Hospitals Would Owe Millions If Exempt Properties Were Taxed

December 09, 2013

Hospitals Would Owe Millions If Exempt Properties Were Taxed

December 09, 2013

Download summary (2 pp)Download full report (5 pp)Press releaseCuyahoga County’s two largest private nonprofit hospital systems together would owe tens of millions of dollars a year in additional property tax if their exempt properties in Cleveland were subject to taxation.

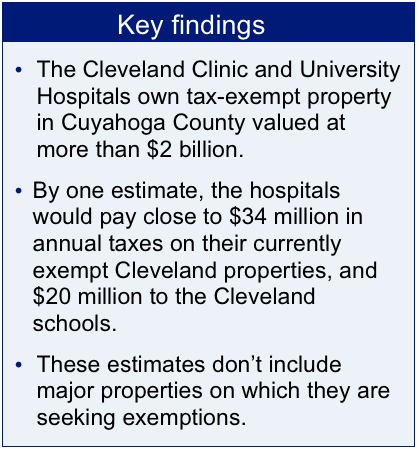

Nine years ago, Policy Matters Ohio analyzed the size of the property holdings of Cuyahoga County’s two major private nonprofit hospital systems.[1] At the request of Common Good Ohio and the Cleveland Teachers Union, we have updated that analysis. The key finding: The area’s two leading nonprofit hospital systems, the Cleveland Clinic and University Hospitals, together would owe tens of millions of dollars a year in additional property tax if their exempt properties in the city of Cleveland were subject to taxation. By one estimate, that would amount to close to $34 million a year, and more than $20 million annually for the Cleveland Metropolitan School District. Those figures do not include the very substantial properties for which the Clinic, in particular, is seeking exemptions now.

Nine years ago, Policy Matters Ohio analyzed the size of the property holdings of Cuyahoga County’s two major private nonprofit hospital systems.[1] At the request of Common Good Ohio and the Cleveland Teachers Union, we have updated that analysis. The key finding: The area’s two leading nonprofit hospital systems, the Cleveland Clinic and University Hospitals, together would owe tens of millions of dollars a year in additional property tax if their exempt properties in the city of Cleveland were subject to taxation. By one estimate, that would amount to close to $34 million a year, and more than $20 million annually for the Cleveland Metropolitan School District. Those figures do not include the very substantial properties for which the Clinic, in particular, is seeking exemptions now.

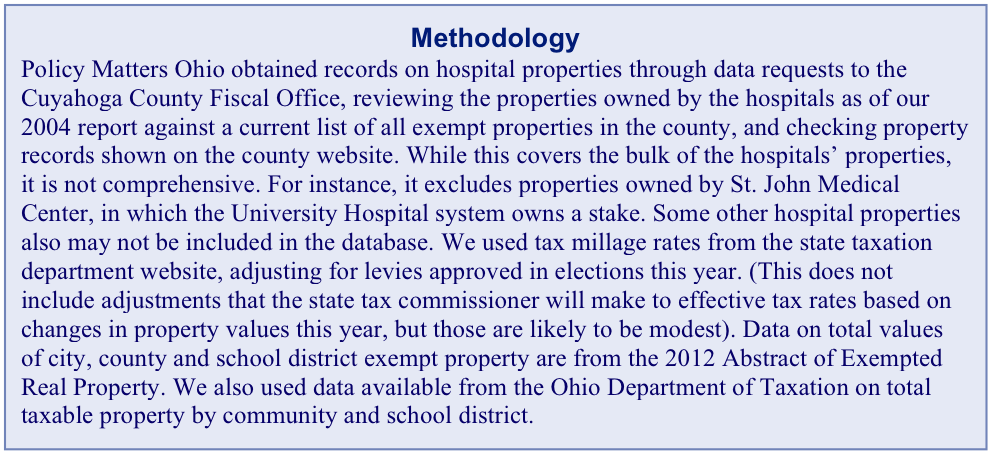

Policy Matters used data from the Cuyahoga County fiscal office to calculate the size of the hospitals’ property holdings in the county. This also allows a determination of the property taxes foregone because these institutions do not pay on most of their holdings.

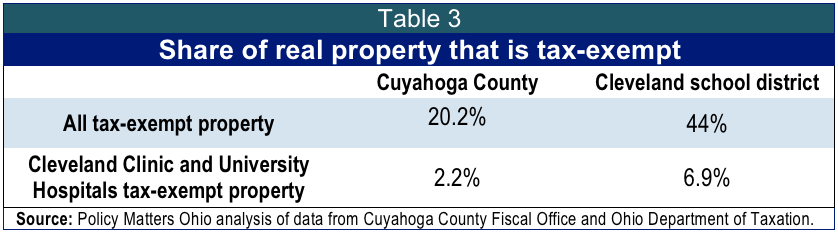

Nonprofit, government and tax-abated property accounted for 20.2 percent of the real property in Cuyahoga County in Tax Year 2012.[2] The county has more exempt property as a share of its total than the state as a whole.[3] Charitable institutions own $3.3 billion worth of real property in Cuyahoga County, or 17.1 percent of the total $19.4 billion in exempt property in 2012 (this property owned by charitable institutions excludes that of churches and private educational institutions).[4]

Cleveland has a high share of tax-exempt property. In 2012, exempt property, including that owned by governments and nonprofits, as well as tax-abated property owned by business, accounted for 44.9 percent of the real property in the city.[5] According to the county’s 2012 Abstract of Exempted Real Property, charitable institutions own $2.3 billion of exempt real property in the city, or 21.3 percent of the city’s exempt property.

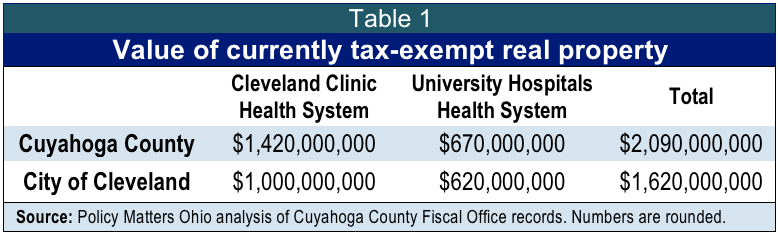

The two major hospitals, the Cleveland Clinic Health System and University Hospitals Health System Inc., together own more than $2 billion in tax-exempt property in Cuyahoga County, according to information from the county fiscal office and analysis by Policy Matters. This amounts to more than three-fifths of the tax-exempt charity holdings in the county and 2.2 percent of all the real property, taxable and exempt. If these institutions paid taxes on all of their exempt real property county-wide, Cuyahoga County, local school districts, municipalities, public libraries, Cuyahoga Community College and other taxing jurisdictions would receive more than $71 million a year in additional taxes. Their exempt properties in Cleveland alone would generate tax revenue of more than $56 million.

In our report nine years ago, we noted that the values as they appear on the books likely overstate the properties’ real value.[6] That’s because nonprofit institutions that do not pay taxes have no incentive to appeal the valuation given to their tax-exempt properties, unlike for-profit businesses. Based on earlier experience at two nonprofit Cleveland hospitals that were purchased by for-profit operators, the earlier report also reviewed what values would be if they were reduced by 40 percent.

Together, CCHS and UHHS have currently tax-exempt property in Cleveland worth more than $1.6 billion, or more than three-quarters of their exempt property county-wide. Among the properties identified in this study, the Clinic has exempt property in the city valued at $1 billion, while the University Hospitals system’s properties are valued at more than $620 million.[7] These numbers reflect significant increases from nine years earlier, when Policy Matters identified exempt property owned by the two institutions worth $960 million. Table 1 shows the estimated value of the two hospital systems’ tax-exempt property in the county and the city.

New properties have been added, while the value of properties that were previously exempted from taxes has grown. For example, three different properties on the Cleveland Clinic main campus have increased their tax-exempt value by at least $100 million apiece since the last Policy Matters report. Similarly, the tax-exempt value of the biggest property on University Hospitals’ main campus has increased by almost $100 million. Altogether, the exempt property of the two institutions adds up to 6.8 percent of the total real property in the city.[8]

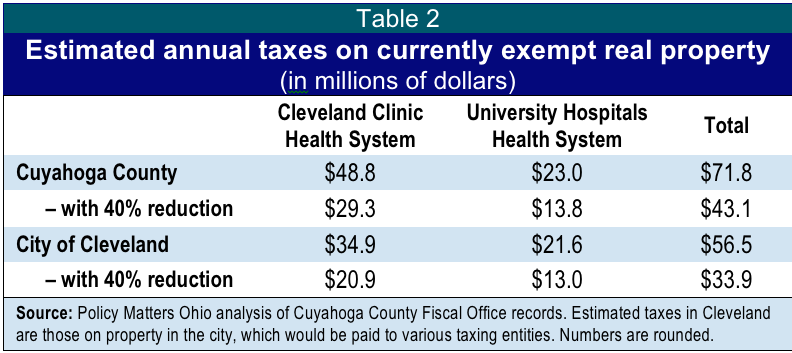

If the Clinic were taxed on these Cleveland properties, it would pay $34.9 million in annual taxes. That number is based on values as shown by the county fiscal office – these values are not adjusted downward. Even knocking 40 percent off these values, the Clinic would pay an additional $20.9 million a year if it were fully taxed on its Cleveland properties. UH’s exemptions in the city are worth $21.6 million in taxes, or $13 million after a 40 percent adjustment. Thus, the two hospital systems together would pay $33.9 million a year. Table 2 provides estimates of what each hospital system would pay on their exempt properties, with and without the adjustment.

These taxes would go to the county, the city, the school district and other government entities. Three-fifths of the total the two would pay on properties in the Cleveland school district would go to the district. At the listed values of the hospital properties, the school district would receive $34.2 million a year; reducing that by 40 percent, the district would receive $20.5 million a year. The lower figure amounts to nearly 30 percent of the annual amount that the school district’s 15-mill levy approved by voters last year was expected to generate.[9]

These numbers, however, do not take into account the sizeable values of properties for which the two institutions – especially the Clinic, in the city of Cleveland – are seeking tax exemptions. According to data provided by the county, the two hospital systems are seeking exemptions in the county for more than 30 properties. These parcels are valued overall at $975 million county-wide, and $600 million in Cleveland. That doesn’t mean the hospitals are seeking exemptions for the full amounts; determining the exact amounts being sought is beyond the scope of this report. However, it is clear that the hospitals are seeking exemptions for most of that.

A December 2007 application by the Clinic with the county auditor sought exemptions covering properties on its main campus including the Glickman Tower, the tallest building there; the Miller Pavilion, housing the hospital’s Heart and Vascular Institute and including 288 single patient rooms, 16 operating rooms and 10 cardiac catheterization laboratories; and construction or renovation of eight other buildings.[10] Altogether, the taxable value of these properties is $426.4 million, an increase of $400 million since our earlier report. According to the county, the 2012 tax due this year on that property was $14.5 million.[11] UH likewise has sought an exemption on the Ahuja Medical Center in Beachwood (Warrensville Heights school district), which is valued at more than $179 million.

The Clinic’s attempt to win an exemption for its family health and surgery center in Beachwood was challenged by the Beachwood City Schools.[12] The case has been argued before the state Board of Tax Appeals (BTA), and a decision is likely next year. Its resolution, along with that of a separate case being heard by the BTA involving the Clinic’s Taussig Cancer Center and the Cleveland schools, will help determine whether exemptions are approved for other major properties as well. The Ahuja case also is pending before the BTA.

Under Ohio law, nonprofit institutions must pay property tax on properties they own if they are not being used for a charitable purpose.[13] Thus, both the Clinic and UH pay taxes on some of their properties, such as the Clinic’s InterContinental Hotels. Data from the county fiscal office show that, leaving aside the properties cited above on which they are seeking exemptions in whole or in part, the two institutions have taxable property between them in the county worth close to $340 million. According to records on the county web site, the two institutions paid a total of almost $10.5 million county-wide in property taxes covering 2012. However, as indicated above, these taxes are only a small share of the total they would pay if they were liable to pay tax on all of their property.

In summary, Cuyahoga County’s two private nonprofit hospital systems avoid tens of millions of dollars a year in taxes that they would pay if most of their property were not exempt from taxation. The Cleveland school district foregoes the most – more than $20 million a year by a conservative estimate.

Acknowledgements

The authors would like to thank Robin Darden Thomas, Land Bank Program Director of the Thriving Communities Institute, for her help with data for this report. Any errors are entirely our own.

[1] Se “Valuing the Tax-Exempt Property of Private Nonprofit Hospitals at http://bit.ly/1fdaHWQ. This analysis was conducted at the request of then-County Treasurer James Rokakis.

[2] See 2012 Abstract of Exempted Real Property, Cuyahoga County Total, p. 81, available at http://fiscalofficer.cuyahogacounty.us/pdf_fiscalofficer/en-US/DTE94_2012.pdf.

and Ohio Department of Taxation, Tax Data Series, 2012 Real Property Abstract by Taxing District, available at www.tax.ohio.gov/tax_analysis/tax_data_series/publications_tds_property/12rpatd.aspx.

[3] Figures from Tax Year 2011 show that Cuyahoga County had 12.6 percent of the taxable real property in Ohio, and 14.4 percent of the exempt real property. Ohio Department of Taxation, 2012 Annual Report, Assessed Valuation of Exempt Real Property Compared to Total Assessed Real Valuation, by County, Tax Year 2011, p. 105, available at www.tax.ohio.gov/communications/publications/annual_reports/2012_annual_report.aspx.

According to the report, in Tax Year 2011, the 18.27 percent share of real property in Cuyahoga County that was tax-exempt that year outstripped that of all neighboring counties except Portage: Geauga, 8.01 percent; Lake, 7.97 percent; Lorain, 13.24 percent; Medina, 8.37 percent; Portage, 19.69 percent, and Summit, 12.61 percent.

[4] 2012 Abstract of Exempted Real Property, Cuyahoga County Total, p. 81, available at http://fiscalofficer.cuyahogacounty.us/pdf_fiscalofficer/en-US/DTE94_2012.pdf. The largest share of tax-exempt property is owned by government. Federal, state, county and local governments own $6 billion, school districts $2.1 billion, and park districts $731 million. Private schools and colleges accounted for $2.14 billion, churches and public worship, $1.2 billion, and other, $1.4 billion. Tax abatements amounted to $2.5 billion. Figures here as elsewhere in this report are market values for Tax Year 2012, unless otherwise indicated.

[5] Calculation based on 2012 Abstract of Exempted Real Property for Cuyahoga County and Ohio Department of Taxation, Tax Data Series, 2012 Real Property Abstract by Taxing District, available at www.tax.ohio.gov/tax_analysis/tax_data_series/publications_tds_property/12rpatd.aspx. The figure for the Cleveland Metropolitan School District is similar, but not identical, because district boundaries include property in Bratenahl, Linndale, Newburgh Heights, and parts of Brook Park and Garfield Heights, while at the same time some property in Cleveland is located in the Shaker Heights or Berea school districts. Tax-exempt property in the Cleveland school district accounts for 44 percent of the total.

[6] Schiller, Zach, Memorandum to James Rokakis, Cuyahoga County Treasurer, Re: PILOTs – tax values, Dec. 17, 2004, available at http://www.policymattersohio.org/wp-content/uploads/2011/10/TaxValues_2004_12.pdf

[7] According to county records, the UHHS properties in Cleveland include the W.O. Walker Center, which has been co-owned by UHHS and the Clinic.

[8] Similarly, the two hospitals own 6.9 percent of the total real property in the Cleveland school district.

[9] Cleveland Metropolitan School District web site, “The 2012 CMSD School Levy,” states: “Based on the county’s current Certificate of Estimated Property Tax Revenue and on county certified tax collection rates, the 15 mill levy is generating $67.4 million per year.” See www.clevelandmetroschools.org/Page/1076.

[10] Application for Real Property Tax Exemption and Remission, The Cleveland Clinic Foundation, Received by County Auditor Dec. 28, 2007, DTE Application Number 5084.

[11] See http://fiscalofficer.cuyahogacounty.us/AuditorApps/real-property/REPI/default.asp, Parcel No. 119-16-001.

[12] William W. Wilkins, then state tax commissioner, ruled in favor of the school district and denied the exemption in a 2005 determination, which was appealed. See Ohio Department of Taxation, Office of the Tax Commissioner, Final Determination, DTE No. KE 4775, Oct. 20, 2005.

[13] This is the standard set in sections 5709.12 and 5709.121 of the Ohio Revised Code. More recently, hospitals have sought exemptions under another section of state law, 140.08. This exempts hospital facilities financed by “obligations issued by a public hospital agency…” As long as such bonds are still being paid off, a hospital could avoid property taxes without meeting the charity standard required by the tax provisions.

Tags

2013Revenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22