Business tax break proposal: Costly, unfocused and unlikely to bring new jobs

April 09, 2015

Business tax break proposal: Costly, unfocused and unlikely to bring new jobs

April 09, 2015

Governor Kasich's plan for expanding a business tax break would drain needed revenue and do little to spur job creation.

Contact: Zach Schiller, 216.361.9801

By Zach Schiller

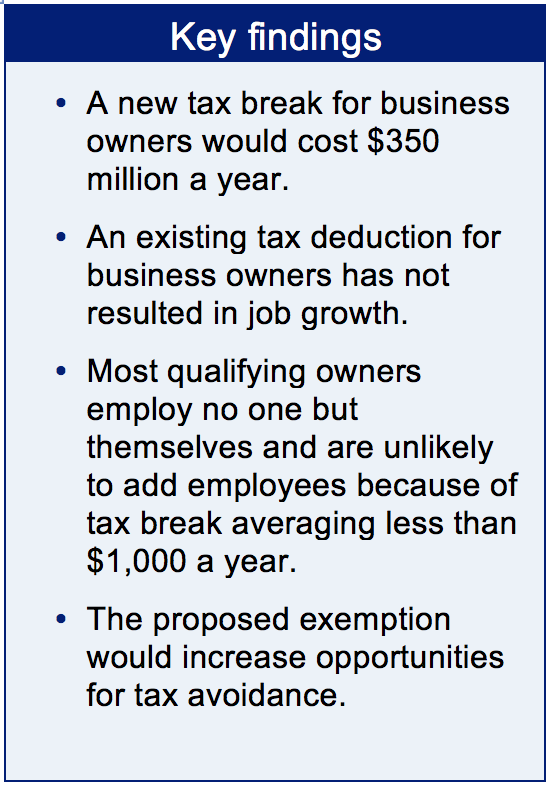

Governor Kasich has proposed eliminating the Ohio income tax for hundreds of thousands of business owners who pay the tax on their companies’ profits.[1] The plan covers owners of businesses with $2 million or less in annual receipts. It would roughly double, to $700 million a year, the overall size of a tax deduction for business owners created less than two years ago. This deduction quickly became the 9th largest state tax break under Ohio law,[2] but has yet to show results in job growth. While draining revenue needed to pay for vital public services, the proposed new tax break – like its predecessor – would be poorly targeted and is unlikely to result in significant new job creation. It would also expand opportunities for tax avoidance.

Governor Kasich has proposed eliminating the Ohio income tax for hundreds of thousands of business owners who pay the tax on their companies’ profits.[1] The plan covers owners of businesses with $2 million or less in annual receipts. It would roughly double, to $700 million a year, the overall size of a tax deduction for business owners created less than two years ago. This deduction quickly became the 9th largest state tax break under Ohio law,[2] but has yet to show results in job growth. While draining revenue needed to pay for vital public services, the proposed new tax break – like its predecessor – would be poorly targeted and is unlikely to result in significant new job creation. It would also expand opportunities for tax avoidance.The expanded business tax break is estimated to cost about $350 million a year.[3] The benefits will be scattered over 380,000 individuals,[4] most of whose businesses do not employ anyone but the owner. A national study in 2011 by researchers at the U.S. Treasury Department found that only 11 percent of taxpayers reporting business income – and 2.7 percent of all income-tax payers – own a bona fide small business with employees other than the owner.[5]

According to the Ohio Department of Taxation, the state has more than 1 million pass-through businesses with receipts of $2 million or less a year.[6] However, fewer than 300,000 private companies pay unemployment tax, which essentially means that they employ someone.[7] Tax Commissioner Joe Testa testified Feb. 12 to the House Finance Committee, “Jobs and the need to create jobs underlie all aspects of the tax proposals.”[8] Spreading a tax break to owners of all businesses with receipts of $2 million or below is unlikely to meet that need.

As Michael Mazerov, a senior fellow with the Center on Budget and Policy Priorities in Washington, D.C., told the Ohio House Finance Committee in testimony two years ago, “The vast majority of people reporting income from a pass-through business on their personal income tax returns are people who might earn a small amount of income from self employment on the side. Or they’re passive investors in investment partnerships that themselves are passive investors in other businesses, again, with no authority over job-creation decisions by those businesses. Or they’re owners of real businesses, but they’re entirely self-employed as plumbers, lawyers, and so on and have no intention, need, or desire to hire anyone else.”[9] Moreover, as he noted, most of these businesses serve a local market, and have no plans to do otherwise. “Only a tiny share of new businesses are seeking to develop a new product, service, technology or business model that has the potential to be the next Google, Facebook, or Amazon,” he testified. “So tax cuts for everyone is a very expensive way to try to help the very few that are even in a position to create a meaningful number of jobs.”

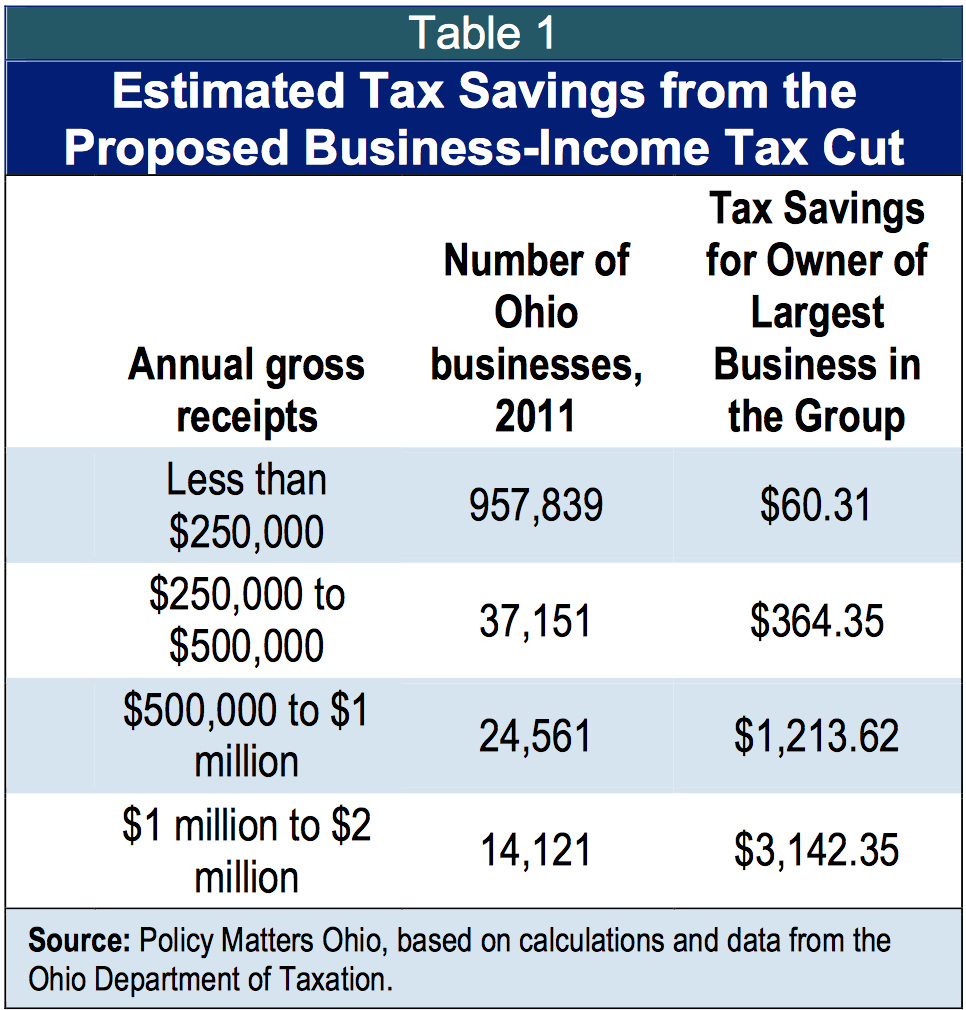

Most of those who benefit also will get too little in savings to add employees in any meaningful way. At one newspaper’s request, the taxation department calculated how much certain hypothetical owners would save in their taxes covering 2016, based on a 10 percent profit margin. It found that such an owner of a business with $250,000 in receipts and no other income would save $60.31; an owner of a business with $500,000 in receipts and $50,000 in income would save $364.35.[10]

Table 1 below shows the tax savings for four such hypothetical business owners. Each is included in a group in which his company has the maximum amount of receipts, and the table shows how many businesses fall into each category. The vast bulk of businesses have gross receipts of less than $250,000.

While these reflect hypothetical calculations, they underline that despite the overall size of the tax cut, for most small-business owners, the savings will be small indeed. Most are unlikely to hire someone based on a tax cut that, on average, will amount to less than $1,000 a year.

While these reflect hypothetical calculations, they underline that despite the overall size of the tax cut, for most small-business owners, the savings will be small indeed. Most are unlikely to hire someone based on a tax cut that, on average, will amount to less than $1,000 a year.

Proponents of the exemption have begun to acknowledge that and frame their argument differently. “By itself, the deduction may not be sufficient to fully pay for and hire a new employee but it could mean that a small business is able to purchase advertising, or equipment, or offer its existing employees more hours to help grow the business,” Testa testified. “It may also provide the extra capital needed that, when combined with other income or with the tax savings of the other business owners, allows the business to hire an employee. And just as important, it may help a business operating on the margin to meet payroll or to keep its doors open. Every dollar counts to the small business owner.”[11] Some will become larger businesses, Testa said.

No doubt, the tax break will prove helpful to some individual businesses. However, overall, this reflects a misunderstanding of why most businesses grow. Business owners expand when they anticipate greater demand for their products or services, not because they have a few hundred dollars more in their wallets. And ironically, some of the fastest-growing young businesses won’t benefit from this tax break at all – because often such businesses don’t have any profits, because they are investing in research, sales and new employees. Citing the large number of business owners who have not claimed the existing deduction for business income, Dan Navin, assistant vice president of tax and economic policy for the Ohio Chamber of Commerce, noted in testimony that “the fact is that small businesses are not clamoring for the proposed exemption from income tax…”[12] Moreover, we know that Ohio’s own recent history of tax cuts – including the deduction created two years ago for business owners – have not generated the jobs that their authors promised.

The existing tax break for small-business owners shows little sign of creating jobs. In June 2013, the Ohio General Assembly approved a new tax deduction allowing owners to deduct half of the first $250,000 in income received from passthrough entities.[13] Some 403,647 business owners claimed $8.3 billion in such deductions for 2013, adding up to roughly $370 million.[14] Over the 20 months since the tax break was approved, Ohio jobs have grown no faster than they did in the 20 months preceding that – in fact, the growth actually has been slightly slower.[15]

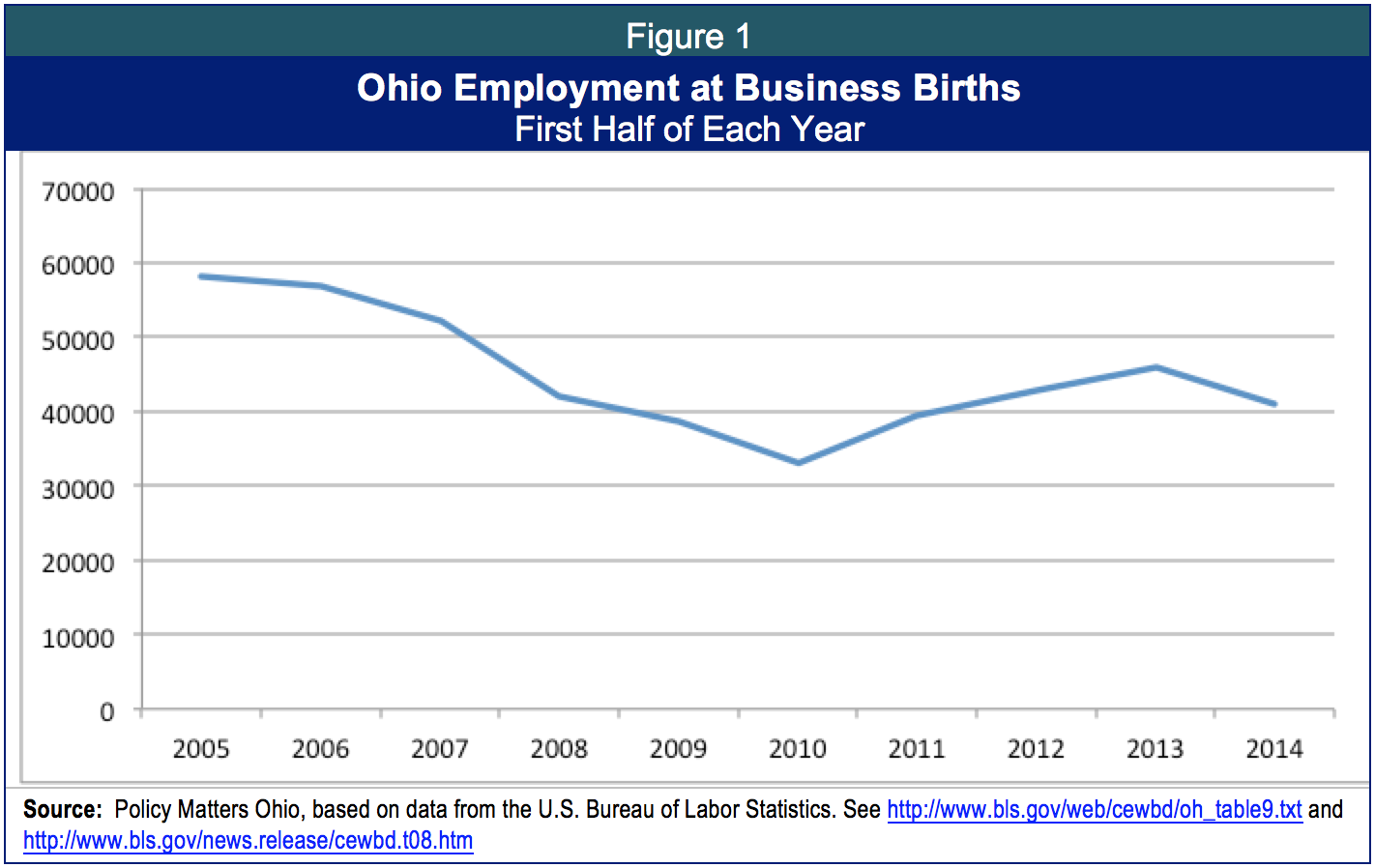

U.S. Bureau of Labor Statistics tracks the number of small businesses that add employees for the first time. Ohio’s business births, as the BLS calls them, increased by just 79, or less than 1 percent, between the first half of 2013 and the first half of 2014. Though there was some growth after the recession, business births in the first half of 2014 were 11 percent below the number in the first half of 2005, when our last big tax cuts were approved. New employment at these small companies, which also grew somewhat after the economic slump, fell in the first half of 2014 from a year earlier, and remains 29 percent below the same period in 2005 (see Figure 1 below).[16]

Another measure of economic performance, the total number of Ohio companies with employees, has fallen as a share of the national total since major income-tax cuts were enacted in 2005. Private employers with employees must pay taxes quarterly to cover unemployment compensation.[17] According to data from the U.S. Department of Labor, the number of such establishments in Ohio in the fourth quarter of 2014 was lower than it was nine years earlier, when the tax cuts were approved.[18] During that time, the number of these establishments in the United States grew by more than 500,000. As a result, Ohio’s share of employers compared to the country as a whole dipped from 3.17 percent to just 2.79 percent during this time period. During the last quarter of 2014, the state’s share was almost identical to when the new business tax break was approved.

Admittedly, the new business-income tax deduction had only been in effect for 18 months. However, given the lack of impact, as well as the lack of results from earlier income-tax cuts that also applied to small business owners, it suggests that Ohio should at the very least wait and see that this big new tax break is accomplishing something before doubling the size of it.

This expanded tax break could lead to tax avoidance.[19] The tax exemption for business income earned from entities with $2 million or less in receipts creates a cliff at that amount: The owner of a business with receipts of $2,000,001 is not eligible for the tax break. A number of those who testified before the House Ways & Means Committee about the Kasich tax plan raised the issue of whether that might encourage tax avoidance. Fred Nicely of the Council on State Taxation, which represents about 600 major corporations engaged in multistate and international business, said that, “…providing favorable tax treatment to certain types of business legal structures could drive businesses and their employees to restructure their operations to reduce their Ohio income tax exposure without necessarily improving Ohio’s business climate.”[20]

Whether or not many business owners try to take advantage of the $2 million threshold, there is a real possibility that some employees could become independent contractors, with no net gain to jobs or the economy. An employee working as a plumber or landscaper or any other number of occupations could start a business, make arrangements with her former employer to do work as a contractor, and eliminate her Ohio income-tax liability. The conservative Tax Foundation has attacked the proposal, making that very argument.[21] Responding to a legislator’s question of what was to prevent this, Testa maintained to the House Ways & Means Committee that it was not so easy, because of the possible loss of benefits such a person might suffer and Internal Revenue Service rules governing independent contractors.[22] However, despite such rules, significant numbers of workers already have been misclassified as independent contractors.[23]

As it is, the existing deduction means that a taxpayer who receives income in wages pays far more state tax than another doing a similar job who happens to be a contractor. Meanwhile, for 2013, those with the most business income benefitted the most from the existing deduction: The 6 percent of those claiming the break with business income of $200,000 or more received more than a third of the total tax break.[24]

Financing the tax break. Gov. Kasich has proposed to finance much of the business-income tax exemption and income-tax rate cuts with other tax increases. But some of the cuts – $523 million over two years, including the effects of the proposal on local taxes – are not paid for with tax increases. This will reduce the resources available to pay for vital public services, including investments needed by small businesses. These are things like paving the streets, providing adequate police and fire protection and educating the workforce of the future.[25] A recent survey of founders of some of the nation’s fastest-growing companies found that a skilled workforce and high quality of life were the main reasons why they founded their companies where they did. Taxes were not a major factor.[26] Most often, they located their businesses where they lived at the time.

This illustrates that cutting taxes on business income is not a smart economic development strategy. Nor has it proven to work elsewhere. In Kansas, which took a more extreme approach than Ohio and eliminated its income tax on all income from pass-through entities, more taxpayers than expected have taken advantage of the tax break.[27] That and other income-tax cuts contributed to opening a hole in the state budget that caused rating agencies to downgrade the state’s credit, while job growth has been tepid.

Gov. Kasich’s proposed business-income tax exemption has drawn opposition from across the political spectrum. It is unlikely to produce additional jobs, just as a previous tax break for business owners has not shown evidence of doing so. It would cost vital revenue, while creating new opportunities to avoid taxes. The General Assembly should reject the proposal.

[1] These include a variety of different kinds of businesses – S Corporations, limited liability companies, partnerships and sole proprietorships – that have one thing in common: Ohio does not tax the businesses directly on their profits, but rather as the profit passes through to the individual income tax returns of the owners. Hence, they are called “passthrough entities.” The proposal is one part of Gov. Kasich’s overall budget plan, which also includes a 23 percent income-tax rate cut and a variety of tax increases. See Governor John R. Kasich, Blueprint for a New Ohio, The State of Ohio Executive Budget Fiscal Years 2016-2017, at http://blueprint.ohio.gov/doc/budget/State_of_Ohio_Budget_Recommendations_FY-16-17.pdf

[2] Governor John R. Kasich, Blueprint for a New Ohio, The State of Ohio Executive Budget Fiscal Years 2016-2017, Tax Expenditure Report, at http://blueprint.ohio.gov/doc/budget/State_of_Ohio_Budget_Tax_Expenditure_Report_FY-16-17.pdf

[3] Joe Testa, Tax Commissioner, Testimony to House Finance Committee, Feb. 12, 2015, p. 7, at http://www.ohiohouse.gov/committee/finance More specifically, Governor Kasich’s budget estimated that the expanded tax break would cost $337.8 million in Fiscal Year 2016 and $358.2 million in Fiscal Year 2017. See Governor John R. Kasich, The State of Ohio Executive Budget, Fiscal Years 2016-2017, Table B-6, p. B-16, at http://blueprint.ohio.gov/doc/budget/State_of_Ohio_Budget_Recommendations_FY-16-17.pdf

[4] E-mail from Ernest C. Massie, Administrator-Tax Analysis, Ohio Department of Taxation, Feb. 5, 2015

[5] Calculations by Michael Mazerov, in “Cutting State Personal Income Taxes Won’t Help Small Businesses Create Jobs and May Harm State Economies,” Center on Budget and Policy Priorities, February 19, 2013 (http://www.cbpp.org/files/2-19-13sfp.pdf) based on data from Matthew Knittel, Susan Nelson, Jason DeBacker, John Kitchen, James Pearce, and Richard Prisinzano, "Methodology to Identify Small Businesses and Their Owners," Office of Tax Analysis, U.S. Department of Treasury, August 2011,

Table 14; http://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/OTA-T2011-04-Small-Business-Methodology-Aug-8-2011.pdf. Those limited liability companies that do not choose to be taxed as C corporations are included with partnerships in the Treasury data.

[6] Testa, Testimony to House Finance Committee, Feb. 12, 2015, p. 19, at http://www.ohiohouse.gov/committee/finance

[7] Ohio Department of Job & Family Services, Labor Market Review, February 2015, p. 48, at http://ohiolmi.com/ces/LMR.pdf

[8] Ibid, p. 1.

[9] Mazerov, Michael, Testimony to House Finance and Appropriations Committee on HB 59 Income Tax Plan, March 19, 2013, at http://www.policymattersohio.org/mazerov-mar2013

[10] While some businesses could make more than a 10 percent profit margin, that represents a very healthy return. The taxation department’s calculations assume each taxpayer will have one personal exemption and no other income. It also assumed each business had just one owner. It calculated the income tax under current law, allowing for an increase in income-tax brackets. This includes the existing business-income deduction and the $20 personal exemption credit. Emails from Gary Gudmundson, Ohio Department of Taxation, March 11 and April 9, 2015.

[11] Testa, Op. Cit., p. 7.

[12] Navin, Dan, Assistant Vice President of Tax & Economic Policy, Ohio Chamber of Commerce, “Opponent Testimony on the Package of Tax Provisions in HB 64,” March 11, 2015, p.2, at http://www.ohiohouse.gov/committee/ways-and-means Prior to the approval of the existing business-income tax deduction in 2013, Tax Commissioner Testa said that some 717,000 tax returns included business income that would be covered by the exclusion. It appears that more than 300,000 have not claimed it, based on claims through mid-March 2015. See below.

[13] Unlike the proposed tax break, the existing one is available to passthrough business owners regardless of the size of the entity. Last year, this tax break was temporarily increased to 75 percent for 2014 income.

[14] Email from Gary Gudmundson, Ohio Department of Taxation, March 18, 2015. Figures include claims through that date. Policy Matters Ohio calculated the amount of savings based on an average tax rate of 4.5 percent, as ODT roughly estimated. Based on that estimate, the average claimant saved about $926.

[15] The number of Ohio jobs grew by 130,400 between June 2013 and February 2015, or 2.48 percent. During the previous 20 months, they grew by 134,000, or 2.62 percent. U.S. Department of Labor, Bureau of Labor Statistics, State and Area Employment, Hours and Earnings, at http://data.bls.gov/cgi-bin/surveymost?sm+39

[16] U.S. Department of Labor, Bureau of Labor Statistics, Business Employment Dynamics Data by States, Ohio, Table 9, at http://www.bls.gov/bdm/bdmstate.htm#OH

[17] This data, which like the data on business births is collected under the Quarterly Census of Employment and Wages, covers active employers that pay at least one employee for 20 weeks in a year or have payroll of $1,500 in a quarter, and agricultural businesses paying $20,000 or more or employing at least 10 individuals in the current or preceding year, with some modest exceptions. The numbers include a small number of government employers.

[18] Bureau of Labor Statistics, Quarterly Census of Employment and Wages, data received by email from Amanda Yap,, U.S. Department of Labor, Feb. 19, 2015, and April 7, 2015. Employers report for each establishment they have.

[19] The taxation department has not yet brought any enforcement actions against tax filers for claiming the existing business-income deduction inappropriately. It is waiting on federal tax return data used to conduct the analysis, which the department said doesn’t arrive for 18 to 24 months. Email from Kristin K. Begg, Ohio Department of Taxation, March 11, 2015.

[20] Nicely, Fred, Senior Tax Counsel, Council on State Taxation, “Concerns with House Bill 64: Main Operating Budget FY 2016 & FY 2017,” Testimony to the Ohio General Assembly House Ways & Means Committee, March 10, 2015, at http://www.ohiohouse.gov/committee/ways-and-means Nicely pointed out in a footnote to his testimony that, “Businesses with high profit margins would have a much greater incentive to restructure their business operations

compared to those with low profit margins.” Ernst & Young illustrated this point in detail in a study it did for COST that was initiated by the Coalition of Ohio Metro Chambers of Commerce. See March 10, 2015, testimony of Dan Mullins before the House Ways & Means Committee, “Analysis of Proposed Changes to Select Ohio Taxes Included in the Ohio Executive Budget and Ohio House Bill Number 64,” also at the above link. As worded, the study said, the proposal “…has the potential to encourage the owner to organize their business into multiple distinct entities to avoid exceeding the two-million dollar threshold in any one entity to maximize the level of income deduction.” Pp. 8-9

[21] Drenkard, Scott, Economist and Manager of State Projects, Tax Foundation, “Suggestions for Improvement in the Ohio FY2016-17 Budget,” Committee on Ways & Means, Ohio House of Representatives, March 4, 2015, at above website

[22] Notes by the author on Testa’s appearance, Feb. 17, 2015.

[23] National Employment Law Project, “Independent Contactor Misclassification Imposes Huge Costs on Workers and Federal and State Treasuries,” A Survey of Research, August 2014, at http://www.nelp.org/page/-/Justice/IndependentContractorCosts.pdf?nocdn=1

[24] Calculations are based on data from the Ohio Department of Taxation as of March 18, 2015, op. cit.

[25] Ohio has a host of other unmet needs. See Wendy Patton, “An Investment Budget,” Policy Matters Ohio, March 18, 2015, at http://www.policymattersohio.org/invest-march2015, for a partial list.

[26] Endeavor Insight, “What Do the Best Entrepreneurs Want in a City? Lessons from the Founders of America’s Fastest-Growing Companies,” at http://issuu.com/endeavorglobal1/docs/what_do_the_best_entrepreneurs_want. Cited in Michael Mazerov, “More Evidence You Can’t Lure Entrepreneurs with Tax Cuts,” Off the Charts blog, Center on Budget and Policy Priorities, Feb. 14, 2014, at http://www.offthechartsblog.org/more-evidence-that-you-cant-lure-entrepreneurs-with-tax-cuts/

[27] Lowry, Brian, “More business owners using tax exemption than Kansas expected,” The Wichita Eagle, Feb. 21, 2015, at http://www.kansas.com/news/politics-government/article10802204.html

Tags

2015Tax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22