Lingering damage from recession-era budget cuts

January 06, 2016

Lingering damage from recession-era budget cuts

January 06, 2016

State spending in the new two-year budget increases by 9.3 percent, or $4.2 billion, without accounting for inflation. This is an improvement, but the increase masks grim realities that leave Ohio behind in funding for critical needs.

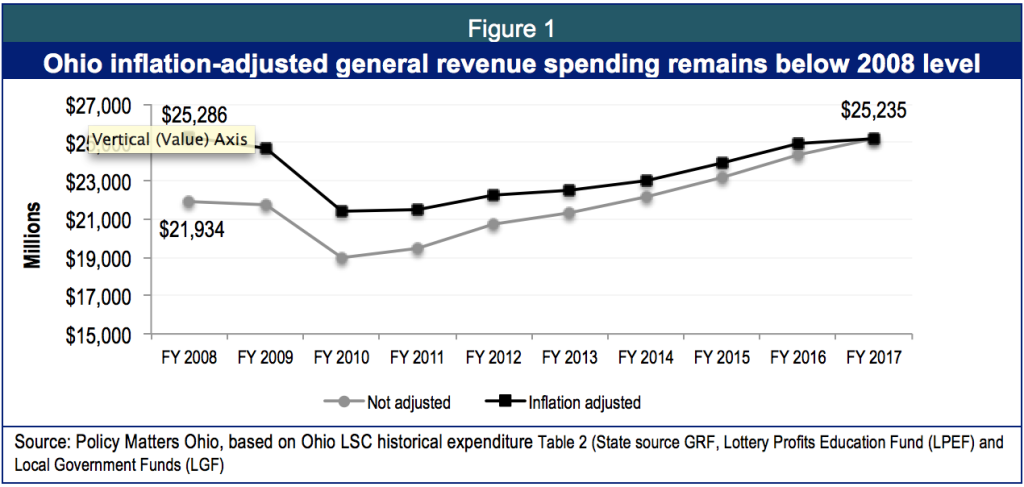

Accounting for inflation, state spending through 2017 is no higher than it was a decade earlier, when the recession began. The Kasich administration has not fully restored deep cuts made during the recession years. Instead, Ohio has slashed taxes, mainly benefitting the wealthy.

The administration has made good investments in some key areas for 2016-17, such as health care. But we remain far behind in funding for work supports, post-secondary education and early learning, even with the modest improvements of the current budget.

Between 2008 and 2017, Ohio weathered recession and recovery. There were cuts and restorations. The chart below (Figure 1) shows how inflation compounds deep cuts since 2008.

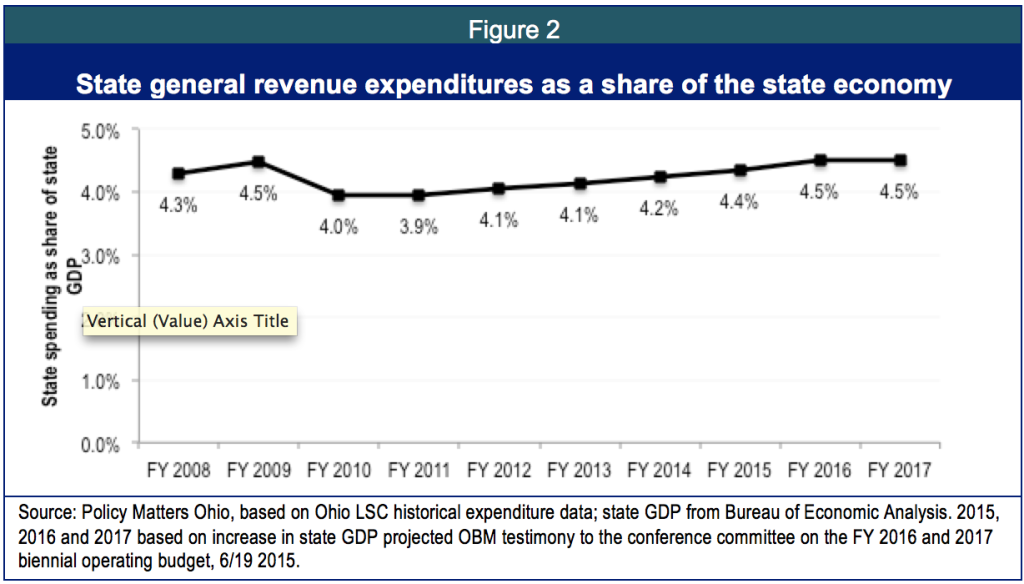

Ohio’s budget fell more than other states during and immediately after the recession. The Pew Charitable Trust evaluated total state expenditures as a share of state personal income and found spending by all states dropped by an average of 0.4 percent in 2011 compared to 2008. It dropped twice as much in Ohio. By 2012, Ohio’s spending of state funds (not counting federal money) across major accounts, as a share of income, ranked 34th among the 50 states and the District of Columbia.

Figure 2 shows that state spending as a share of the economy dipped following the recession and is just now returning to the levels of 2009. Years of curtailed investment has weakened infrastructure in important programs. For example, public childcare eligibility dropped from 200 percent of poverty to 125 percent of poverty –third lowest in the nation. The increase in the 2016-17 budget raised initial eligibility to 130 percent of poverty, but even so, Ohio remains one of the 10 hardest states to get help with childcare. Restoration has not gone far enough.

The state ended last fiscal year in good shape, with an ending balance of just over $1.7 billion. The funds were used to meet required carryover, for outstanding commitments, for the budget stabilization fund (the rainy day fund) and for other one-time uses. The rainy day fund now has $2 billion. The state’s stable fiscal condition and ability to dole out tax cuts were made possible in significant measure by cuts to local government. These cuts have not been restored, either.

The administration prioritized tax cuts over restoring funding, particularly for human services and education. Uncertainty in funding for public schools has led to the institutionalization of harsh policies like pay to play. Enormous cuts to need-based financial aid during the recession excluded community college students entirely; House Bill 64 reinstated their eligibility during summer months, but should go further. Cuts to local government and social service levies eroded local response to poverty. The situation was made worse by harsh policies like stringent requirements for cash assistance, which led to under-spending of safety net dollars even as poverty remained high. In a similar vein, Ohio did not request waivers of time limits for federal food aid to non-elderly adults in many places eligible for relief.

The governor boasted of human service investments in his recent summary of accomplishments in 2015, but many of those steps were baby steps, inadequate to restore damage since the recession. Tax cutting has not yielded jobs or the kind of economic growth that helps families to self-sufficiency. We need major policy changes -- raising the minimum wage, significantly boosting eligibility for childcare, restoring need-based financial aid, creating public jobs where work opportunities fail and restoring revenues to local government. These are the investments needed to help get more Ohioans back on their feet.

-- Wendy Patton

Wendy is Policy Matters senior project director.

Tags

2016Budget PolicyRevenue & BudgetWendy PattonPhoto Gallery

1 of 22