Patton testifies on school funding and tax policy

July 18, 2012

Patton testifies on school funding and tax policy

July 18, 2012

Download testimonyPress releaseA modern, fair state tax system is needed to generate revenue to support public education for Ohio’s families and children.

Testimony of Wendy Patton to the Extended Subcommittee on Primary and Secondary Education

Chairman Amstutz, Ranking Members Sykes and Lundy, I am Wendy Patton, senior project director for Policy Matters Ohio. Thank you for the opportunity to testify on the matter of tax policy and education today. When we asked your office, Chairman Amstutz, about the specific topic, we were told it was very open-ended, so today I speak broadly about tax policy in terms of raising adequate revenues for Ohio’s schools.

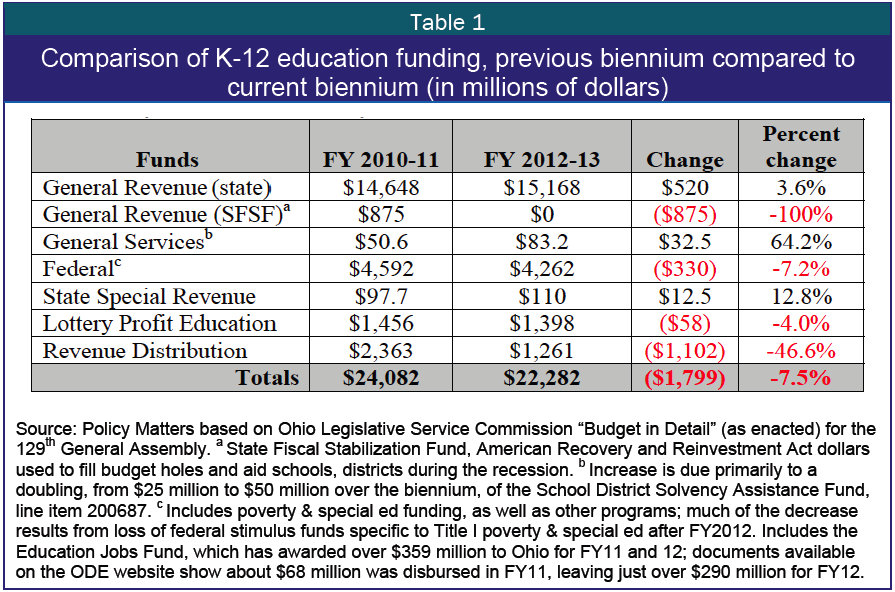

We start from an understanding that K-12 schools lost funding in the last biennial budget. Just to clarify, when we analyze state budgets, we compare the total appropriated amounts of the current budget, which covers two years, with the biennial appropriations of the prior budget, which covered two years. From that perspective, Ohio’s schools saw large losses in funding, outlined in Table 1, below, taken from our August 2011 report on the FY2012-13 budget.[1] They are attributable to a loss projected in HB 153 in lottery profits, tax reimbursements (Revenue Distribution) and federal stimulus funds.

Instead of imposing reductions of $1.8 billion dollars on primary and secondary schools, we wish the legislature had turned to tax policy instead. The tax overhaul of 2005 effectively removed $5 billion from state funding in the current biennium.[2] The tax cutting was to lead to an improved economy with expanded revenues for schools and other good things for residents and communities, but it hasn’t. Since the tax overhaul of 2005, Ohio has lost traction on a national scale, and now has a smaller share of the nation’s jobs than before. Restoration of some of those tax cuts could have mitigated the cuts in funding imposed on schools.

Policy Matters Ohio surveyed school business officials last fall about the fiscal condition of their districts. A quarter of the state’s districts responded. Two-thirds anticipated a budget shortfall in 2011-12. Thirty-eight percent forecast an increase in classroom size; 19 percent anticipated turning to pay-to-play strategies; 15 percent thought they would have to reduce course offerings. Unless we restore revenues, this becomes the “new normal.”

The state needs to have a robust, state-level tax system to support K-12 education. This means that the income tax needs to be maintained and strengthened. As the only major tax that is based on ability to pay, the income tax is a crucial element in our tax and budget system. It is forecast to account for 30 percent of revenue in the current General Revenue Fund budget.

Low- and middle-income Ohioans pay a larger share of their incomes in state and local taxes than do high-income Ohioans. According to the Institute on Taxation & Economic Policy, which has a sophisticated model of the tax system, middle-income Ohio taxpayers pay 11 percent of their income in such taxes, compared to just 7.8 percent for the top 1 percent, who earn at least $352,000. The bottom fifth of taxpayers pay 12 percent.[3] This disparity becomes even larger once you include the ability of taxpayers to deduct state income tax on federal tax returns. The income tax is the only major tax that keeps our state and local tax system from being even more unfairly weighted against low- and middle-income taxpayers. It also is an important source of revenue for the state to repay its debt and remain within the 5 percent debt cap.

The income tax should be bolstered by raising rates at the top. By reinstating the 7.5 percent rate on income over $250,000 and instituting an 8.5 percent rate on income over $500,000, Ohio would generate about $650 million a year. Some of this could be used to restore a significant share of the K-12 education cuts in the current budget while not affecting tax rates for nearly 99 percent of Ohioans.

Some argue that the income tax drives rich people out of Ohio. However, upper-income taxpayers are more likely to live in states with income taxes than average taxpayers are.[4] Recent research has shown that state income taxes are not a primary driving force in interstate migration decisions.[5] And states without income taxes don’t perform any better on a number of key measures of economic performance, such as median household income growth, than those with the highest top income-tax rates; in fact, they often do worse.[6] Ohio’s income tax should be protected and bolstered to ensure that we have the state funds needed to adequately support our K-12 education system.

Regional economies change and the tax system needs to adapt. Ohio’s severance taxes on oil reflect an industry that peaked a century ago; the rates on oil and gas are very low. But new drilling technologies promise new production. The Governor has proposed modernizing taxes for oil and gas produced through fracking, and we support that. We’d like to see higher rates – 5 percent on all production. We’d like to see a permanent fund for local impacts and risk management - a 2.5 percent fee. We do not agree with the governor’s proposal to use the severance tax for an income tax cut. Severance tax revenues need to be used to restore services and to mitigate local impacts. Natural resource economies around the world emphasize the importance of schools to build opportunity for after the resources are depleted. Ohio is no different. The severance tax should be used not for an income tax cut, but to fund critical public services like schools.

Besides these measures, we should regularly review the $7 billion in annual exemptions, credits and deductions in our tax code. Committees in both houses have heard testimony on tax expenditures, and a specific review should eliminate unneeded tax breaks and generate added revenue. In addition, we need to strengthen our system of business taxation, which has resulted in a greater share of overall taxes being paid by individuals compared to businesses over the past generation. Ohio legislators also should support the enactment by Congress of legislation to require online retailers to collect sales tax.

A modern, fair state tax system is needed to generate revenue to support public education for Ohio’s families and children.

[1] Patton, Wendy. “We need a better business plan: An assessment of Ohio’s new biennial budget,” August 1, 2011, at policymattersohio.org/we-deserve-a-better-business-plan-an-assessment-of-ohios-new-budget.

[2] Testimony of Deputy Tax Commissioner Fredrick Church, “Understanding the Commercial Activity Tax in the context of the 2005 tax reform,” Legislative Study Committee on Ohio’s Tax Structure, August 24, 2011.

[3] ITEP’s analysis covers non-elderly taxpayers and is based on 2007 income levels and 2009 tax laws.

[4] In 2008, 19.0 percent of taxpayers with income of more than $200,000 lived in states without a personal income tax, compared to 20.0 percent of all taxpayers. Internal Revenue Service Statistics of Income, calculations by the Institute on Taxation and Economic Policy.

[5] Bruce, Donald and William Fox, “Revenue Options for Ohio’s Future,” Report prepared for The Education Tax Policy Institute, Columbus, Ohio, Feb. 22, 2011, p. 66. Available at http://bit.ly/xgrBVj. See also Tannenwald, Robert, Jon Shure and Nicholas Johnson, “Tax Flight is a Myth: Higher State Taxes Bring More Revenue, Not More Migration,” Center on Budget and Policy Priorities, Aug. 4, 2011, available at http://www.cbpp.org/cms/index.cfm?fa=view&id=3556

[6] Institute on Taxation and Economic Policy, ““High Rate” Income Tax States Are Outperforming No-Tax States,” February, 2012. Available at http://www.itepnet.org/pdf/junkeconomics.pdf .

Tags

2012Revenue & BudgetTax ExpendituresTax PolicyWendy PattonPhoto Gallery

1 of 22