Wendy Patton's letter to Sen. Chris Widener, Chair of the Senate Finance Committee

May 10, 2012

Wendy Patton's letter to Sen. Chris Widener, Chair of the Senate Finance Committee

May 10, 2012

Dear Chairman Widener:

During testimony before the Finance Committee yesterday, you questioned some of the numbers that we presented. We stand by these numbers, and provide the following information to show how we arrived at them.

The two figures you specifically mentioned: the $1.8 billion reduction in funding for K-12 education and the $1 billion for local services, were published before in our budget brief of August 1, 2011.[1] We present the published information here. As we often do, in writing this report we relied on data on from documents published on the website of the Ohio Legislative Service Commission.

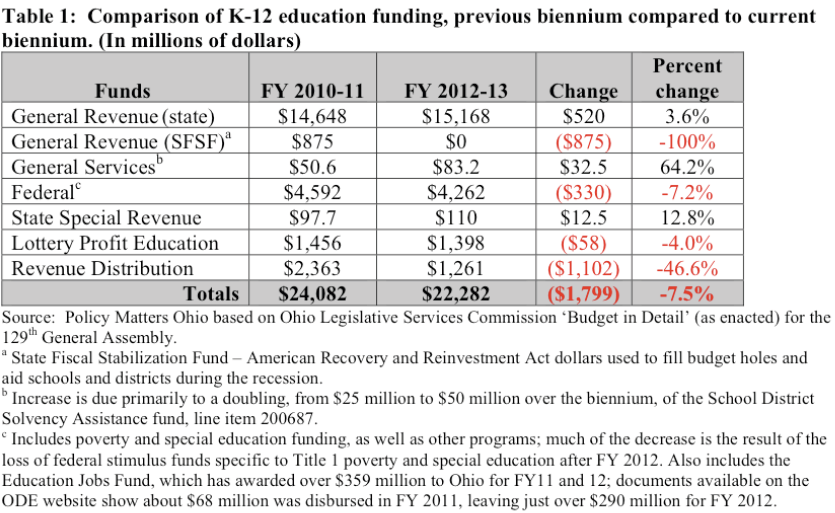

Table 1, below, is taken from that brief and illustrates the source of our conclusion that the funding to K-12 schools in the current budget is $1.8 billion less than in the prior biennial budget.

We compared the level of spending from biennium to biennium: total funding in the biennial budget for FY 2010-11 compared to total funding in the biennial budget for FY 2012-13. As Table 1 shows, we include in our calculations funds outside of the General Revenue Fund (GRF) because state legislators can make decisions about use of funds in some other fund categories, such as the revenue distribution categories, and because legislators have the ability to replace funding lost from sources they do not control – such as the federal stimulus spending – by restoring lost tax revenues and appropriating them for specific purposes. For example, revenues could be raised by closing loopholes and taxing oil and gas to restore funding for primary and secondary education and local governments.

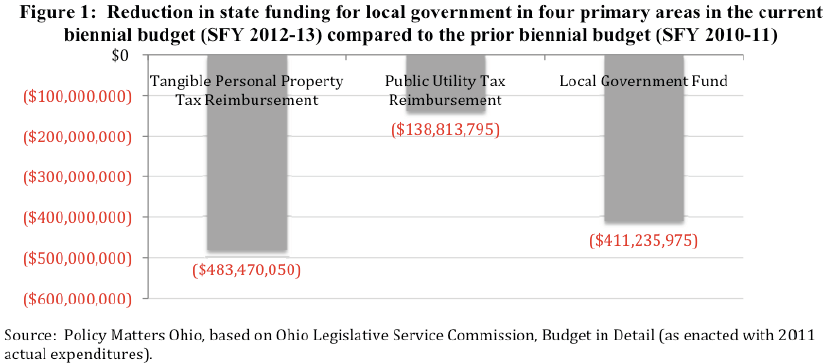

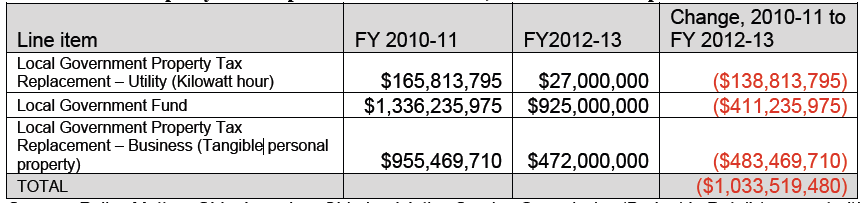

The loss to community services is attributable to the reductions in three areas: the Local Government Fund, reimbursement of tangible personal property tax, and reimbursement of the kilowatt-hour tax. The change in funding in these three line items is illustrated in Table 2, below.

Table 2. Cuts to Local Government Property Tax Fund – Utility, Local Government Fund, and Local Government Property Tax Replacement – Business, FY 2010-11 compared to FY 2012-13.

Source: Policy Matters Ohio, based on Ohio Legislative Service Commission ‘Budget in Detail (as enacted)’

Source: Policy Matters Ohio, based on Ohio Legislative Service Commission ‘Budget in Detail (as enacted)’

for the 129th General Assembly.

We looked at the change in funding in these lines on a biennial basis: FY 2010-11 compared to FY 2012-13. We looked at these funds, which are outside of the GRF, because legislators have authority over use of those funds. Figure 1, below, illustrates the loss of funding. These are flexible funds: the state does not tell local governments how to use those funds. Some communities use it to repair street lighting, others use it to supplement human services, and so forth.

In our testimony, we also reference a half-billion-dollar reduction in funding for higher education. This is a figure we have included in prior writings, including the August 1, 2011, budget brief. This reduction in funding for classroom teaching (State Share of Instruction) resulted from the expiration of federal stimulus money that filled gaps in the state budget during the recession and enabled tuition to rise more slowly than in the current biennium. This is not GRF funding, but policymakers could have chosen to raise revenues to replace these funds. As with K-12 and local services, we based our analysis on data provided by the Ohio Legislative Service Commission.

As residents of Ohio, we appreciate the opportunity to add our testimony to the range of opinions we hope lawmakers consider. We thank you for the opportunity to respond to your comments on the accuracy of these specific numbers. We also stand by additional comments and numbers in our testimony, which is available at www.policymattersohio.org/mbr-testimony-may2012.

Best Regards,

Wendy Patton

Senior Project Director

Cc: Senate Finance Committee: Shannon Jones (Vice Chair), Tom Sawyer (Ranking Minority Member), Kevin Bacon, Bill Coley, Keith Faber, Jim Hughes, Peggy Lehner, Scott Oelslager, Tom Patton, Michael J. Skindell, Shirley A. Smith, Charleta B. Tavares.

Photo Gallery

1 of 22