Tax breaks grow in new Ohio budget

August 08, 2013

Tax breaks grow in new Ohio budget

August 08, 2013

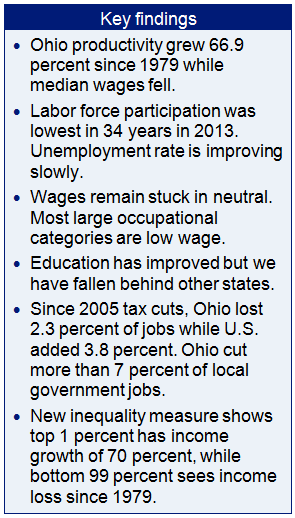

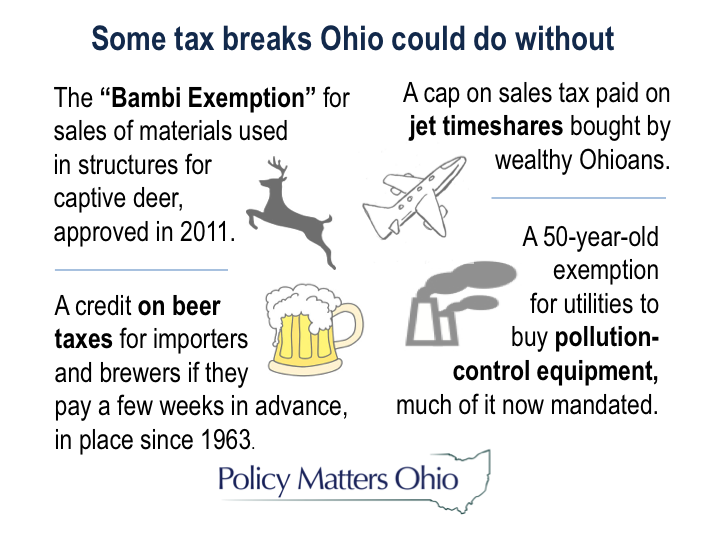

Download summary (2 pp)Download full report (7 pp)Some breaks Ohio could do withoutPress releaseThe Ohio General Assembly’s recently approved budget adds eight new tax breaks while getting rid of only four, and overall increased tax expenditures by several hundred million dollars a year. Revenue from the closed or reduced exemptions that could have been used to bolster needed public services instead was used to support reductions in the income tax.

Exemptions increase despite moves to cut them

The Ohio General Assembly’s recently approved budget eliminates some tax breaks, which is unusual. In the previous decade, the legislature had repealed only two individual exemptions, leaving aside cases where they were repealed and replaced with something similar, or originally approved for just a limited time.[1] However, the budget adds eight entirely new tax breaks while subtracting only four – and while the total increase in value isn’t certain, it clearly amounts to several hundred million dollars a year. Revenue from the closed or reduced exemptions that could have been used to bolster needed public services instead was used to support reductions in the income tax.

The Ohio General Assembly’s recently approved budget eliminates some tax breaks, which is unusual. In the previous decade, the legislature had repealed only two individual exemptions, leaving aside cases where they were repealed and replaced with something similar, or originally approved for just a limited time.[1] However, the budget adds eight entirely new tax breaks while subtracting only four – and while the total increase in value isn’t certain, it clearly amounts to several hundred million dollars a year. Revenue from the closed or reduced exemptions that could have been used to bolster needed public services instead was used to support reductions in the income tax.

Exemptions, deductions and credits, known as tax expenditures, already amount to $7.7 billion a year, according to the biennial tax expenditure report produced by the Ohio Department of Taxation.[2] Yet the state has no systematic mechanism for reviewing this form of state spending. Such a regular review is certainly possible. Washington state, which already has a review process, recently required that all new tax expenditures have a sunset date, so that they will automatically expire unless renewed (the default sunset is 10 years).[3] The law also calls for each new break to include a statement of legislative purpose, and to spell out specific goals and metrics to measure performance. Taxpayers taking advantage of these new tax breaks also will have to report how much they are receiving, with certain exceptions and after a 24-month delay.[4]

By far the largest new tax break created in the new Ohio budget covers business income.[5] Both the Legislative Service Commission and the Office of Budget and Management estimate the business income tax cut will be worth more than $530 million in fiscal year 2014 and over $555 million in fiscal year 2015, making it the third-largest tax break in the state tax code (neither of these estimates includes what are likely to be sizeable additional revenue losses in fiscal year 2014, because beneficiaries of the exemption are likely to have more tax withheld this year than is eventually needed to pay their full year tax bills). This  new tax break is unlikely to generate new jobs.[6] The bulk of Ohio business owners eligible for the break employ no one but themselves. They are unlikely to hire employees because of a subsidy that for most will amount to no more than a few hundred dollars a year, and at maximum, less than $7,000. An analysis commissioned by the Small Business Administration that was published last year concluded, “We find no evidence of an economically significant effect of state tax portfolios on entrepreneurial activity.”[7]

new tax break is unlikely to generate new jobs.[6] The bulk of Ohio business owners eligible for the break employ no one but themselves. They are unlikely to hire employees because of a subsidy that for most will amount to no more than a few hundred dollars a year, and at maximum, less than $7,000. An analysis commissioned by the Small Business Administration that was published last year concluded, “We find no evidence of an economically significant effect of state tax portfolios on entrepreneurial activity.”[7]

While there are usually better ways of accomplishing policy goals than tax credits, sometimes tax credits are a good approach. For example, the General Assembly created a new, state Earned Income Tax Credit, which will allow some of those who qualify for the federal EITC to receive a 5 percent credit on their Ohio income tax. This is a smart policy that takes a step toward correcting a state and local tax code that requires low-income families to pay a larger share of their income than the affluent do. [8] The federal EITC does more than any other program to keep working families out of poverty, and Ohio now joins two dozen other states with their own credits.[9] However, many of the poorest Ohioans will be unable to qualify for the credit. The credit is not refundable, meaning that even though low-income Ohioans on average pay more of their income in all taxes combined, they won’t qualify if they aren’t paying income tax. It also is limited so that those earning more than $20,000 will only be able to receive a credit towards half of their taxable income.[10]

New or expanded tax breaks

The following list describes many of the new or expanded state tax breaks.[11] The budget bill also creates or expands a number of other tax expenditures at the local level. Only those that affect state revenue are captured in the biennial reports produced by the taxation department on tax expenditures.

A Commercial Activity Tax exclusion for grain handlers. The Ohio Legislative Service Commission has estimated this would reduce CAT revenue by $11 million a year, half of which would have gone to the General Revenue Fund and half to school districts and local governments. This new exemption is based on the idea that for-profit grain handlers need it to compete with nonprofit grain handlers, which aren’t subject to the tax. It was opposed, however, by the Ohio Manufacturers’ Association, whose representative noted in testimony to the Senate Ways and Means Committee that, “All for-profit enterprises should be paying the CAT; in fact, equality in the burden of taxation demands that they all remain subject to the tax.”[12]

A property-tax exemption covering fraternal organizations like the Masons that provide financial support for charitable purposes and have been operating in Ohio for at least 100 years. The LSC has provided a rough estimate that the cost to local governments and school districts likely will be less than $4.8 million a year.[13] This would not show up in the tax expenditure report, because it is not a state exemption, but a local one. It is no less a matter of state policy, however.

A retailer can keep 75 percent of the piggyback sales tax it would otherwise pay to a county if it employs at least 150 people and meets certain other requirements. This giveaway, originally approved in 2006 to support Bass Pro Shops in Wood County, had expired, but was revived in the Senate. Others will be able to apply for it, with a lower investment requirement and a lower threshold for how much it has to attract customers from outside the area. It has a tighter restriction than before, however, in that relocations of employees and property from other facilities elsewhere in Ohio are not permitted. Promoted as a spur to other development in the area, the Bass Pro has not attracted much nearby investment.[14]

Expansion of an existing sales-tax break for purchases of computer data center equipment. Among other things, a taxpayer would only need to maintain an annual payroll at the data center of $1.5 million to qualify, instead of the existing $5 million.

Extension by five years of the deadline for owners of a qualified energy project to submit a property tax application to qualify for an exemption. This tax break against tax that utilities pay was implemented to encourage renewable energy generation projects. Already extended by two years in the last biennial budget, this further extends the deadline.

An income tax deduction for retirement pay related to service in the Commissioned Corps of the National Oceanic and Atmospheric Administration (NOAA) and the Commissioned Corps of the Public Health Service (PHS). The LSC estimates the annual revenue loss to the state’s General Revenue Fund at $235,000 a year, beginning in FY2015.

The nonprofit corporation that owns the Toledo Mud Hens baseball team can avoid paying sales and use tax on its purchases. This provision is retroactive, and wiped out a $553,389 assessment that the corporation owed to the state under a determination by the tax commissioner that the corporation is appealing. While this measure may have deserved consideration, given the corporation’s close relationship to Lucas County, this long-standing issue should not have been resolved through an amendment added into the Senate budget bill two days before its approval.

Certain large companies that do not meet current requirements may qualify for a Job Retention Tax Credit. Specifically, for companies that maintain a unit or division with at least 4,200 employees at the project site, the principal place of business no longer has to be in the same political subdivision as the investment. As with a number of the new or expanded tax expenditures, the LSC cited a potential revenue loss, but was uncertain about the amount.

Expansion of a property tax exemption for veterans’ organizations by increasing the income limit to $36,000 a year. The LSC noted that current law exempts veterans' organization property unless the property is held for the production of rental or other income in excess of $10,000. It estimated that the new, higher limit will cost up to $4 million a year statewide, possibly considerably less.

Excluding workers’ compensation insurance premium deposits from the domestic and foreign insurance company premiums tax base, under certain conditions. The LSC noted that a similar exclusion applies under continuing law to premiums deposits received for fire and inland marine insurance provided by such companies.

Cable television providers and broadcast stations regulated by the federal government are exempt from sales tax on sales or purchases of cable, video or audio service or programming. Some of these sales, such as movies that are electronically transferred, now would be taxable because of the extension of the sales tax to digital goods.[15]

While some of these new or expanded tax breaks are reasonable, others are not. Many were inserted into the budget very late in the process with little opportunity for close public review. This highlights the need for a tax expenditure review process encompassing new and existing exemptions, deductions and credits.

Tax breaks repealed

The budget repealed some existing tax breaks. In his budget plan, Gov. Kasich proposed elimination of four specific tax breaks. These were indeed repealed despite earlier legislative reluctance on some:

- The sales-tax exemption for magazine subscriptions, worth $11 million a year according to the Kasich administration, was eliminated.

- The income-tax deduction for gambling losses, created in 2010 to go into effect this year, was repealed. This new deduction, worth $29 million a year according to the Tax Expenditure Report, would have allowed gamblers to subtract their losses from their winnings in calculating their income tax. As columnist Tom Suddes of The Plain Dealer pointed out at the time, unlike the Internal Revenue Service, Ohio hadn’t allowed a deduction for gambling losses. Though it was approved as part of casino legislation, Suddes noted, it doesn’t just cover casino losses in Ohio, but “losses racked up anywhere (Indiana or Las Vegas, say) and not just losses from casino gambling, but also losses on horse-race bets; lottery tickets; ‘you name it,’ a Taxation Department official confirmed.” [16]

- An individual no longer can be claimed as a dependent on the state income tax by more than a single taxpayer. The LSC pegged the revenue from this at $3.7 million a year for the General Revenue Fund, beginning in FY2015.

- The Technology Investment Tax Credit, a program that provides credits to investors in qualified, technology-based Ohio companies, was eliminated, though previously authorized credits will be honored (the LSC said that according to estimates from the executive budget, eliminating the credit “is presumed to have no revenue impact due to the expected full utilization of the program’s authorized tax credits as of November 2012.”)[17]

The General Assembly turned down Gov. Kasich’s proposal to broaden the sales tax to cover many services that have not been taxed. However, as Gov. Kasich had proposed, the budget bill subjects digital goods such as video, music and electronic book downloads to the sales tax. This didn’t eliminate a specific tax break in the same way as the four above, since services are not covered under the sales tax unless they are specifically enumerated as being taxable, but it represents a reasonable expansion of the tax base. The administration estimated that this would generate $15 million in additional revenue in both fiscal years 2014 and 2015.

In order to pay for income-tax cuts that will go mostly to Ohioans in the top 20 percent of the income scale – further tilting the tax system against low- and middle-income taxpayers – other changes were made in the tax code. These included raising the state sales tax rate by ¼ percent, to 5.75 percent, and adjusting the minimum amounts due under the Commercial Activity Tax, the state’s main business tax. They also included changes in existing income-tax exemptions and credits, including:

- A three-year freeze in the personal exemption, which is indexed to inflation and deducted from income when taxpayers figure their income tax. The administration estimated this would save the state $17 million in fiscal year 2014 and $34 million in 2015.

- Freezing for three years the indexing of income-tax brackets, which has kept taxpayers from moving into higher brackets because of growth in their income that merely matches inflation. This is estimated to raise $37 million in fiscal year 2014 and $90 million in 2015.

- Means-testing the $20 credit that taxpayers receive for themselves and each other personal exemption. This is estimated to save the state $125 million in both years.

While this last measure is friendly to moderate-income taxpayers, the overall effect of the tax package is to further shift the tax load from affluent Ohioans to those with less income.[18]

Vetoed budget provisions

Gov. Kasich vetoed a number of other budget provisions that would have created new tax breaks or expanded existing ones. These included:

A new sales tax break for goods and services used in aerospace vehicle research and development. The LSC described the revenue loss from this tax break, which was identical to one Gov. Kasich vetoed last year, as “potentially sizable.”[19] Among the reasons the governor gave for his veto was that, “…this expansion of the exemption is contrary to the policy of maintaining a broad sales tax base with as few exemptions as possible.”[20] The governor did not apply this principle to other similar special-interest tax breaks that found their way into the budget.

Looser requirements for the New Markets Tax Credit program, which is supposed to support investments in low-income communities. The vetoed language would have eliminated the requirement that a taxpayer receive a federal credit in order to qualify for a state credit.

Reinstatement of a sales-tax exemption for investment coins and metal bullion. This exemption was previously known as the Noe amendment because of coin dealer Tom Noe, convicted in the Coingate scandal for engaging in a pattern of corruption in his management of Ohio's $50 million rare-coin fund investment with the Bureau of Workers’ Compensation. He had helped win its approval in the General Assembly in 1989. The exemption was repealed in the 2005 biennial budget bill after the scandal came to light, but was included in House Bill 59. The LSC said it would have cost up to $8 million.

An income-tax deduction for the value of services provided free by dentists and dental hygienists under the Hope for a Smile program. This program, vetoed by the governor, was to be a collaboration between the Ohio Department of Health and colleges, other schools, and dental and dental hygienists’ associations to improve the oral health of school-age children.

An increase in the maximum historic rehabilitation tax credit that could be awarded for a specific project, from $5 million to $10 million.

Kasich vetoed another provision that would have required online and other remote retailers to collect Ohio sales tax if they met one of a number of different criteria. This provision would not have created any new tax liability – tax is already supposed to be paid on merchandise purchased over the Internet or from a catalogue – but such sellers are not mandated to collect if they lack a physical presence in Ohio. It would have expanded the definition of such a presence to include those who pay Ohio residents who make more then $10,000 in sales over 12 months by referring customers through a link or web site.

Separately, the governor in July issued an executive order calling for Ohio to apply for full membership in the Streamlined Sales and Use Tax Project, a multi-state effort to harmonize sales-tax rules and ensure that online and catalogue retailers collect sales and use tax as other retailers do.[21] The administration estimated that becoming a full member of the compact would generate $9 million in fiscal year 2014 and $24 million in 2015. The General Assembly approved a provision in the budget to transfer new revenue the state may receive because of voluntary collection of use taxes into a fund that is used to reduce income-tax rates. Thus, incremental revenue the state receives will not go toward state services.

The budget bill ends some special-interest tax breaks, and Gov. Kasich appropriately vetoed some others that the General Assembly would have created. However, the net result is still a growing number of exemptions, causing a loss of revenue, and no system for determining which tax breaks are worth keeping and which aren’t.[22] Another legislative study committee, this one from the House, will soon start hearing from Ohioans at meetings around the state about possible reforms to the tax system.[23] The message loud and clear should be: Set sunset dates for all of our tax expenditures, and provide a permanent way to examine all those in the tax code now.

The author thanks Policy Matters Ohio interns Shubo Yin and Natalie Davis, and Andy Nicholas of the Washington State Budget & Policy Center, who provided help for this report.

[1] See Zach Schiller, Policy Matters Ohio, “Breaking Bad: Ohio Tax Breaks Escape Scrutiny,” June 17, 2013, p. 12, available at www.policymattersohio.org/tax-breaks-jun2013.

[2] Tax Expenditure Report, The State of Ohio Executive Budget, Fiscal Years 2014-2015, available at http://media.obm.ohio.gov/OBM/Budget/Documents/operating/fy-14-15/bluebook/budget/Tax_14-15.pdf.

[3] Engrossed Substitute Senate Bill 5882, Chapter 13, Laws of 2013, 63rd Legislature, 2013 Second Special Session, p.58, available at http://apps.leg.wa.gov/documents/billdocs/2013-14/Pdf/Bills/Session%20Laws/Senate/5882-S.SL.pdf.

[4] Previously, the state had more limited reporting on certain tax breaks. See http://1.usa.gov/T3bpYJ.

[5] This includes income from different kinds of businesses – S Corporations, limited liability companies, partnerships and sole proprietorships – that have one thing in common: Ohio does not tax the businesses directly on their profits, but rather as the profit passes through to owners’ individual income tax returns. Hence, they are called “passthrough entities.”

[6] See Michael Mazerov, Center on Budget and Policy Priorities, Testimony to House Finance and Appropriations Committee On HB 59 Income Tax Plan, March 19, 2013, available at www.policymattersohio.org/mazerov-mar2013, and Zach Schiller, Policy Matters Ohio, Tax Break for Business Owners Won’t Help Ohio Economy, April 2, 2013, available at www.policymattersohio.org/tax-break-apr2013.

[7] Bruce, Donald and John Deskins, “Can state tax policies be used to promote entrepreneurial activity?”, quoted in Michael Mazerov, Center on Budget and Policy Priorities, “Cutting State Personal Income Taxes Won’t Help Small Businesses Create Jobs and May Harm State Economies,” Feb. 19, 2013

[8] Policy Matters Ohio, “Ohio’s state and local taxes hit poor and middle class much harder than wealthy,” Jan. 30, 2013, available at www.policymattersohio.org/income-tax-jan2013.

[9] Rothstein, David, Policy Matters Ohio, “Small Investment, Big Difference: How an Ohio Earned Income Tax Credit Would Help Working Families,” March 15, 2013, available at www.policymattersohio.org/eitc-mar2013.

[10] See Schiller, Zach, Policy Matters Ohio, “Limiting Loopholes: A Dozen Tax Breaks Ohio Can Do Without,” Sept. 29, 2008, available at www.policymattersohio.org/limiting-loopholes-a-dozen-tax-breaks-ohio-can-do-without.

[11] Unless otherwise stated, dollar values of tax breaks cited below are estimates by the Legislative Service Commission. See Legislative Service Commission, Comparison Document, H.B. 59 of the 130th General Assembly, Main Operating Appropriations Bill, As Enacted, July 2, 2013, available at http://bit.ly/16zTrYB.

[12] Mark Engel, Bricker & Eckler, Ohio Manufacturers’ Association Tax Counsel, House Bill 59 Testimony before the Ways & Means Committee of the Ohio Senate, May 22, 2013, p.7. He continued: “If for-profit grain handlers are competing with non-profit cooperatives, the answer is not to exempt the for-profit entities from the CAT. Rather, perhaps to the extent that a non-profit entity is performing a commercial activity in competition with for-profit enterprises, receipts from that activity should be subject to the tax just like those of a for-profit entity.” Available, as is the following letter, at www.ohiosenate.gov/committee/ways-and-means, under Committee Documents. The OMA was joined by five other groups in a statement to the committee that read in part: “Continuing our united support over the past eight years against diluting the CAT base, the Ohio Manufacturers’ Association, The Ohio Society of CPAs, Ohio State Bar Association, Ohio Chemistry Technology Council, Ohio State Medical Association and Ohio Dental Association have joined together again to reiterate our continued opposition to exemptions, earmarks, and/or credits to the CAT.” Letter to the Hon. Tim Schaffer, Chair, Senate Ways & Means Committee, May 21, 2013.

[13] In its assessment of the enacted budget, the LSC said, “Tax revenue losses to local governments likely would be less than the $4.8 million estimate for the version of the bill passed by the House and Senate, but is based on a 2001 survey so is very rough.” See p. 60 of www.lsc.state.oh.us/fiscal/comparedoc130/enacted/tax.pdf.

[14] See Chavez, Jon, “Bass Pro’s Allure Falls Short,” The Toledo Blade, July 8, 2009, at http://bit.ly/14zgemk. A recent visit to the area found little new development.

[15] Zaino Hall & Farrin LLC, SALT Buzz, “Ohio’s Biennial Budget Bill,” July 1, 2013, available at media.wix.com/ugd/448546_0aed6def4f9a93fde1d843fa61643de1.pdf.

[16] Suddes, Tom, “Tax Deduction for Gambling Losses Doesn’t Make Sense,” The Plain Dealer, June 6, 2010.

[17] See LSC Comparison Document, Taxation Department, p. 2.

[18] See Policy Matters Ohio, “Tax plan still rewards affluent, leaves some of poorest Ohioans paying more,” June 26, 2013, available at www.policymattersohio.org/itep2-jun2013.

[19] LSC Comparison Document, Department of Taxation provisions, p. 25.

[20] Office of the Governor, Veto Messages, Statement of the Reasons for the Veto of Items in Amended Substitute House Bill 59, June 30, 2013, Item No. 12, p. 6.

[21] John R. Kasich, Governor, State of Ohio, Executive Order 2013-09K, Instructing Tax Commissioner to Seek Full Membership for Ohio in the Streamlined Sales and Use Tax Project, available at http://1.usa.gov/13kcYrG.

[22] Bills have been introduced by legislators on both sides of the aisle that would require a regular review of tax expenditures: House Bill 24 by Rep. Terry Boose, R-Norwalk (see http://bit.ly/16zSXS7), and House Bill 81, by Reps. Mike Foley, D-Cleveland, and Denise Driehaus, D-Cincinnati, (see http://bit.ly/15Oe6ak). The bills differ on certain points, such as how often they would be conducted, and neither calls for sunsets.

[23] Gongwer News Service Ohio Report, “Batchelder Creates Summertime Committees To Study Policy ‘Reform,”' Volume #82, Report #147--Tuesday, July 30, 2013.

Photo Gallery

1 of 22