Mid-Biennium Review should focus on investments, not tax cuts

April 01, 2014

Mid-Biennium Review should focus on investments, not tax cuts

April 01, 2014

Download summary (1 pg)Download brief (4 pp)Press releaseInvestment in services that benefit all Ohioans would be a better use of state funds than tax cuts. Gov. Kasich’s proposal continues to shift the weight of state taxes from the most affluent to middle- and lower-income Ohioans.

The Kasich administration’s most recent round of tax proposals would continue to shift the weight of state taxes from the most affluent to middle- and lower-income Ohioans. The billion-dollar-a-year income-tax cut he proposed in the Mid-Biennium Review, much of which would be financed by increases in other taxes, fails to address the problems that years of state budget cuts have created in our communities: unrepaired potholes and cracks in roads, longer emergency response times, dimmed streetlights and growing use of fees for young athletes to play sports at school.

Tax cuts are promoted as boosting the economy, but they haven’t worked in Ohio. Instead of tax cuts for the wealthy, we should restore and expand funding to local governments, public schools, health and human services and post-secondary education. This approach would improve communities, build opportunities for children and create the needed infrastructure for businesses. Below are some investments – far from a comprehensive list – that could benefit all Ohioans.

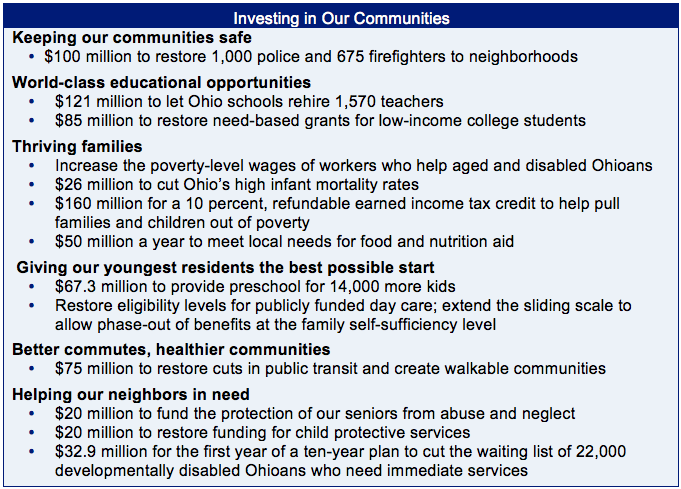

Keeping our communities safe

We all want communities that are safe and provide a positive environment for raising a family.  However, in Ohio state aid across many programs has fallen by $1.1 billion since the budget of fiscal years 2010-11. An important local tax source – the estate tax, which impacted only 7 percent of Ohio’s wealthiest estates – was eliminated. Communities have eliminated capital equipment funds, reduced emergency and protective services, closed swimming pools and recreation centers, dimmed streetlights, and struggled to keep up with road repairs. Many other services have been stopped or slowed across the state. This hurts communities and local economies. Restoring this funding will help our communities be places where families thrive.

However, in Ohio state aid across many programs has fallen by $1.1 billion since the budget of fiscal years 2010-11. An important local tax source – the estate tax, which impacted only 7 percent of Ohio’s wealthiest estates – was eliminated. Communities have eliminated capital equipment funds, reduced emergency and protective services, closed swimming pools and recreation centers, dimmed streetlights, and struggled to keep up with road repairs. Many other services have been stopped or slowed across the state. This hurts communities and local economies. Restoring this funding will help our communities be places where families thrive.

World-class educational opportunities

We owe it to our kids to be good stewards and provide them with a strong future by investing in a world-class public education. Their legacy is our responsibility. State funding sent directly to school districts remains $607 million below what it was four years ago. While some new money has gone to targeted grant programs like the Straight A Fund, it hadn’t made up for previous losses. Continued growth of charter schools and voucher programs also undercuts school district finances. A Policy Matters Ohio survey last fall found that the 261 responding school districts had eliminated 1,570 positions in 2012-2013. Instead of a tax cut, funds could be used to rehire teachers and other critical personnel.

world-class public education. Their legacy is our responsibility. State funding sent directly to school districts remains $607 million below what it was four years ago. While some new money has gone to targeted grant programs like the Straight A Fund, it hadn’t made up for previous losses. Continued growth of charter schools and voucher programs also undercuts school district finances. A Policy Matters Ohio survey last fall found that the 261 responding school districts had eliminated 1,570 positions in 2012-2013. Instead of a tax cut, funds could be used to rehire teachers and other critical personnel.

Ohio needs to make our workforce more competitive by expanding opportunities for an advanced  education. Need-based aid for low-income college students has plummeted since the recession and has not been fully restored. An investment of $85 million would restore it to pre-recession levels, better preparing tomorrow’s workers for success and helping employers find the workers they need. An investment of just $20 million in the Ohio College Opportunity Grant could help restore need-based aid to students at two-year public institutions.

education. Need-based aid for low-income college students has plummeted since the recession and has not been fully restored. An investment of $85 million would restore it to pre-recession levels, better preparing tomorrow’s workers for success and helping employers find the workers they need. An investment of just $20 million in the Ohio College Opportunity Grant could help restore need-based aid to students at two-year public institutions.

Thriving families

Home health care workers allow Ohioans who are aged, disabled, or ill to live with dignity in their own homes. While services in home health care are desperately needed, the work pays so little that a stable workforce has not developed.  Turnover among the direct service workforce in Ohio is between 30 percent and 35 percent annually. Low pay, lack of benefits and unstable hours make for poor working conditions. Some of the funds used for income-tax cuts could instead be used to boost the wages of these workers and help build the workforce needed by Ohio’s aging population.

Turnover among the direct service workforce in Ohio is between 30 percent and 35 percent annually. Low pay, lack of benefits and unstable hours make for poor working conditions. Some of the funds used for income-tax cuts could instead be used to boost the wages of these workers and help build the workforce needed by Ohio’s aging population.

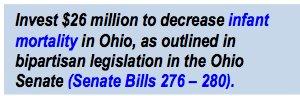

Do we really want to live in a state that has the nation’s third-highest infant mortality rate and  the second-highest infant mortality among African Americans? Funds being used for tax cuts for wealthy Ohioans could help more babies live.

the second-highest infant mortality among African Americans? Funds being used for tax cuts for wealthy Ohioans could help more babies live.

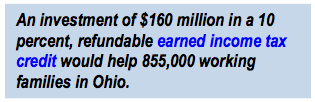

Tax credits reduce tax liability, but the decision on whether or not to make them refundable has an enormous impact on who benefits. The federal EITC and all but five state EITCs are fully refundable, meaning that if a household’s tax liability is less than the amount of the credit, the balance is returned in the form of a tax refund. Families use this refund for childcare, transportation, school or work supplies, and other essentials. The refund raises family income, reduces child poverty, supports work, and  helps offset some of the inequitable impact of the overall tax code. Governor Kasich has proposed boosting the state EITC to 15 percent of the federal credit, from 5 percent currently. A boost is a good thing, but refundability is what really helps families. Boosting Ohio’s EITC to 10 percent and making it refundable would be an investment that would help families across Ohio.

helps offset some of the inequitable impact of the overall tax code. Governor Kasich has proposed boosting the state EITC to 15 percent of the federal credit, from 5 percent currently. A boost is a good thing, but refundability is what really helps families. Boosting Ohio’s EITC to 10 percent and making it refundable would be an investment that would help families across Ohio.

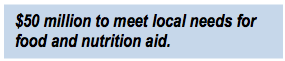

It is our obligation to help our neighbors when they are struggling to meet their basic needs. The Kasich Administration toughened requirements to get food aid for adults without dependents in most of the state, although the federal government  offered to waive such requirements. This jeopardized nutritional assistance (food stamps) for thousands. Many of these Ohioans will turn to food pantries and local agencies, and state funds will be needed to make up for the rejection of federal aid.

offered to waive such requirements. This jeopardized nutritional assistance (food stamps) for thousands. Many of these Ohioans will turn to food pantries and local agencies, and state funds will be needed to make up for the rejection of federal aid.

Giving our youngest residents the best possible start

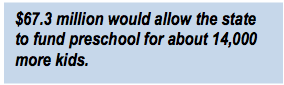

Early education is an investment that more than pays for itself over time. During state budget deliberations,  Ohio Senator Peggy Lehner asked for $100 million to put 22,000 of Ohio’s eligible children in preschool. The request was funded at $32.7 million over the biennium. Instead of income-tax cuts, we should ensure more of Ohio’s kids are ready for kindergarten. Ohio could also reinstate the requirement for full-day kindergarten and provide funding for school districts to better prepare our future citizens and workers.

Ohio Senator Peggy Lehner asked for $100 million to put 22,000 of Ohio’s eligible children in preschool. The request was funded at $32.7 million over the biennium. Instead of income-tax cuts, we should ensure more of Ohio’s kids are ready for kindergarten. Ohio could also reinstate the requirement for full-day kindergarten and provide funding for school districts to better prepare our future citizens and workers.

Making sure that kids have affordable, quality childcare helps not only them, but parents struggling to make ends meet. Eligibility for public childcare has fallen to 125 percent of the federal poverty level (or $24,735 for a family of three) from 150 percent ($29,682 for a family of three). Some families fear moving up the career ladder because as their earnings increase marginally they could lose their childcare subsidy, which would devastate their income. Restoring eligibility to 150 percent of the poverty level would help more parents work. Slowly phasing out the subsidies until a family earns enough to be self-sufficient – between 200 and 270 percent of the federal poverty level, depending on the county they live in - would allow parents to climb the career ladder without fear of abruptly losing benefits.

from 150 percent ($29,682 for a family of three). Some families fear moving up the career ladder because as their earnings increase marginally they could lose their childcare subsidy, which would devastate their income. Restoring eligibility to 150 percent of the poverty level would help more parents work. Slowly phasing out the subsidies until a family earns enough to be self-sufficient – between 200 and 270 percent of the federal poverty level, depending on the county they live in - would allow parents to climb the career ladder without fear of abruptly losing benefits.

Better commutes, healthier communities

At the beginning of the last decade, Ohio’s budget included about $80 million to support public  transportation. That aid has been slashed by 75 percent. Some of the money used for proposed tax cuts could be used instead to boost public transportation. This would reduce our economic vulnerability to oil, help those without dependable cars get to work, create jobs for transit drivers, create healthier, walkable communities and help employers by giving their workforce an inexpensive way to commute.

transportation. That aid has been slashed by 75 percent. Some of the money used for proposed tax cuts could be used instead to boost public transportation. This would reduce our economic vulnerability to oil, help those without dependable cars get to work, create jobs for transit drivers, create healthier, walkable communities and help employers by giving their workforce an inexpensive way to commute.

Helping our neighbors in need

We need to better protect seniors, at the same time creating jobs and helping communities.  Ohio’s General Assembly appropriated just $500,000 per year for 88 counties for the protection of vulnerable elderly or disabled adults. Between 14,000 and 15,000 cases are investigated annually in Ohio, but estimates suggest that as many as 115,000 may need attention.

Ohio’s General Assembly appropriated just $500,000 per year for 88 counties for the protection of vulnerable elderly or disabled adults. Between 14,000 and 15,000 cases are investigated annually in Ohio, but estimates suggest that as many as 115,000 may need attention.

Ohio is 50th in the nation in state funding for protecting and serving children. Spending cuts in children’s programs and cuts to local governments that impacted local children’s services levies have further eroded state support since the budget of fiscal years 2010-11. Some of the funds that would be used for the income tax cut could be used to better protect vulnerable kids.

Ohio is 50th in the nation in state funding for protecting and serving children. Spending cuts in children’s programs and cuts to local governments that impacted local children’s services levies have further eroded state support since the budget of fiscal years 2010-11. Some of the funds that would be used for the income tax cut could be used to better protect vulnerable kids.

More than 41,000 developmentally disabled Ohioans are on waiting lists for services. The  Ohio Developmental Disabilities Council estimates that 22,000 need services immediately. It recommends a “10 percent solution” that would provide services to 2,200 on the wait list every year for each of the next 10 years.

Ohio Developmental Disabilities Council estimates that 22,000 need services immediately. It recommends a “10 percent solution” that would provide services to 2,200 on the wait list every year for each of the next 10 years.

Money the state received from the federal government for the “Save the Dream” foreclosure prevention and homeowner assistance program is mostly spent. New applications for assistance will not be accepted after April 30, 2014, although thousands of families across the state continue to suffer from foreclosure. A few  million dollars a year would at least retain counseling for homeowners needing assistance. Communities need hundreds of millions more to rehabilitate or demolish the thousands of vacant properties that threaten neighborhoods across Ohio.

million dollars a year would at least retain counseling for homeowners needing assistance. Communities need hundreds of millions more to rehabilitate or demolish the thousands of vacant properties that threaten neighborhoods across Ohio.

Conclusion

This is just a partial list of investments needed to boost quality of life and opportunity in Ohio, a small share of what we should consider. Budget cuts have been so deep, and the recession so long, a vision for a state with robust opportunity for all seems to have faded.

There is much Ohio could do to restore communities and build broad family wealth. The Mid-Biennium Review is one more opportunity to look at needs and invest for the future.

Tags

2014Budget PolicyTax ExpendituresTax PolicyWendy PattonPhoto Gallery

1 of 22