Ohio Senate plan increases tax shift

June 12, 2015

Ohio Senate plan increases tax shift

June 12, 2015

Contact: Zach Schiller, 216.361.9801

By Zach Schiller

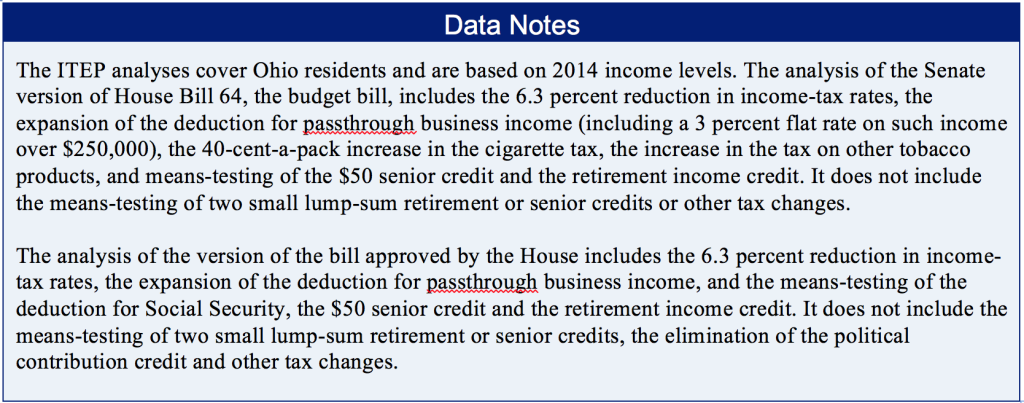

State budget bills approved by the Ohio House of Representatives and proposed by the Senate majority both would slant Ohio’s tax system further in favor of the state’s wealthiest and against low- and middle-income residents. However, the Senate bill introduced this week would provide a bigger windfall to the most affluent and produce an even bigger shift than the House plan. That is the major finding of an analysis done for Policy Matters Ohio by the Institute on Taxation and Economic Policy, a Washington, D.C.-based research group with a sophisticated model of the tax system.

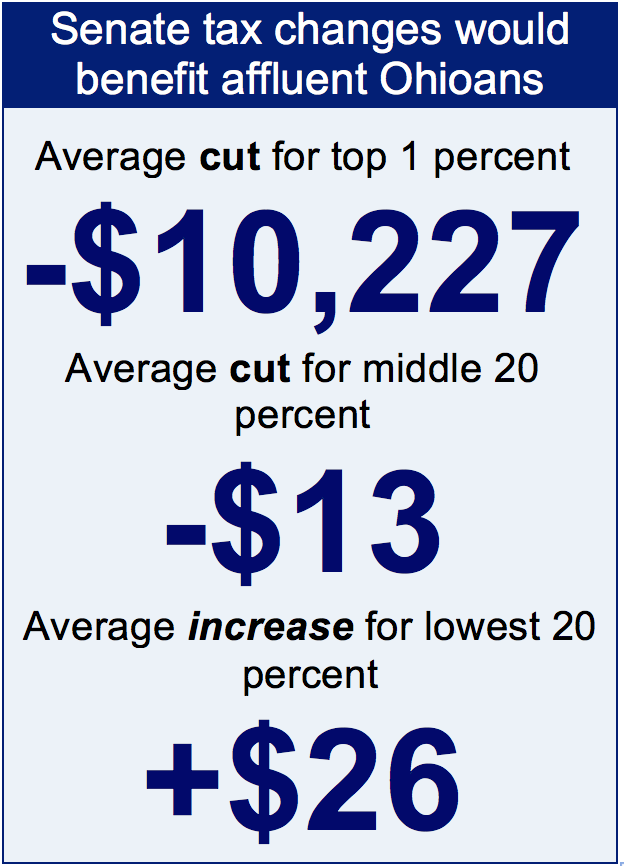

State budget bills approved by the Ohio House of Representatives and proposed by the Senate majority both would slant Ohio’s tax system further in favor of the state’s wealthiest and against low- and middle-income residents. However, the Senate bill introduced this week would provide a bigger windfall to the most affluent and produce an even bigger shift than the House plan. That is the major finding of an analysis done for Policy Matters Ohio by the Institute on Taxation and Economic Policy, a Washington, D.C.-based research group with a sophisticated model of the tax system.The top 1 percent of Ohioans, who made at least $388,000 last year, would receive half of the income-tax cuts under the Senate plan. This group on average would see an annual tax cut of $10,227, even with other tax increases in the plan. The middle fifth of taxpayers, who made between $37,000 and $58,000, would see an average cut of just $13. The bottom fifth of taxpayers, who made less than $20,000 last year, would see an average increase of $26.

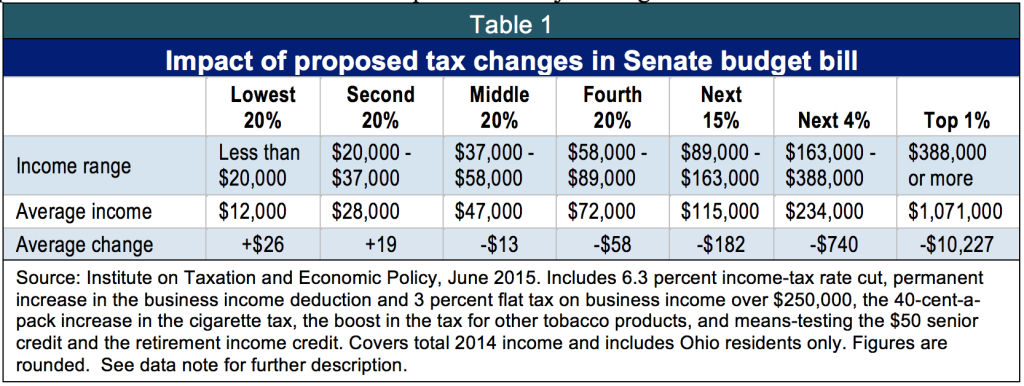

The Senate Finance Committee is considering the budget bill, including the tax changes, and the full Senate is expected to vote on it next week. A conference committee with representatives from both the House and Senate will then meet to hammer out a budget to send to Governor Kasich. Table 1 provides the breakdown of the overall impact of the major changes in the Senate bill:

The Senate plan boosts the gains for Ohio’s most affluent largely because it would go much further than the House plan in expanding an existing deduction for business income. Current law allows owners of businesses who pay individual income tax on their profits to deduct half of the first $250,000 in such income. The House would boost that permanently to 75 percent, the level that was temporarily in place just for 2014. The Senate would eliminate all such tax on the first $250,000 in business income, and reduce to a flat 3 percent the tax rate on any such income over $250,000. The Legislative Service Commission has estimated that this would cost $958 million over the two-year budget, compared to $270 million for the House plan.

Much of this gain would go to the most well-off Ohioans. Data from the Ohio Department of Taxation (ODT) show that just 22,675 Ohioans claimed deductions of at least $100,000 under existing law for 2014, or 6.2 percent of all those claiming the deduction.[1] Yet they claimed 41.9 percent of the total deductions, amounting to around $162 million, based on previous ODT estimates.

An even smaller number of business owners will be eligible for the new 3 percent flat rate. Yet they will include partners in big law firms and other substantial enterprises. In short, the expanded tax break, costing nearly $1 billion over the biennium, will not go just to owners of small business. In fact, the vast majority of small business owners will not benefit at all from the 3 percent flat rate in the expanded tax break, since their businesses don’t earn enough to qualify. Two years ago, the taxation department said more than 700,000 tax returns included business income that could be covered by the tax break. Many have not bothered to claim the deduction, and despite claims it would bolster the economy, Ohio’s job performance has not improved since the existing deduction was approved two years ago.[2]

Both the House and Senate discarded most of the tax increases that Gov. Kasich had proposed in order to support a 23 percent cut in income-tax rates.[3] However, the biggest element in both the House and Senate tax plans is a 6.3 percent across-the-board income-tax rate cut. This would cost more than $1.2 billion over the biennium. The Senate plan dropped a feature of the House version, and Gov. Kasich’s original proposal, that would limit the Social Security income-tax deduction to those with below $100,000 in annual income.[4] That would make the tax system fairer and is financially responsible, as it preserves revenue as the population ages. Its deletion in the Senate plan increases the gains for upper-income Ohioans.

The Senate plan also includes a 40-cent-a-pack increase in the cigarette tax and a comparable boost in the tax on other tobacco products. These increases are worthwhile because of the demonstrated improvement of higher tobacco taxes on public health. However, these tobacco-tax changes fall most heavily on the lowest-income Ohioans. Cigarette taxes are charged per unit, not based on price, and lower-income individuals are more likely to smoke.

Of course, only tobacco users will pay the added tobacco taxes. However, excluding the tobacco tax changes, the proposal remains highly rewarding to Ohio’s most affluent, while providing meager benefits most Ohioans. The bottom four-fifths of Ohio residents would receive just 15 percent of the tax cuts. Even those making between $58,000 and $89,000 would only receive an average annual benefit of $94.

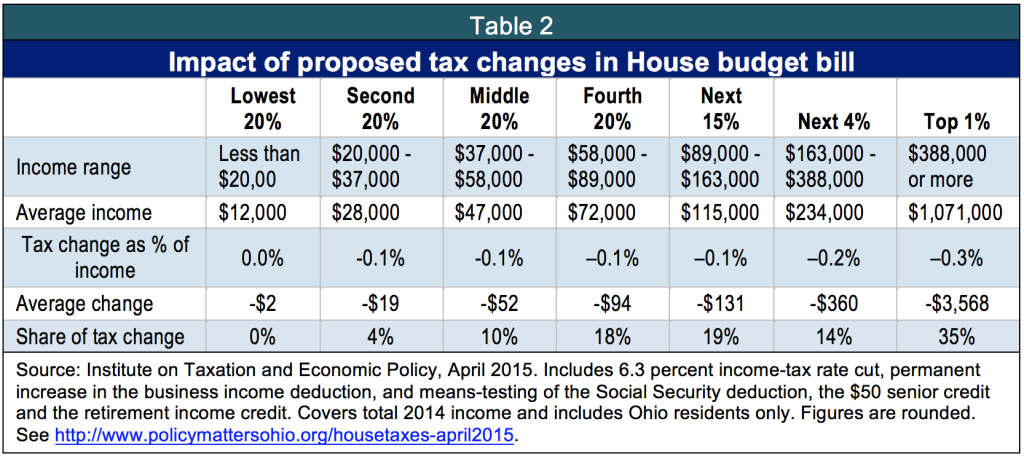

As noted above, the Senate plan shifts who pays taxes to lower- and middle-income Ohioans more than the House bill.[5] Table 2, based on an earlier analysis ITEP did of the House plan, breaks out how it would affect those in different income groups:

Overall, the Senate bill would increase the size of the total net tax cut to $1.7 billion over two years, considerably more than the $1.2 billion in the House plan.[6] Ohio can ill afford such tax cuts, which will go mostly to well-off Ohioans, when we have gaping needs. We need to restore aid to local governments far more than the amounts outlined in the Senate bill. We need to assist more families to pay for childcare, helping many to work. We have tens of thousands of vacant homes that need to be demolished or rehabilitated. Ohio’s support for public transit ranks below that of South Dakota and needs a substantial boost. Protective services for elders and children, never adequately funded by the state, will see ongoing loss through elimination of tax reimbursements to local levies. These are just a few of our unmet needs.[7]

Income-tax cuts flow heavily to the most affluent, further increasing inequality in Ohio. A separate ITEP analysis issued in January 2015 found that overall, nonelderly Ohioans in the top 1 percent pay considerably less of their income in state and local taxes than middle-class and poor Ohioans do.[8] Previous income-tax rate cuts have done little for our economy.[9] The House tax plan takes Ohio in the wrong direction, and the Senate plan goes even further. The Senate should not approve this plan.

Policy Matters Ohio is a nonprofit, nonpartisan state policy research institute with offices in Cleveland and Columbus. The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization based in Washington, D.C. that works on federal, state, and local tax policy issues. ITEP’s Microsimulation Tax Model allows it to measure the distributional consequences of federal and state tax laws and proposed changes in them, both nationally and on a state-by-state basis. We are grateful to the Saint Luke’s Foundation, the George Gund Foundation, the Ford Foundation, and the Center on Budget and Policy Priorities for funding that enables us to do this analysis.

[1] Email from Kristin K. Begg, Ohio Department of Taxation, June 3, 2015. Figures were as of that date; additional taxpayers could file claims later.

[2] Schiller, Zach and Wendy Patton, “Testimony to the Senate Finance committee on House Bill 64,” Policy Matters Ohio, June 9, 2015, p. 3, at http://www.policymattersohio.org/senate-testimony-june2015

[3] Senate leaders are still trying to negotiate an increase in the severance tax on oil and gas, which Gov. Kasich had proposed. However, House Speaker Cliff Rosenberger said the House would not pass a severance tax as part of the budget. See Jim Siegel, “Fracking Tax Won’t Be Part of Final Budget Deal, Ohio House Insists,” The Columbus Dispatch, June 11, 2015, at http://www.dispatch.com/content/stories/local/2015/06/11/house-insists-fracking-tax-wont-be-part-of-final-deal.html

[4] Both the House and Senate plans include Gov. Kasich’s proposal to limit four smaller retirement income or senior credits to those with below $100,000 in income.

[5] For details on the effects of Gov. Kasich’s original proposal, see Zach Schiller, “Kasich tax proposal would skew tax system even more in favor of Ohio’s affluent,” Policy Matters Ohio, Feb. 10, 2015, at http://www.policymattersohio.org/kasich-tax-proposal-feb2015

[6] The Senate bill also includes numerous other tax provisions. Many have an uncertain revenue effect, according to the Legislative Service Commission, or would not affect revenues significantly. Policy Matters Ohio will produce additional analysis on the tax proposals.

[7] For a partial list of Ohio’s needs, see Wendy Patton, “An Investment Budget for Ohio,” Policy Matters Ohio, March 18, 2015, at http://www.policymattersohio.org/invest-march2015

[8] Patton, Wendy, “Ohio State and Local Taxes Hit Poor and Middle Class the Hardest,” Policy Matters Ohio, Jan. 14, 2015, at http://www.policymattersohio.org/tax-report-jan2015

[9] Schiller, Zach, “Income-Tax Cuts: Bad Medicine for Ohio,” Policy Matters Ohio, March 3, 2015,at http://www.policymattersohio.org/income-tax-cuts-march2015 and Schiller and Patton, op.cit.

Tags

2015Revenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22