Cuyahoga EITC Coalition Evaluation

September 22, 2014

Cuyahoga EITC Coalition Evaluation

September 22, 2014

by Joseph Digby and Audrey SteinerDownload summary (1pg)Download report (13 pp)Press releaseFree tax program served 12,082 families this year, brought $14.8 million to Cuyahoga County.

Executive Summary

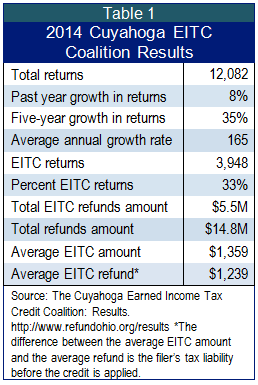

The Enterprise-led Cuyahoga Earned Income Tax Credit Coalition (the Coalition) has provided free, high-quality tax preparation assistance services to Cuyahoga County since 2005. In 2014, the Coalition provided services for 12,082 clients, 3,948 of whom received the Earned Income Tax Credit (EITC). The Coalition and its 40 plus partners helped Cuyahoga County residents obtain $14.8 million in federal refunds during the 2013 tax filing season, buffering clients against poverty and injecting funds into the local economy.

The Coalition helps families earning up to $51,567 claim the EITC – the average family served in 2014 earned under $25,000. This report analyzes this tax preparation program and summarizes Policy Matters Ohio’s 2014 survey of nearly 2,700 clients. We found that low-income families that rely on their EITC refunds primarily use it to pay for basic needs. Other findings include:

-

The Coalition’s outreach is growing, bringing substantial resources to Cuyahoga County. In 2014, the Coalition served 12,082 clients, 3,948 of whom received the EITC. Since 2013, the Coalition’s client base has grown by 9 percent, and the number of EITC recipients has grown by 18 percent.

-

Tax returns prepared by the Coalition resulted in $14.8 million in refunds. The EITC accounted for $5.5 million of that amount.

-

The Coalition assisted 12,082 clients. Among about 33 percent had not received free tax services last year; about 10 percent had paid for tax preparation and 2 percent had never filed a return.

-

Client satisfaction is high. Close to half of all clients were return customers, 96 percent were pleased with their experience, and 92 percent said they would return.

-

Respondents who received free tax preparation services from the Coalition received on average $1,359 for their federal EITC credit, $1,239 of which was received in refunds.

-

Every dollar the Coalition spends brings $30 in state and federal refunds to the county.

This report found that the Coalition assists low-income taxpayers, brings federal money back into the economy, relieves poverty, and consistently achieves a high rate of customer satisfaction. The main goals for Cuyahoga County are to improve outreach and to change the state EITC to better address the needs of its lower-income workers.

Introduction

The Cuyahoga EITC Coalition, led by Enterprise Community Partners, is a group of social service agencies, community groups, and government entities that provides free tax preparation to low and middle-income families in Cuyahoga County. In the 2013 tax season, the Coalition helped clients obtain more than $14.8 million in federal tax refunds by preparing 12,082 tax returns. Roughly a third of the clients received the EITC, a refundable tax credit that helps low and middle-income working families, primarily those with children.

The Cuyahoga EITC Coalition, led by Enterprise Community Partners, is a group of social service agencies, community groups, and government entities that provides free tax preparation to low and middle-income families in Cuyahoga County. In the 2013 tax season, the Coalition helped clients obtain more than $14.8 million in federal tax refunds by preparing 12,082 tax returns. Roughly a third of the clients received the EITC, a refundable tax credit that helps low and middle-income working families, primarily those with children.

The size of the federal EITC a family receives depends on number of children and marital status. Families earning between $13,000 and $23,000 with three or more children qualify for the maximum credit of $6,143. Families with two children qualify for up to $5,460, while families with one child qualify for a maximum of $3,305. Those without children receive up to $496.[1]

The federal EITC is the nation’s largest poverty relief program. It goes only to working families. The program helps make up for the fact that poor and moderate-income families pay a larger portion of their income to state and local taxes than wealthier families do. In 2012, the EITC lifted nearly 10 million Americans out of poverty.[2] The federal EITC is a refundable credit, which contributes greatly to its ability to help Americans avoid poverty. If the filer qualifies for a credit exceeding his or her tax liability, the difference can be claimed as a refund.

In June 2013, Ohio established a state EITC, joining 24 other states and the District of Columbia in providing this important support to low-income working families. This is an important step in the right direction for Ohio, but provisions of the Ohio credit make it different, and much less effective, than credits in most other states. See the appendix for details about Ohio’s new credit.

Survey Methodology

The Cuyahoga EITC Coalition commissioned Policy Matters Ohio to evaluate its free tax preparation program. Ten Volunteer Income Tax Assistance (VITA) sites distributed the surveys in 2014. Of those clients who received the survey, 2,741 voluntarily responded – a response rate of 23 percent. This is an adequate survey response rate for statistical purposes but given that clients were on-site and receiving a free service, the Coalition could explore ways to improve response rates in the future. Clients were not required to fill out the survey to receive assistance, and it was not mandatory to answer all nineteen questions. The survey was structured to understand client financial issues, assess Coalition marketing efforts, and analyze the effects of free tax services on client well-being.

Survey Results

Overall, the Coalition is reaching more clients and helping more families retain the full value of the EITC. Clients report that they will use their EITC to catch up on utility bills or to pay rent. Paying for utilities and rent were the top ranked Coalition client concerns. Clients are highly satisfied with the service they receive from the coalition, with 96 percent reporting a positive experience. No customers reported an overall negative experience.

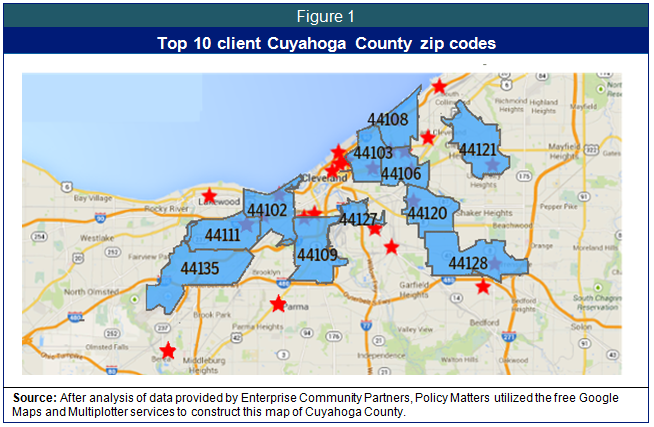

Respondents came from various areas in the county, but most EITC clients live in inner city Cleveland. Figure 2 is a map of Cuyahoga County with the ten most common zip codes of EITC survey respondents outlined and color-coded in blue. Coalition sites are marked with red stars. The most common zip code was 44108. The map revealed a strong correlation between the locations of Coalition sites and the top zip codes; few respondents were traveling long distances.

Demographics

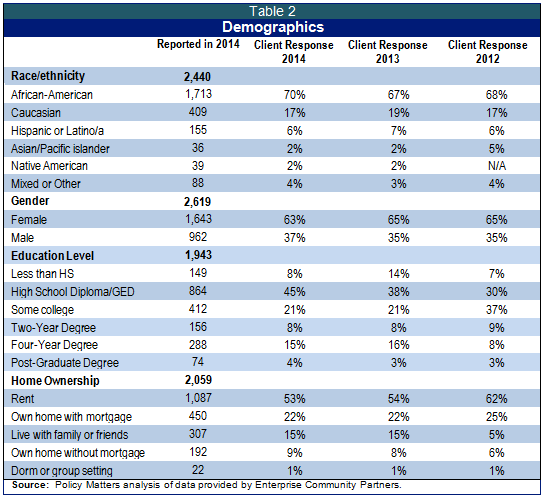

There were few changes in the demographics of the Coalition’s survey respondents from 2013 to 2014. The Coalition continues to serve primarily African American (70.2 percent) and Caucasian (16.8 percent) clients. The percentage of clients reporting an education level below a high school diploma fell from 14 percent in 2013 to 8 percent in 2014. However, 44.5 percent of all respondents cited a high school diploma or GED as their highest level of education, and there was a slight decrease in the percentage of clients who had completed undergraduate degrees.

The 1,160 survey respondents who reported their annual income earned an average of $24,866, marking a decrease from the $25,035 average annual income of the 2013 survey’s respondents. Over a third of respondents (34 percent) earned between $20,000 and $30,000, placing them just above the cap and eliminating their ability to take full advantage of the Ohio EITC. The cap on Ohio’s EITC is described in the appendix.

With regard to home ownership, the Cuyahoga EITC Coalition’s 2014 report showed few changes from past years. The majority of clients continued to rent, not own, their homes or apartments. An alarming 11.1 percent of respondents faced eviction or foreclosure; this figure was unchanged from last year.

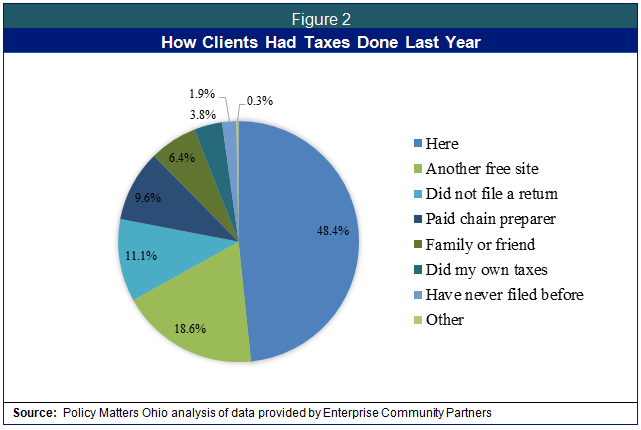

Figure 2 shows how the Coalition’s clients prepared their taxes last year. Nearly half had gone to a Coalition site last year and another 18.6 percent had been to another free site, meaning that a full 67 percent were return customers to free sites – this was an increase compared to last year’s results, when 62 percent were returning to a free site.[3] A slightly smaller percentage of clients had their taxes filed by a paid chain preparer (9.6 percent) than last year (11.9 percent). There was also a drop in the percentage of clients who had never filed before. A vast majority of clients (92 percent) stated that they would return to the Coalition to have their taxes done in the future.

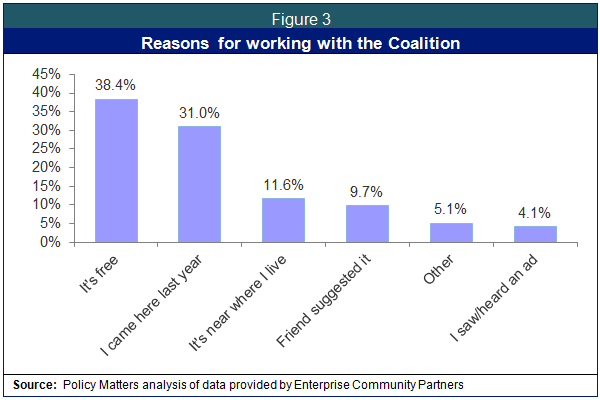

Figure 3 shows that about 38 percent of the respondents chose to work with the Coalition primarily because their services were free. Past experience with the Coalition and its location near their places of residence were also influential factors. The latter is consistent with the analysis presented in Figure 1.

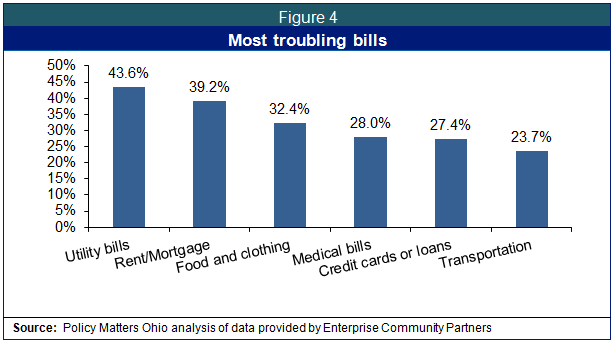

Figure 4 shows that utility bills, and rent or mortgage costs continue to be primary concerns for clients, 43.6 percent and 39.2 percent of whom cited these costs as most troubling, respectively. Survey results also found the costs of food, clothing and medical bills to be particularly problematic for clients. In accordance with past reports, clients said that they would spend potential refunds on these expenses.

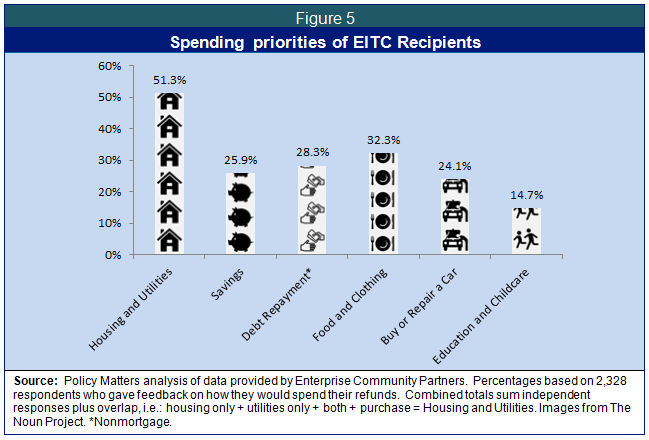

Clients planned to use EITC refunds for essential purchases of utilities, food, housing and transportation. Figure 5 displays clients’ spending priorities with some combining of related categories. Refunds are clearly important in helping clients meet their basic spending needs.

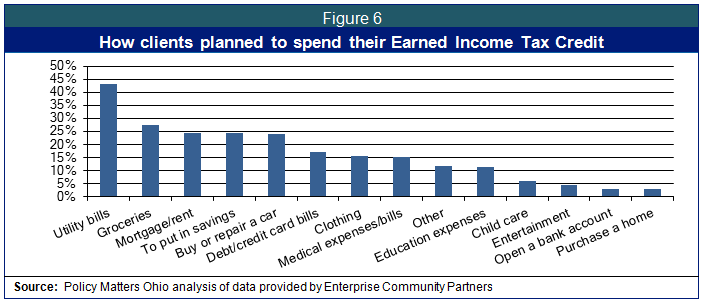

Figure 6 provides a more in depth breakdown of spending plans, distinguishing between childcare and education as well as between rent and utilities. This chart makes clear what a challenge it is for low-income families to cover their utility costs – these bills are often paid only when a lump sum of cash, like the EITC, arrives in a household. It is also clear that groceries, housing costs, savings, bills and car repair are major expenses.

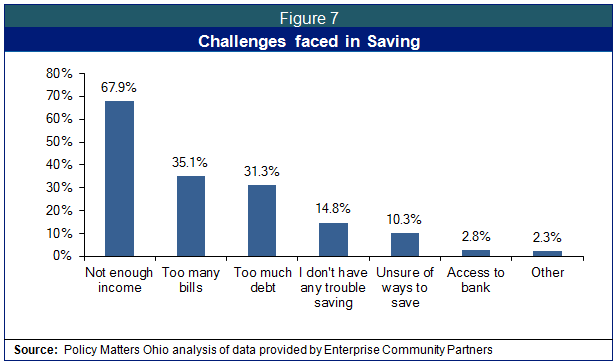

Figure 7 reports client responses to their challenges in saving. Most clients (67.9 percent) reported having trouble saving due to limited incomes. Thirty-five percent reported having too many bills and just over 30 percent said they had too much debt to save.

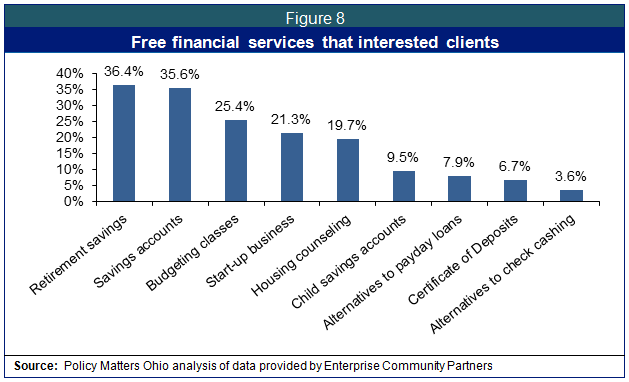

Most survey respondents showed interest in receiving other free financial services. Figure 8 illustrates the need for programs that address saving and budgeting assistance in particular. Clients were also eager to learn about start-up businesses, housing counseling, and child savings accounts. Retirement planning held the most interest among clients, though many were already at or near retirement age.

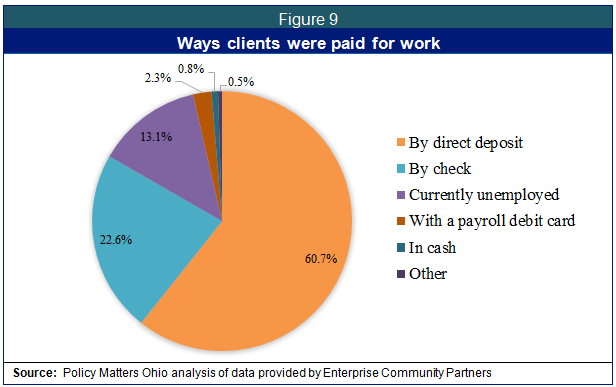

Figure 9 breaks down the different ways that clients were paid. The majority of clients (60.7 percent) received payment through direct deposit into a bank account, which made them eligible for faster refunds from the IRS when they filed electronically. A smaller portion (13.1 percent) of clients reported being unemployed than last year. The EITC requires eligible recipients to be working, so Coalition clients who did not work at all during 2013 do not qualify for the EITC.

Figure 10 shows client responses regarding participation in safety net programs. About 60 percent reported that someone in their household receives food assistance (the Supplemental Nutrition and Assistance Program or food stamps), about a third receive Medicaid or health benefits, and just over a quarter reported some disability benefits.

Client Satisfaction

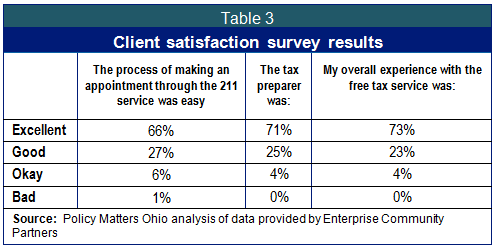

The Coalition has produced consistently high levels of client satisfaction in the past several years. Survey results found that 93 percent of those who used the 211 – First Call for Help service had an excellent or good experience in making their appointments, and 96 percent of clients described their tax preparer as excellent or good. 96 percent also reported overall satisfaction with the tax preparation experience that the Coalition provided.

Recommendations

The Cuyahoga EITC Coalition uses a modest annual budget of $540,000 to create multiple benefits for the County. The Coalition serves over 11,000 Ohioans, bringing millions of federal dollars into Cuyahoga County, and helping thousands of families avoid poverty and unnecessary and sometimes exploitative charges from paid tax return preparers. However, the Coalition would benefit from improving its outreach to better reach Cuyahoga County residents.

-

Expand Coalition tax prep services beyond Cleveland. Over an eighth of survey participants listed proximity as a primary reason for choosing the Coalition as their tax preparer. This is consistent with the Policy Matters analysis of Coalition site locations and common zip codes. Expanding Coalition sites would improve the Coalition’s ability to reach more Ohioans, therefore increasing their influence on Ohio’s citizens and economy.

-

Engage in targeted volunteer recruitment efforts to university students. The Coalition recruits roughly one-third of its volunteers from the student populations of various local institutions of higher learning. Experiential learning is of increasing importance to students, particularly in accounting and business studies. The Coalition already provides internship credit to students at Notre Dame College. This sort of partnership could be replicated in other universities. The Coalition should collect or utilize existing data on where student volunteers attend school to guide this process.

-

Give the Coalition and similar organizations more resources. The Coalition has an impressive return rate. For every dollar spent, $30 are brought into Cuyahoga County. More resources would enable the Coalition to reach more clients in the county and recruit more volunteers. The Coalition would be able to partner with more free service providers, increasing outcomes for all organizations involved and broadening the EITC’s client base to ensure that those eligible for the EITC know how to receive their credit.

Appendix: The Ohio Earned Income Tax Credit

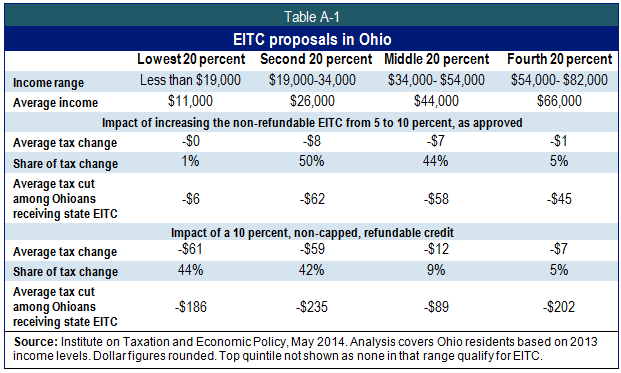

Ohio created a state Earned Income Tax Credit in 2013 and increased its size in 2014, joining 24 states in piggybacking on the federal EITC. Ohio’s new Earned Income Tax Credit will help 855,000 families to make ends meet, with an average credit of $226.[4] However, Ohio is one of only four states that have nonrefundable EITCs. The federal EITC, and the EITC in almost every state with a credit, is refundable, to make up for the fact that poor families pay more in other state and local taxes. When the credit is refundable, families who earn too little to pay income tax (but still pay a disproportionate share of other state and local taxes) still see the full value of their refund. The fact that the Ohio credit is not refundable severely limits its ability to keep families out of poverty. Since the average Coalition client served earned just $25,000, most clients likely saw a very small benefit, if any, from the Ohio EITC, which doesn’t help the average filer in the lowest 20 percent of income. Table A-1 shows how the new Ohio EITC affects different tax filers and how the same size credit, made refundable and without a cap, would help.

For Ohio filers with taxable incomes that exceed $20,000, the EITC is capped at 50 percent of the tax that would be due after the deduction of all other credits. Of all survey respondents, 57 percent earned incomes above that cap, and 54 percent of those respondents reported a lack of sufficient income. One third of all clients earned between $20,000 and $30,000, representing a large share of clients whose potential gains were gutted by the cap. The cap on the state credit hurts the middle-income families who could use the full aid of the EITC.

Ohio’s low-income earners have experienced positive policy changes in the past, from the creation of the state EITC to the federal government’s elimination of predatory practices like Refund Anticipation Loans (RALs).[5] Continued adjustments would help the Coalition to better achieve its aims.

Authors

Joseph Digby, a research intern at Policy Matters Ohio, is a rising senior at Case Western Reserve University majoring in Political Science with minors in Asian Studies and Public Policy.

Audrey Steiner, a research intern at Policy Matters Ohio, is a rising junior at the College of Wooster, where she studies History and Political Science.

Acknowledgements

We are grateful to Enterprise Community Partners for funding this report. The Wean Foundation, the Cleveland Foundation, and the Ohio Benefit Bank provide generous funding to the Ohio CASH coalition. As always, any errors are the sole responsibility of the authors.

Thanks to our fellow interns Elizabeth Jacob, Robert McCarthy, and Annie Racine for assistance with data entry. We would also like to thank the Policy Matters Ohio staffers for their help in editing the report.

Finally, our gratitude goes to Keely Andrews and Kathy Matthews from Enterprise Community Partners for answering our questions about data and the survey.

Policy Matters Ohio is a non-profit, non-partisan research institute researching how to make Ohio’s economy work for all. Generous funding comes from the Cleveland, Ford, George Gund, Sisters of Charity, St. Luke’s, and Raymond John Wean foundations, as well as the Center on Budget and Policy Priorities, Greater Cleveland Community Shares and the Economic Policy Institute. To those who want a more prosperous, equitable, sustainable and inclusive Ohio… Policy Matters.

3631 Perkins Avenue, Suite 4C-E • Cleveland, Ohio 44114

125 East Broad Street, Fourth Floor • Columbus, Ohio 43215

© 2013 Policy Matters Ohio. Permission to reproduce this report is granted provided that credit is given to Policy

Matters Ohio. All rights reserved.

[1] Internal Revenue Service. "EITC Home Page--It’s easier than ever to find out if you qualify for EITC" . http://www.irs.gov/Individuals/EITC-Home-Page--It's-easier-than-ever-to-find-out-if-you-qualify-for-EITC (accessed June 2014).

[2] Center on Budget and Policy Priorities. "Policy Basics: The Earned Income Tax Credit." http://www.cbpp.org/cms/?fa=view&id=2505 (accessed June 2014).

[3] Klingshirn, Laura, and Shubo Yin. "Cuyahoga County EITC Coalition Evaluation." . http://www.policymattersohio.org/eitc-aug2013 (accessed June 2014).

[4]Halbert, Hannah. "A Credit that Counts." Ohio EITC should be made a credit that counts. http://www.policymattersohio.org/eitc-oct2013 (accessed June, 2014).

[5] “The Story Behind the Demise of Refund Anticipation Loans”, a blog from 5-10-12 on the Tax Credits for Working Families blog, http://bit.ly/16Se7uS (accessed June 2014).

Tags

2014EITCOhio Income TaxRevenue & BudgetTax PolicyPhoto Gallery

1 of 22