Beyond the Boom: Ensuring adequate payment for mineral wealth extraction

December 19, 2011

Beyond the Boom: Ensuring adequate payment for mineral wealth extraction

December 19, 2011

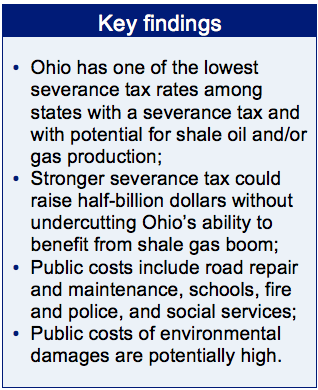

The anticipated boom in natural gas and oil in Ohio stands to create great private wealth. But Ohio’s severance tax, which specifically captures a share for the public good, is low. Policy Matters recommends that Ohio’s lawmakers raise its severance tax in order to retain a fair share of wealth to help pay for costs associated with drilling and lay the groundwork for a better future.

Executive Summary

The oil and gas industry is anticipating a boom in natural gas and possibly oil production in Ohio. The mineral wealth that lies under the land can create great private wealth, but in Ohio the one tax that specifically captures a share of that wealth for the people of the state – the severance tax – is low. Ohio ranks 19th among natural gas-producing states and 17th among oil-producing states in production, yet ranked 25th among 35 states in severance tax collections in 2010. Ohio’s rate on gas and oil is the lowest among neighboring states with a similar tax, and among the lowest of states with viable shale formations, or plays, that levy a severance tax.

The oil and gas industry is anticipating a boom in natural gas and possibly oil production in Ohio. The mineral wealth that lies under the land can create great private wealth, but in Ohio the one tax that specifically captures a share of that wealth for the people of the state – the severance tax – is low. Ohio ranks 19th among natural gas-producing states and 17th among oil-producing states in production, yet ranked 25th among 35 states in severance tax collections in 2010. Ohio’s rate on gas and oil is the lowest among neighboring states with a similar tax, and among the lowest of states with viable shale formations, or plays, that levy a severance tax.

Oil and gas extraction firms pay the commercial activity tax and local property taxes like other firms; their employees pay income and payroll taxes. These are ordinary costs of doing business and in Ohio, business taxes have been substantially lowered since 2005. The oil and gas industry has the potential to create jobs, enrich owners and investors, and add to the tax base. In so doing, it uses up Ohio’s natural resources, which will then no longer be available to future investors or citizens. It also has the potential to cause public expenditure – on roads, worker training, environmental clean-up and public services. As industry representatives predict a drilling boom, we need to consider the special costs drilling could impose and the special responsibilities this industry has because of its reliance on natural resources that will be depleted. The wealth that lies under the land should be adequately taxed to pay for costs associated with drilling and to lay the groundwork for a better future for residents of the state.

Would taxation policy similar to that in other states ruin Ohio’s chances for oil and natural gas production? Activity in other states indicates it would not. North Dakota's oil production averaged over 460,000 barrels per day in September 2011, more than four and one-half times its September 2005 level, although the severance tax rate is 11.5 percent. Shale gas production is growing in Texas, where the severance tax rate on natural gas is 7.5 percent; Oklahoma, where the rate is 7 percent and Arkansas, where the rate is 5 percent. West Virginia, with a severance tax rate of 5 percent, saw more wells drilled in 2010 than in the biggest year forecast for Ohio between now and 2015.

The up-front costs associated with a drilling boom go beyond the road maintenance and repair issues under debate in Columbus. While the up-front costs of new or burdened roads is a pressing problem even now in some Ohio counties, other costs can include traffic control, building and zoning services, schools, water and sewer, social services, fire and police. In Ohio, with recent budget cuts to local governments and schools, meeting the up-front demands for a rapid development schedule could be tough. Protecting quality of life could be tougher.

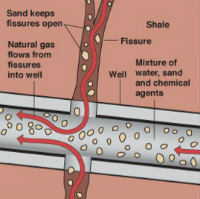

Moreover, this drilling boom brings unusual concerns about environmental impact. Today’s drilling involves pumping millions of gallons of water laced with chemicals and other additives into the well (‘hydrofracturing’ or ‘fracking’). Fracking has been exempted from federal safe drinking water standards, but chemicals used in the process have been found in an aquifer that supplies drinking water in Wyoming, where the technique has been used for some time. There are also concerns about toxic emissions.

Pollution brings risk of public costs. In some cases, private drilling firms now provide drinking water to homes where the water supply has been spoiled. If the private firm enters bankruptcy, who provides water? If the groundwater of a city is polluted, and that pollution has lasting impact, how does that population get water to drink? If people are sickened on a widespread basis, how are medical expenses financed? Ohio needs to charge more than it currently does for the oil and gas that will be extracted from the land to prepare for these new, unusual risks.

In this report, Policy Matters Ohio makes the following recommendations to boost the state and provide for the future:

Increase Ohio’s severance tax - The state of Ohio implemented the severance tax in 1972 on a mature oil and gas industry. As the industry ramps up for robust expansion, the state can expect new costs at a time when existing public services have been deeply cut and need to be restored. With a 5 percent severance fee on shale gas, Ohio would see increased revenues of $538 million – just on new natural gas production as forecast by industry over the four years between 2012 and 2015. Oil reserves in the shale have not been quantified so projections of revenue are not possible, but the severance tax on oil should be the same as for gas.

Establish a severance tax trust fund: Seven producing states have established trust funds based on severance or royalty earnings to build sustainable wealth for communities today and into the future. In the case of Ohio, taxes on new oil and gas development could assist with the up-front infrastructure needs associated with drilling, restore some of the cuts to education and otherwise help communities prepare for the realities they will face after the oil boom. Earnings on the funds could support economic development planning for a diversified, post-boom economy in Ohio’s communities, particularly those impacted by the drilling and its related industries.

Press release Executive summary Full reportTags

2011Severance TaxWendy PattonPhoto Gallery

1 of 22