Local governments keep losing

February 25, 2013

Local governments keep losing

February 25, 2013

Download briefDespite new revenues from casino gambling and an expanded sales tax, the administration’s budget proposal leaves local governments in the lurch. As the economy improves, we must restore the fiscal partnership between state and community.

New budget continues and deepens cuts

New budget continues and deepens cuts

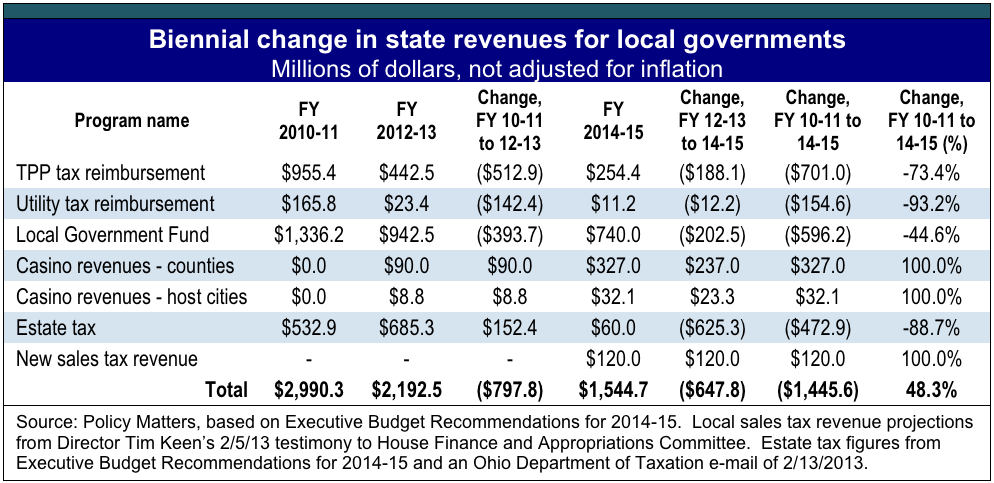

For those seeking restoration of battered local services, Gov. John Kasich’s new state budget plan isn’t the place to look. A preliminary analysis shows that Ohio’s local governments will receive $1.4 billion less in state aid under the governor’s budget proposal for fiscal years 2014-15 than in FY 2010-11 despite new revenues from casino gambling for counties and host cities and an expanded sales tax from a broadened base.

The current budget, for FY 2012-13, took hundreds of millions in appropriations from localities, cutting the Local Government Fund in half and seizing two thirds of tax reimbursements, promised when the state eliminated local taxes earlier in the decade. Another billion dollars were taken from schools. Libraries, which saw their funds slashed in the previous budget, were trimmed further. The seizure of funds continues under the budget proposal for fiscal years 2014-15, as the figure below shows.

New sources of funding for local governments have emerged since the 2010-11 budget. Casino tax revenue for counties and host cities, most of which was dedicated to local government and schools in the constitutional amendment that authorized casino gambling, has grown as casinos have opened. At the same time, the estate tax, a major source of local government funding that affected only 8 percent of all Ohio estates, was eliminated as of 2013; while some revenues will come in this year as estates are settled, all revenues from this source will stop next year.

The Kasich administration’s proposal to broaden the sales tax base to include services would benefit counties and public transit authorities that piggy-back their sales tax on the state sales tax base. But the result of all these tax policy changes is a net loss: with the administration’s proposal local governments would see $628 million less in state funding for FY 2014-15 than they received in FY 2012-13 (the current budget) and $1.4 billion less than in FY 2010-11. As the table below shows, if the provisions of the proposed budget are passed into law funding for local governments will be about half of what it was in FY 2010-11, the last budget of the previous administration.

Budget Director Tim Keen estimates that the proposed expansion of the sales tax base could add $700 million to counties and transit agency coffers. However, because the administration proposes to take control of local sales tax rates, reducing the increases the local entities can bring in because of the expansion, local sales taxes would bring in no more than $120 million in new revenue over the coming biennium.[1]

To encourage growth we need good schools, reliable public safety and emergency services, and strong communities. During hard times, state and local policy led to cuts. But further cuts in appropriations for local government are not helping communities. Curtailing local control of local revenues will complicate recovery – as the economy improves, it is time to restore the fiscal partnership between state and community.

[1] Testimony of Budget Director Tim Keen at http://1.usa.gov/12u25mb.

Tags

2013Budget PolicyRevenue & BudgetWendy PattonPhoto Gallery

1 of 22