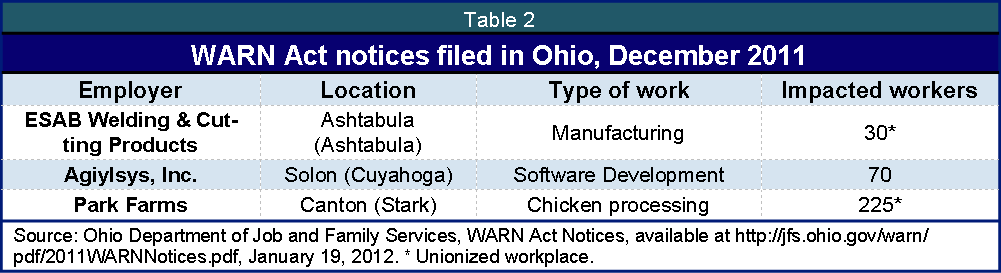

Of the 164 responses to the question on polling successes and failures, 61.5 percent (101 respondents) reported that they had not requested a levy or income tax increase since 2008. The risk involved in defeat at the polls may depress efforts to seek local taxpayer relief. A downturn in the number of local school issues on the ballot in 2011 may be reflective of this; then again, it may also reflect caution pending the outcome of the vote on Issue 2, which would have eliminated most collective bargaining provisions for teachers and other public employees. Whatever the cause, Table 2 shows that the historic reduction in state aid to schools and local governments did not result in a mad dash to the polls. In fact, there has been a reduction in overall school issues on the local ballot since 2005.

Figure 8 further illustrates the downward trend in the number of school issues considered annually by Ohio voters in local elections over the past seven years. The 584 school issues in 2005 comprised 21 percent of the 2,783 local issues considered by Ohio voters in February, May, August and November elections in that year.[7] In 2011, the 363 school issues comprised about 17 percent of the 2,159 local issues put to the voters in all local elections that year.

There were 183 school issues up for a vote in the November 2011 elections. Results were mixed. Just over half of all the issues passed; most renewals passed but few requests for new funds were approved.

Fiscal deficit projections

School districts anticipate growing fiscal problems in the coming school year, they reported in the survey. The first category indicating potential fiscal distress for school districts is fiscal caution, which is declared under guidelines developed by the Ohio Department of Education (ODE) in consultation with the Auditor of State.[8] The second category is fiscal watch, which is declared if the school district exhibits financial conditions that threaten its solvency. Fiscal emergency status is the last and most severe stage of a school district's financial solvency problems. Following a declaration of fiscal emergency by the Auditor of State, a commission is created that may assume all or part of the powers of the local board of education.

Figure 9 shows that slightly more than a quarter (26.7 percent) of the districts participating in the survey indicated that they anticipate being in some level of fiscal distress in the 2011-12 school year: either fiscal caution, fiscal watch or fiscal emergency. If these results are extrapolated across all 613 Ohio districts, it is possible that some 20 percent of districts – about 121 – anticipate being in fiscal caution, compared to the 21 districts identified by ODE as being in fiscal caution as of January 2012. Four percent – which would be 25 schools if survey results are extrapolated across all school districts – could see budget problems that take them into fiscal watch, compared to five districts identified by ODE. Three percent – about 18 districts if this projection is applied statewide – could be taken over in fiscal emergency, compared to nine districts identified as being in fiscal emergency by ODE.[9]

Summary and recommendations

Between the loss of federal stimulus dollars, cuts in property tax reimbursements, and direct cuts, Ohio’s K-12 schools will receive $1.8 billion dollars less in the current biennium than in the prior biennium. Responses to the Policy Matters Ohio school survey in the fall of 2011indicate that schools that lose a levy election have a lower chance of success in subsequent elections; this may prevent them from asking the local voters to replace lost state resources. Sixty-two percent of survey respondents had not gone to the voters since 2008 and almost three quarters had no plans to do so through November 2012. Instead, they expected to cut staff, reduce pay and benefits, increase class size, cut programs, supplies and materials, and reduce extra curricular activities, including asking students to pay to participate. Ohio’s school districts are caught between a rock and a hard place. More than a quarter of responding districts anticipate being in official fiscal distress next year, and 7 percent anticipate that they will be in fiscal watch or get taken over by the Ohio Department of Education in a state of fiscal emergency. Extrapolated across school districts, this could mean that as many as 43 school districts anticipate being in fiscal distress, compared to the 14 in those circumstances today.

The strategies districts report using to manage the budget shortfalls can erode educational quality and exacerbate the inequality of opportunity. Ohio needs to restore its revenue system and reinvest in Ohio’s schools and children.

Long-term investment in education remains the best way to build opportunity for Ohioans. This can be paid for by closing tax loopholes and restoring income tax rates on the wealthiest Ohioans and on corporations doing business in the state. In addition, emerging and growing parts of our economy should be taxed appropriately so that they contribute their fair share to Ohio's infrastructure. These include oil and gas production as well the collection of taxes on internet sales by out-of-state retailers.

It’s time to restore investment in our children’s education and other services that support Ohio’s people, families and communities.

Press releaseExecutive summaryFull report (with appendices)[1] The reduction in funding includes expiration of Recovery Act funds that had supported local school districts budgets in the prior biennium, loss of property tax replacement funds related to the tax overhaul of 2005, and other state budget cuts.

[2] Policy Matters Ohio. “Economic Impact of Kasich Budget Cuts to Education: An Input-Output Analysis,” April 8, 2011. The report is available for download at www.policymattersohio.org/budget-brief-input-output-analysis.

[3] Responses from joint vocational school districts, educational service centers and career centers were not included in the analysis as these entities have a somewhat different funding composition.

[4] Source: Ohio Department of Education, 2010, Data: Typology of Ohio School Districts. Retrieved at http://www.ode.state.oh.us/GD/Templates/Pages/ODE/ODEDetail.aspx?page=3&TopicRelationID=390&ContentID=12833&Content=89486.

[5] No districts from this typology (‘Island district or college corner’) responded.

[6] A Policy Matters Ohio input-output analysis of job loss due to a $1.8 billion biennial state budget cut to K-12 education projected 29,133 direct educational jobs would be lost over the biennium; see www.policymattersohio.org/wp-content/uploads/2011/10/BudgetBriefInputOutput2011_04.pdf.

[7] Local ballot issues range from electric aggregation and local liquor options to school bond or tax issues, charter amendments and zoning, as well as local tax levies.

[8] Fiscal caution can be declared by the state superintendent after consultation with a local board of education if a five-year forecast (required by the state) indicates conditions that could result in fiscal watch or emergency. Description of fiscal caution requirements found at www.ode.state.oh.us/GD/Templates/Pages/ODE/ODEDetail.aspx?page=3&TopicRelationID=1012&ContentID=1020&Content=103459.

[9]Ohio Department of Education, “Fiscal Caution Districts,” Excel file downloaded from the web January 12, 2012 that shows the districts that were in each of the three categories as of that date. Downloaded from: http://education.ohio.gov/GD/Templates/Pages/ODE/ODEDetail.aspx?page=3&TopicRelationID=4&ContentID=7646&Content=114813

Tags

2012Budget PolicyK-12 EducationRevenue & BudgetWendy PattonPhoto Gallery

1 of 22