A Credit that Counts

October 17, 2013

A Credit that Counts

October 17, 2013

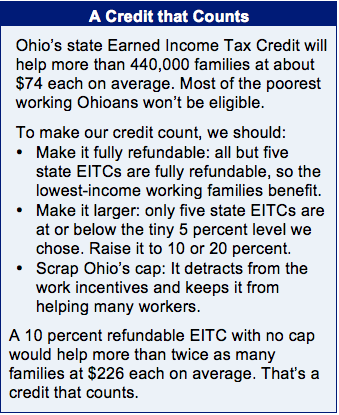

Download report (14 pp)Download summary (2 pp)Press releaseMore than 440,000 Ohioans will be eligible for the state’s new Earned Income Tax Credit, at an average of $74 per recipient. However, the Ohio EITC is one of the smallest among state credits and has three weaknesses that mean it does less to help working families and reduce poverty than it should.

Ohio needs a stronger EITC

Last spring Ohio, for the first time, enacted a state Earned Income Tax Credit (EITC). A strong Ohio credit would amplify the poverty-alleviating impact of the federal credit, which does more to lift working families out of poverty than any other federal initiative. A strong Ohio EITC would also bring much needed balance to our state tax system, which is weighted against low-income Ohioans.[1]

Last spring Ohio, for the first time, enacted a state Earned Income Tax Credit (EITC). A strong Ohio credit would amplify the poverty-alleviating impact of the federal credit, which does more to lift working families out of poverty than any other federal initiative. A strong Ohio EITC would also bring much needed balance to our state tax system, which is weighted against low-income Ohioans.[1]

The Ohio EITC as passed is a modest step in the right direction for Ohio's tax system but is much less helpful than it could be because of a few unusual provisions that Ohio included in its EITC – provisions that make it different from the credits in most other states. The Ohio EITC is nonrefundable, capped for those with taxable income over $20,000, and set at 5 percent of the federal credit. As enacted, the overwhelming majority of the poorest working Ohioans will not be eligible for the new credit.

Slightly more than 440,000 Ohio taxpayers will benefit from the Ohio EITC. That is less than half the number that claimed the federal EITC in tax year 2011[2] and only 7.9 percent of Ohio taxpayers.[3] These families will receive an average tax cut of $74. The vast bulk of low-income Ohioans will not benefit from the Ohio EITC and those who do on average will receive a modest credit.

Policy makers should take immediate action to make our EITC count:

- Make it refundable: All but 5 of the 26 state EITCs are refundable, so the lowest-income working families benefit;

- Make it larger: Only 5 state EITCs are at or below the tiny 5 percent level we chose. Raise the credit to 20 percent or even 10 percent;

- Scrap the cap: The Ohio cap detracts from the work incentives and keeps it from helping people working their way into the middle class.

These changes would have a substantial impact on working poor families and their communities. Just a 10 percent refundable EITC with no cap would help more than twice as many families, more than 855,000, at $226 each on average.[4] That’s a credit that counts.

Overview of the Ohio EITC

Tax credits reduce tax liability. A tax credit can be refundable or nonrefundable and that decision has an enormous impact on who benefits. With a refundable credit, if tax liability is less than the amount of the credit, the balance is returned in the form of a tax refund check. A nonrefundable credit will only reduce or eliminate tax liability but will not provide a refund to those whose liability is less than the credit.

The state EITC is modeled on the federal EITC, which is an anti-poverty powerhouse. The federal refundable EITC kept 5.7 million Americans, including 3.1 million children, above the poverty line in 2011.[5] It helped more than 950,000 Ohio families (20 percent of all tax filers) in tax year 2011.[6] The average federal EITC refund in Ohio was $2,238, which can equal two or three months of pay for a low-wage working family.[7] The credit brought more than $2 billion federal dollars to Ohio communities in 2011.

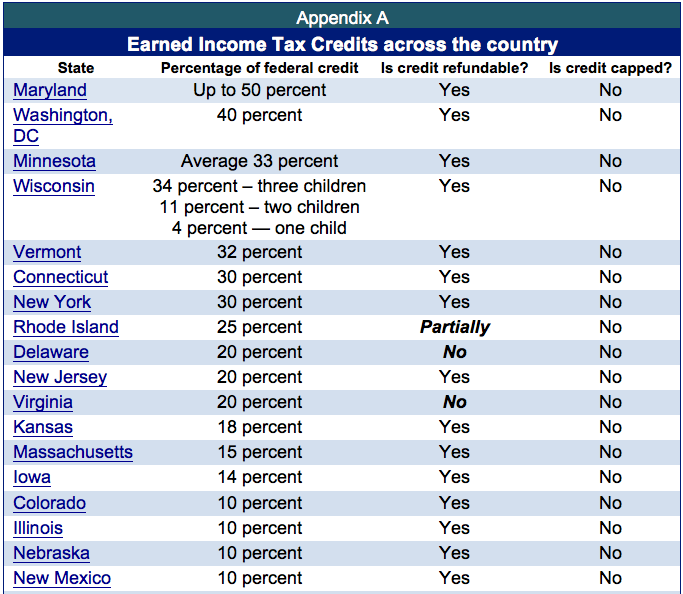

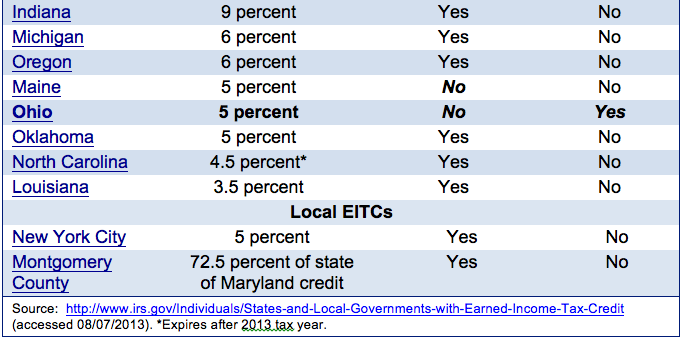

There are three key features that make the federal EITC work for working people: the EITC rewards and requires work; it is directly claimed through the tax code, and; the credit is refundable.[8] Currently 26 state EITCs are in effect across the nation.[9] Almost all EITCs share these three components.[10] The Ohio EITC will share in some. Our credit is directly claimed through the tax code, and will largely maintain the structure of the federal credit to incentivize work, although this is somewhat undermined by the cap.[11]

But the Ohio EITC is different in key ways: most notably the credit is one of just five state credits that are not fully refundable.[12] Ohio’s credit is also stingy compared to other state credits. Our credit is set at only 5 percent of the federal credit, and cut further by the Ohio credit cap for taxpayers with Ohio Taxable Income over $20,000.[13] As this report demonstrates, these deviations from the standard EITC structure significantly reduce the credit’s impact on families and communities.

Earned income requirements for EITC eligibility

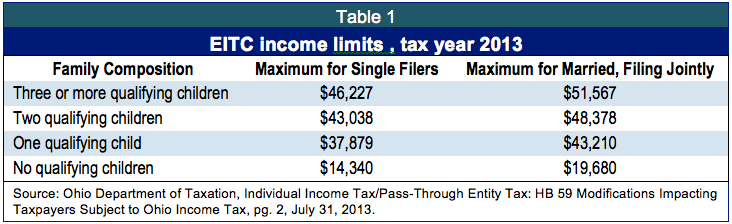

The EITC is structured to incentivize work. Eligibility and the amount of the credit are based on income and family composition (marital filing status and number of children). Workers gain EITC eligibility at the first earned dollar. Ohio taxpayers qualify for the state EITC if they are eligible for the federal credit except that in Ohio many workers will be ineligible or have reduced benefits because of non-refundability and the cap. Claimants must have qualifying income within the limits set out in Table 1.[14]

Amount of the credit is too small and capped

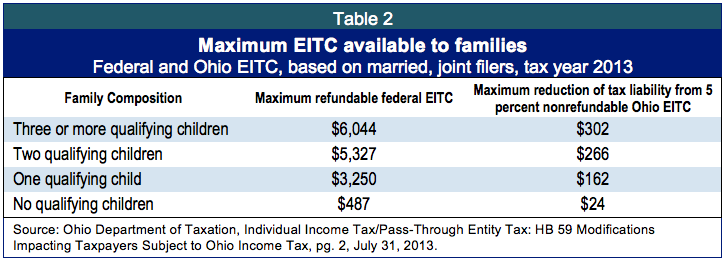

The Ohio EITC is 5 percent of the worker’s federal EITC. For example, someone receiving a federal EITC of $1,000, leaving aside the additional restrictions on the credit, would receive a $50 Ohio credit. Only two state credits are lower, while two others are also set at 5 percent.[15]

The absolute maximum a family with three or more children could claim in Ohio EITC is $302. The maximum a married family filing jointly with no children could claim is $24. Table 2 shows the maximum federal and Ohio EITC a family will be able to claim.

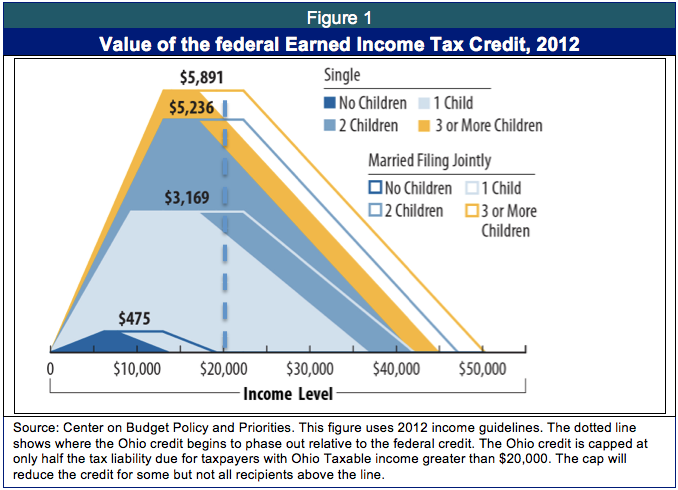

The federal EITC is structured with a long-phase out to create an incentive for workers to increase their work hours. Ohio further limits the amount of the credit by shortening this phase-out. Ohio’s credit is capped at half of the tax due after exemptions for those with Ohio Taxable Income over 20,000.[16] For instance, a taxpayer with Ohio Taxable Income of $28,200, who might have a tax liability of $102 after deducting allowable credits and exemptions, should qualify for 5 percent credit equaling $128, but because of the cap the taxpayer would only receive a reduction of $51, half the tax due. Figure 1, depicts the relationship between qualifying income and the amount of the credit. It also shows the point in the phase out that Ohio starts to cap its credit.

Lack of refundability reduces benefit to Ohio’s poorest workers, reinforces tax disparity

Unlike the federal credit and nearly all other state credits, the Ohio EITC is not refundable.[17] Refundable credits are well-established in the Ohio tax code. They exist for motion picture producers, historic building rehabilitators, and companies receiving job-creation and job-retention subsidies, among others. If the credit exceeds the tax liability of the company or the person, the state writes them a check for the remaining credit.

Data are not available on the exact amount paid this way in refunds, but taxpayers claimed overall job creation tax credits amounting to $68 million against the Commercial Activity Tax in fiscal year 2013.[18] An analysis of data compiled in the Ohio Department of Taxation’s biennial tax expenditure report shows that the two sizable tax breaks that will grow the fastest between fiscal year 2012 and fiscal year 2015 are both refundable: the historic building rehabilitation credit and the job retention tax credit.[19] While companies and investors annually receive refundable credits worth tens of millions of dollars, low-income Ohioans, who typically would only claim the EITC for a year or two during tough economic times, are unable to do so to support their basic needs.[20]

More than 31 percent of working families in Ohio are low income.[21] These workers are paying sales, property and excise taxes. Overall, low-income Ohioans pay more of their income in state and local taxes than upper-income Ohioans do, even when they are paying no income tax.[22] Recent changes – especially income-tax cuts and a sales-tax rate increase – have reinforced that disparity. Even with the EITC, some of the poorest Ohioans will pay more under the new tax plan than they currently do. Table 3 shows the overall impact of the recently enacted tax plan.[23]

Even with the state EITC, the preservation of the $10,000 low-income credit, and the $20 personal and dependent exemption, the average tax change for the lowest-income quintile is an increase of $12.[24] The top 1 percent will see an average reduction of more than $6,000. Enacting a state EITC is an important step forward in building a tax structure that is adequate and fair, but the credit must be sufficiently strong to move the dial toward fairness. Addressing this was one of the fundamental goals initially set out when the federal EITC was established.

Applying the new rules

Despite this disparity, Ohio does have several good provisions in its tax code that make our system better than that of many other states. Ohio, like 33 other states, has a progressive income tax. This means that income raised through the income tax, which is responsible for 39 percent of our state’s tax revenue this fiscal year, is raised in a way that reflects ability to pay. Our state income tax used to be more progressive, but it is good that we still have a graduated approach.[25]

A progressive income tax code does not mean that low income working Ohioans do not pay taxes. Low- and middle-income Ohioans pay a higher share of their income in state and local taxes than rich Ohioans do, even though some will have no income tax liability.[26] Another modest positive in our system is that since 2005 we’ve had a tax credit that eliminates income taxes owed on all households with incomes below $10,000. It is the interplay between the existing low-income tax credits, and the modified Ohio EITC that results in a diminished EITC impact, meaning that many workers who would see substantial benefits under a full EITC see less and some workers, particularly those at the bottom of the income ladder, will see no benefit at all.

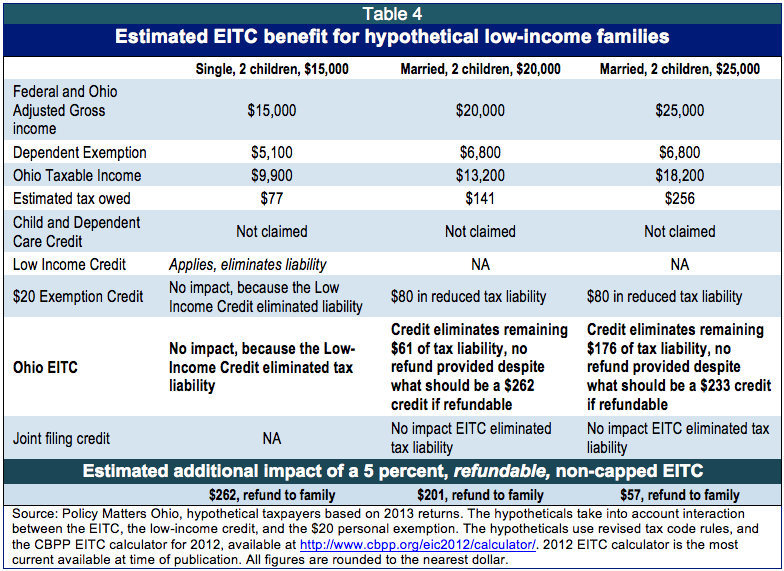

This section uses hypothetical family situations to explore these interactions. In the tables below, the EITC benefit is in bold; the bottom row displays the estimated benefit of a 5 percent, refundable, non-capped credit that, while still modest, would be more helpful than the version that Ohio passed. Refundability is key to making the EITC work for the poorest workers in the state.

A worker earning $15,000, with two children, will claim personal exemptions of $1,700 for herself and two dependents, meaning she has an Ohio Taxable Income of only $9,900. The low-income tax credit will eliminate the tax owed and the nonrefundable EITC has no effect. If the Ohio EITC were refundable, the family would receive a refund of $262. The extra income could be used for emergency savings, childcare, transportation, purchasing school supplies, or work tools, or just making ends meet. The refund helps raise the family’s bottom-line income, reducing poverty, and also helps to offset some of the disparate impact of the overall tax code.

A married couple earning $20,000, with two children, does not qualify for the low-income tax credit but would have their tax liability of about $61 eliminated by the Ohio EITC. If the credit were refundable, the family would receive the remainder of the credit, about $201, in the form of a tax refund. This would be a significant boost to a family of four earning only $20,000 a year.[27]

A married couple earning $25,000, with two children, would have their tax liability of about $176 eliminated by the state EITC. A refundable 5 percent EITC would return another $57, in the form of a tax refund to the family.[28]

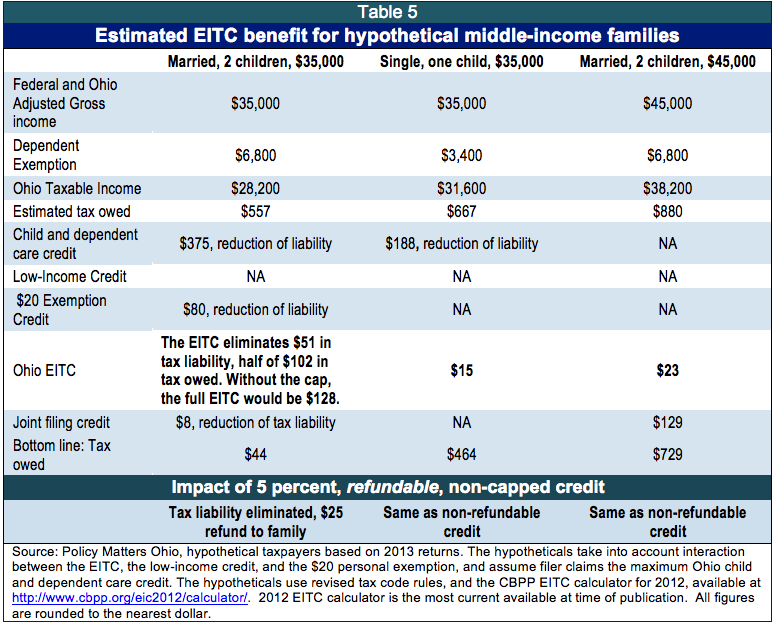

As income increases, the interplay with the low-income credits starts to diminish, but the income cap, which shortens the EITC phase-out, starts to dampen the credit’s benefit for some taxpayers. Table 5 demonstrates these hypothetical situations.

A hypothetical family of four earning $35,000 will only see a small reduction of $51 in tax liability from the EITC if they are claiming the full childcare credit. A refundable EITC would have a more substantial impact, eliminating the full tax liability of $102 and returning $25 to the family. Without the childcare credit the family would have a tax liability that exceeds the EITC cap. The family would claim the full $128 EITC credit, and ultimately pay $297 in tax.

A single parent with one child earning $35,000 has fewer deductions, and a higher taxable income of $31,600. This triggers the EITC cap but because the parent has fewer dependents and income closer to the EITC income limits, the Ohio EITC is only $15, far below the Ohio cap. Because the family’s tax liability exceeds the total amount of the credit, the family would not be eligible for a refund.

A married couple with two children earning $45,000 has an estimated tax liability of $880. The family qualifies for an Ohio EITC but it is very small, $23. The credit is slightly larger for this family than for the family making $35,000, because of family composition. The EITC only provides a modest reduction in their tax liability, and there would be no remainder to return to the family in the form of a refund.

Ohio EITC too weak to impact working poor families

The vast bulk of low-income Ohioans will not benefit from the Ohio EITC and those who do will receive, on average, a modest credit. This is a missed opportunity to boost the income of Ohio’s working poor. Of all the states, Ohio has the 19th largest share of working people living in poverty.[29] More than a quarter of Ohio’s workers are working low-wage jobs.[30]

A national tax research group with a sophisticated model of state and local tax systems, the Institute on Taxation and Economic Policy (ITEP), analyzed how the state EITC will impact taxpayers in Ohio. The ITEP model separates Ohio families into five groups, or quintiles, based on income, and estimates the average effect of tax code changes for each group. Each quintile contains an equal number of families.

ITEP estimates that 441,125 Ohio families will qualify for the new EITC.[31] This is fewer than half of the families that claimed the federal EITC in tax year 2011 and 7.9 percent of Ohio taxpayers.[32] As the hypotheticals demonstrate, some families will receive more, some less, but the average tax cut for recipients of the EITC is an estimated $74. In contrast, a refundable 10 percent EITC would benefit more than 855,000 Ohioans at an average benefit of $226. The average impact of the Ohio EITC on each income quintile is displayed in Table 6.

Taxpayers in the lowest quintile had income of less than $18,000 in 2012 and an average income of only $11,000. Only 6 percent of families in this group will receive some benefit from the credit. The vast majority of taxpayers in this quintile, made up of the poorest Ohioans, will receive no benefit from the non-refundable EITC. The average cut for those claiming the credit in this quintile is $50. Because so few in this group are eligible, the average tax cut for everyone in this income group combined is only $3.

Almost half of EITC recipients (45 percent) will fall in the second income quintile, which has an income range of $18,000 - $33,000 and an average income of $25,000. Even though the majority (56 percent) of the EITC benefit will accrue to this quintile, only a small minority (18 percent) in this quintile will receive the credit. For those receiving the credit in this quintile, the average tax cut is $91. For the quintile as a whole, the average tax cut is just $17. Earners in this quintile get the largest average reduction. Like earners in the lowest quintile, most workers in the second quintile will receive no benefit from the state EITC. More workers would see some benefit if the Ohio EITC were refundable.

The middle quintile encompasses workers earning between $33,000-$51,000 with an average of $42,000. Only 13 percent of workers in the middle quintile will be eligible for the state EITC, and this group will receive 27 percent of the overall tax cut from it. The average tax cut among recipients in the middle quintile is $61. The average tax cut for the whole quintile is $8.

In earlier EITC estimates a more limited income definition was used and estimates showed no EITC impact for taxpayers in the fourth quintile or higher. The modeling for this report uses a comprehensive definition of income, which includes non-earned income such as Social Security benefits, alimony, and other sources to calculate total income and the income quintiles. Under this more comprehensive definition of income a small minority (2 percent) of earners in the fourth quintile will receive some benefit from the Ohio EITC.[33] This group will claim 6 percent of the total tax cut. The average cut among recipients in this quintile is $84 and the average cut for the entire quintile is estimated to be $2.

Recommendations: Ohio needs a strong EITC

It is excellent news that Ohio joined 27 other states and localities adopting an EITC. That said, the Ohio EITC is one of the weakest in the nation. At only 5 percent of the federal credit and without the refundability, Ohio’s EITC is insufficient. The budget bill brought additional tax code changes that negatively impact lower-income Ohioans, who even before the budget bill were paying a larger share of their income on average in state and local taxes than those is all but 10 other states.[34] The state poverty rate remains shockingly high.[35] Of all working families in the state, 11 percent do not earn enough to rise out of poverty.[36] Ohio has a higher than average share of working poor families.[37] Working families desperately need a shot at economic mobility and our local economies need a real boost. A stronger, refundable EITC would be a significant step toward addressing these concerns.

ITEP estimates that a refundable 10 percent state EITC would benefit 855,492 working poor families, almost double the current EITC. Allowing refunds also makes sure that the poorest working families are helped the most. The share of the credit going to the poorest workers increases from a very small 11 percent to 35 percent. Table 7 shows the potential gains from a stronger credit.

More working poor families would benefit from the 10 percent refundable credit modeled above, and they would benefit much more. Qualifying workers in the lowest quintile on average would receive $140 in increased benefit. Workers in the second quintile would see a boost of more than $230.

It is essential that the state build on the groundwork laid by establishment of an Ohio EITC by improving the credit. A 10 percent refundable credit would help alleviate poverty, and push money out to local communities. A 20 percent refundable credit would bring even greater returns to families and communities.

Policy Matters Ohio is a member of the Working Poor Families Project, a national initiative that advances state policies in the areas of education and skills training for adults, economic development, and income and work supports. WPFP supported this research on the EITC.

[1] Zach Schiller, Tax plan still rewards affluent, leaves some of poorest Ohioans paying more, Policy Matters Ohio, June 26, 2013, available at http://www.policymattersohio.org/itep2-jun2013.

[2] IRS EITC statistics as of April 02, 2013, available at http://www.eitc.irs.gov/EITC-Central/eitcstats.

[3] Calculation by Institute on Taxation & Economic Policy, includes filers and nonfilers.

[4] Calculation by Institute on Taxation & Economic Policy.

[5] American Community Survey, U.S. Census, 1-year estimates, see http://www.policymattersohio.org/?p=11681.

[6] See, David Rothstein, Small Investment, Big Difference: How an Ohio Earned Income Tax Credit would help working families, Policy Matters Ohio, March 2013, available at www.policymattersohio.org/eitc-mar2013.

[7] Id.

[8] See, Steve Holt, Ten Years of the EITC Movement: Making Work Pay Then and Now, The Metropolitan Policy Program at Brookings, April 2011. See also, Appendix A.

[9] IRS, http://www.irs.gov/Individuals/States-and-Local-Governments-with-Earned-Income-Tax-Credit (accessed 08/07/2013.) Appendix A includes a table detailing all other state and local EITCs, whether they are refundable credits and the amount of the credit. The 26 state EITCs, includes the District of Columbia. There are 2 local EITCs, one in New York City, and one in Montgomery County, Maryland.

[10] Id.

[11] Ohio Revised Code § 5747.71.

[12] See, IRS, supra at note 9. States with nonrefundable credits: Ohio, Virginia, Maine, and Delaware. Rhode Island has a partially refundable credit. Both local EITCs are refundable. See, Appendix A for a full list of EITCs.

[13] Id. Only five state credits, including Ohio’s, are at or below 5 percent. No other state used a cap similar to Ohio’s cap. Some states such as Wisconsin have a variable credit amount that changes based on the number of dependents in a household or have a partially refundable credit. See, Appendix A for a full list of EITCs.

[14] Qualifying income means having earned income and Federal Adjusted Gross Income (FAGI) within the credit income limits. Earned Income for the EITC includes only income and wages from work or from certain disability payments. Interest and dividends, retirement income, social security, unemployment benefits, alimony and child support are examples of income that is not earned. See, 26 USC § 32. Federal Adjusted Gross Income is total income from all sources minus specific reductions, such as some business or trade expenses, health savings account deductions, some moving expenses, some retirement contributions, alimony, college tuition student loan interest and some fees. See, 26 U.S.C. § 62. A qualifying child for the EITC must meet the IRS tests of relationship, residence and age and must have lived with the taxpayer in the United States for more than half the year and have a Social Security number that is valid for employment in the United States http://www.irs.gov/uac/A-“Qualifying-Child.

[15] Supra at note 9.

[16] Supra at note 11. Ohio Taxable Income is the taxpayer’s Ohio adjusted gross income less allowable personal exemptions.

[17] Supra at note 9. Ohio is one of only four states with EITCs that are not fully refundable. Delaware, Maine, and Virginia have non-refundable credits. Rhode Island has a partially refundable credit. See, Appendix A

[18] Email from Gary Gudmundson, Ohio Department of Taxation, Sept. 6, 2013.

[19] Schiller, Zach, Breaking Bad: Ohio Tax Breaks Escape Scrutiny, Policy Matters Ohio, pp. 13-14, available at http://www.policymattersohio.org/wp-content/uploads/2013/06/TaxBreaks_Jun2013.pdf. The Policy Matters Ohio report reviewed tax breaks that the taxation department estimated would be worth at least $10 million in fiscal year 2015 to come up with it list of the fastest-growing ones. The tax expenditure report is available at http://media.obm.ohio.gov/OBM/Budget/Documents/operating/fy-14-15/bluebook/budget/Tax_14-15.pdf. Here, too, it is not known how much of these credits will be refunded to taxpayers, vs. the amount that will reduce their tax liability.

[20] Tim Dowd and John B. Horowitz, Income Mobility and the Earned Income Tax Credit, Short term safety-net or long-term income support, Public Finance Review, April 2011. See also, New Research Highlights Importance of EITC for Working Families, Center on Budget and Policy Priorities, October 2011, at http://www.offthechartsblog.org/new-research-highlights-importance-of-eitc-for-working-families.

[21] Working Poor Families Project, analysis by Population Reference Bureau, of 2011 American Community Survey. A family for this statistic is a married couple or a single parent with at least one child under age 18 present in the household. Working means a combined household work effort of 39 weeks or more in the prior 12 months or a combined effort of 26 to 39 weeks in the prior 12 months, and one parent looked for work in the prior 4 weeks. Low-income means earning below 200 percent of poverty. In 2011, 200 percent of the poverty threshold for a family of four was $45,397.

[22] See also, Zach Schiller supra note 1.

[23] The ITEP analysis includes the following components of the tax changes: The 10 percent income tax rate cut; the business-income tax exemption; the increase in the state sales tax from 5.5 percent to 5.75 percent; the tiered minimum taxes under the Commercial Activity Tax; the elimination of the $20 personal exemption credit for those with $30,000 or more in annual income; the repeal of the income-tax deduction for gambling losses, and the new Earned Income Tax Credit. The analysis does not include five other changes in sales or income taxes, and two property-tax changes that will affect taxpayers in future. These are either quite small or not easily modeled.

[24] See Appendix B for details a description of key tax credits.

[25] Institute on Taxation & Economic Policy, Who Pays?, January 2013, available at http://www.itep.org/whopays/. See also, Ohio’s state and local taxes hit poor and middle class much harder than wealthy, Policy Matters Ohio, January 2013, available at http://www.policymattersohio.org/income-tax-jan2013.

[26] Id. The top 1 percent of non-elderly Ohio families by income, who earned at least $324,000 in 2010, on average pay 8.1 percent of their income in state and local income, property, sales and excise taxes. By contrast, the lowest fifth, who made less than $17,000 that year, on average pay 11.6 percent. Families in the middle fifth of the income spectrum, who made between $31,000 and $49,000, on average pay 10.6 percent. Id.

[27] If the same family claimed the maximum allowable amount under the Child and Dependent Care Credit, the EITC would have no impact on their household. The CDCC would totally eliminate their tax liability and they would receive no benefit from the Ohio EITC. If the Ohio EITC were refundable, the family would receive an estimated EITC refund of $262.

[28] If the same family claimed the maximum allowable amount under the Child and Dependent Care Credit, the EITC would have no impact on their household. The CDCC would totally eliminate their tax liability and they would receive no benefit from the Ohio EITC. If the Ohio EITC were refundable, the family would receive an estimated EITC refund of $233.

[29] Working Poor Families Project, analysis by Population Reference Bureau, of 2011 American Community Survey. Based on the number of families living below 100 percent of poverty. In 2011, the poverty threshold for a family of four was $22,699.

[30] Working Poor Families Project, analysis by Population Reference Bureau, of Basic Monthly Current Population Survey, March 2012 Supplement. A wage below the full-time, full-year wage required to keep a family of four out of poverty. In 2011,according to the Current Population Survey, a family of four required $23,497 to stay out of poverty (at least $11.30/hr. on a full-time, full-year basis). North Dakota has the lowest rate of workers in low-wage jobs, 14.4 percent. Id. Ohio is ranked 30th out of all the states. Id.

[31] The state has estimated that 475,000 Ohioans will be eligible for the new EITC. Ohio Department of Taxation, Highlights of New State Budget, available at http://www.tax.ohio.gov/portals/0/OhioTaxAlert/ArchivedAlerts/Ohio’s_Newly_Approved_Two-Year_State_Budget_Tax_Law_Changes.pdf.

[32] Supra at notes 2 and 3.

[33] Married, joint filers can qualify for the EITC if they earn less than $51,567 this year. The cut-off is only $567 more than the threshold income for the fourth quintile in Ohio. Some of the filers claiming the EITC in the fourth quintile will be under the maximum allowable income. There are also some earners with total income greater than the EITC cap that have qualifying federal adjusted growth income (FAGI) and Earned Income. For example, a family may have one worker earning $50,000 in earned income and a second person receiving $2,000 in unemployment compensation. The family may also have deductible expenses (health savings exemptions, moving expenses, student loan expenses) of $2,000. The total income ($52,000) pushes the family into the fourth quintile. But for both of the income tests used to determine eligibility for the EITC (FAGI and earned income), this family’s income is only $50,000. The $2,000 in qualifying expenses reduces their AGI to $50,000, and unemployment compensation is not considered “earned income” for calculating the EITC. The family’s FAGI and Earned Income qualify for the EITC after these reductions.

[34] See, Institute on Taxation and Economic Policy, State Tax Codes as Poverty Fighting Tools, September 2013, available at http://itep.org/itep_reports/2013/09/state-tax-codes-as-poverty-fighting-tools-1.php#.UkHe-45QYWY

[35] According to Census data Ohio’s poverty rate stood at 16.3 percent in 2012. See, Hannah Halbert, Census 2011 Update, Policy Matters Ohio, September 2013, available at www.policymattersohio.org/census-data-sept2012.

[36] Working Poor Families Project, analysis by Population Reference Bureau, of 2011 American Community Survey. Working poor refers to families, married or single parents, with at least one child, whose combined work effort is 39 or more weeks in the last 12 months, or 26 or more weeks in the last 12 months and one currently unemployed parent looked for work in the previous four weeks, with household income that is below the federal threshold for poverty. In 2011, the federal poverty threshold for a family of four was $22,699, making the 200 percent threshold for a family of four $45,397.

[37] Working Poor Families, supra at note 29.

Tags

2013Tax ExpendituresTax PolicyPhoto Gallery

1 of 22