Severance Tax Changes Don’t Meet Ohio’s Needs

June 17, 2014

Severance Tax Changes Don’t Meet Ohio’s Needs

June 17, 2014

Fracking costs local communities big, and HB 375 severance taxes are too small; to allay public expenses, implement a five percent plus severance tax on the value of all oil and gas drilled, close the loopholes, add a 2.5% fee for community redevelopment and a backstop against possible environmental damage.

Download summary (1pg)Download report (8pp)Press release

New oil and gas drilling has prompted legislators and others to propose modernizing Ohio’s oil and gas severance tax laws. The current, volume-based severance tax is too low to cover costs to the state and impacted communities. House Bill (HB) 375, the severance tax proposal currently under consideration in the General Assembly, was initially described by Governor Kasich as ‘puny.’[1] As passed by the House of Representatives in May of 2014, the description remains accurate.

HB 375 would retain the volume-based structure of the current severance tax on conventional, vertical wells, but would cut the rates in half. Production of horizontal, fracked wells would be taxed in a different way, on value rather than on volume, which might result in more revenue than current law, but might result in less, depending on production and market changes. Local government would get 17.5 percent of revenues, but the rate is so low and the base so riddled by deductions there may be little for local needs. Most of the severance tax under HB 375 is supposed to fund income tax cuts, but even under the highest production estimate, tax cuts would be worth perhaps $10 per year for average to middle-income Ohioans. House Bill 375 does too little to help Ohio, its communities and its people to see benefits from fracking.

House Bill 375 compared with current law

House Bill 375 as passed by the House repeals the current, volume-based severance tax on oil and natural gas on horizontal (fracked) wells and replaces it with a new form of the tax, based on the value of the product severed from the ground. The severance tax rate is to be 2.5 percent of value.

Conventional (vertical) wells continue to pay the old volume-based tax, but the rate they pay is cut in half, to a dime a barrel and a cent-and-a-half per thousand cubic feet of natural gas.

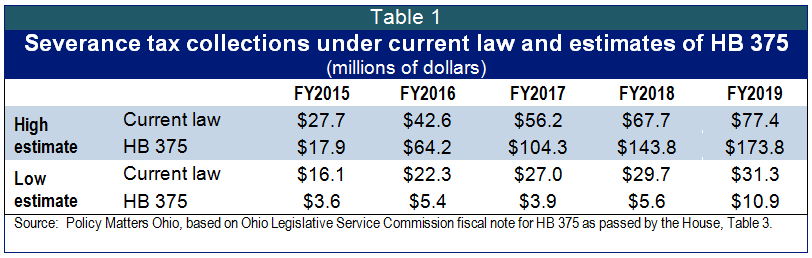

We compare total collections under HB 375 with current collections in Table 1. The new law could collect $96.4 million more (“high scenario”) or $20.4 million less (“low scenario”) than the current law, depending on production, as estimated by the Legislative Service Commission.

Sources and uses of funds under HB 375 are shown in Table 2. Today, all oil and gas severance tax collections are used by the Ohio Department of Natural Resources (ODNR) for industry oversight, regulation and services (like geological mapping and plugging of abandoned wells). Under HB 375, there will be three uses: for current services in ODNR, for local governments impacted by external costs of drilling, and for income tax cuts. Funds would be provided first to ODNR, with a cap at $21 million. Beyond that, impacted local governments would receive 17.5 percent of revenues. The state’s Income Tax Reduction Fund would get the rest.

At present, all severance tax collections are distributed to ODNR. Under HB 375, distributions to ODNR would be capped at $21 million a year. The difference between the current use of Ohio’s severance tax revenues and funding for ODNR in HB 375 is illustrated in Figure 1.

Under HB 375, ODNR gets less funding than under current law, as funds are distributed to new uses.

Small Change

Rural communities with new oil and gas drilling need up-front capital for infrastructure, like widened roads with turning lanes or larger water and sewer capacity to accommodate new business developing to meet industry demands. New business might include processing plants, grocery stores, accounting firms or gas stations. Over time, this is what turns a boom into economic development. While HB 375 provides funding for local governments, there will not be enough within the next five years to accommodate the level of infrastructure needed.

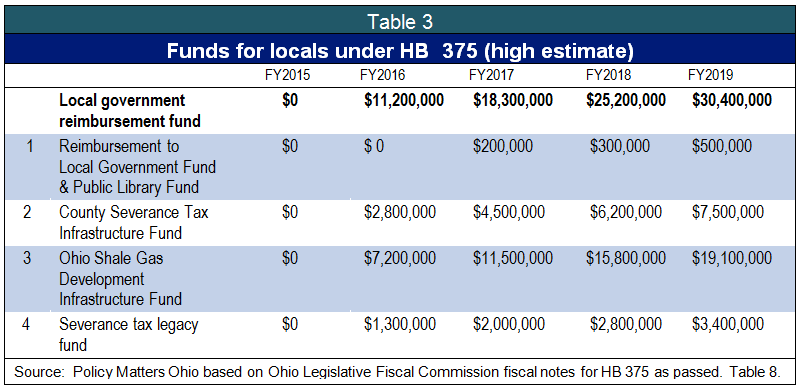

Table 3 shows projected distributions to local governments under HB 375. In the bill as passed by the House, 17.5 percent of proceeds go to local governments. Of that, 25 percent goes to county infrastructure funds, 63.8 percent to a state shale development infrastructure fund, and 11.3 percent to a legacy fund, for use after 2025. Under the low scenario, there are no funds for local government because all revenue is needed for ODNR. Under the high scenario, funds will be available for local uses. The Legislative Service Commission estimate of these uses is shown in Table 3.

If production matches the high estimates, funding for local governments under HB 375 could rise to $30.4 million by fiscal year (FY) 2019, the fifth year of collections. The legacy fund could see $9.5 million of cumulative savings by FY2019. Six years later, the legacy fund will be available for long-term redevelopment of the impacted region. This is a good idea, and many major oil and gas producing states set up ‘permanent’ funds that use interest earnings and a small share of the fund itself to build opportunity for long-term growth: college scholarships, enhanced funding for K-12 or other forms of education and long-term economic development strategies. The growth of savings projected here, however, is very low. The legacy fund will be too small to foster long-term benefits.

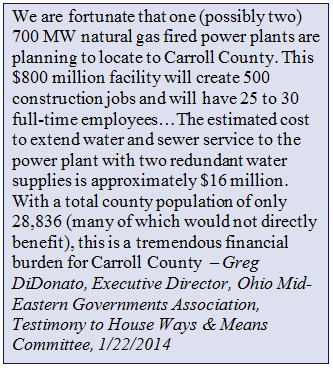

On January 22, 2014, local officials from eastern Ohio described the infrastructure needs of their communities in testimony presented to the House Ways and Means committee.[2] They described specific infrastructure needs of more than $170 million dollars for roads, bridges and water and sewer treatment plants necessary to allow new development in their communities. Yet in the first five years, total funds to local governments under the highest estimate for HB 375 could provide about half of the infrastructure needs described by those who testified. This was representative, but not a complete list; not all local governments in the region spoke – and, it is a snapshot of the present, in the context of a rapidly expanding industry.

On January 22, 2014, local officials from eastern Ohio described the infrastructure needs of their communities in testimony presented to the House Ways and Means committee.[2] They described specific infrastructure needs of more than $170 million dollars for roads, bridges and water and sewer treatment plants necessary to allow new development in their communities. Yet in the first five years, total funds to local governments under the highest estimate for HB 375 could provide about half of the infrastructure needs described by those who testified. This was representative, but not a complete list; not all local governments in the region spoke – and, it is a snapshot of the present, in the context of a rapidly expanding industry.

Further, no funds are provided for the social service needs described in testimony to the House Ways and Means Committee on May 6, 2014. Counties with drilling are strained by a rise in homelessness, drug abuse and other social problems as out-of-state workers flood some areas, driving up rents and bringing some problematic behaviors.[3] House Bill 375 does not provide any funds to address these problems.

The costs associated with horizontal drilling (fracking) are higher than commonly thought and come with costs to safety, the environment and the community. A well-structured, adequate severance tax is how a region captures the benefits of natural resource extraction. [4] Without a well-structured tax, the state and communities can be shortchanged.

Tax cuts, deductions and exemptions in HB 375

Distributions to local government are small under HB 375 because the rate is low and because the base allows many deductions, further reducing collections. In addition, those paying the severance tax get tax credits and exemptions in other Ohio taxes. Tax breaks like this are referred to as tax ‘expenditures,’ because they have the same effect as spending: they reduce funds available for other public uses.

For example, HB 375’s tax exclusions to the Commercial Activity Tax (CAT) and tax credits to the Personal Income Tax may cost the state up to $19.3 million by FY 2019, the fifth year of collections, according to the Legislative Service Commission.[5] No revenues from the severance tax itself are provided to reimburse the General Revenue Fund. Tax cuts and other tax expenditures in HB 375 are listed below,

Regulatory Cost Recovery Assessment repealed

In 2010, a “Regulatory Cost Recovery Assessment,” was added to the oil and gas severance tax for industry oversight, regulation and services. It had the effect of doubling the severance tax from $.10 to $.20 per barrel of oil, and it added $.005 to the severance tax of $.025 per thousand cubic feet of natural gas. The Regulatory Cost Recovery Assessment is repealed in HB 375. The repeal of the Cost Recovery Assessment brings the rate down to $.10 per barrel of oil and $.025 per thousand cubic feet of natural gas.

Vertical wells (not fracked) see severance tax rate cut in half

House Bill 375 cuts in half the severance tax on traditional (vertical) wells, primarily through the repeal of the Regulatory Cost Recovery Assessment. In addition, the actual severance tax rate on natural gas from vertical wells is reduced by an additional penny per thousand cubic feet (MCF).

The new rates of severance tax on vertical wells are $.10 per barrel of oil and $.015 per MCF of natural gas.

Tax holiday exempts first $10 million - after royalties are deducted.

The first $10 million in earnings (“wellhead gross receipts”) from horizontal (fracked) wells are exempted from the severance tax. The exemption starts after royalty payments are deducted. The Legislative Service Commission assumes 15% of wellhead gross receipts are paid as royalties, so the $10 million exemption of wellhead gross receipts is equivalent to an $11.76 million exemption for wellhead gross receipts.[6] The time period during which this exemption may be taken is unlimited.

This type of exemption is sometimes referred to as a “tax holiday.” Used over the past two decades when horizontal drilling was a new technique, the tax holiday allowed the driller to recover the cost of capital investment. A tax holiday is given in HB 375 even though horizontal drilling and well stimulation are no longer new, but are the way oil and gas are extracted from shale formations, which is driving the new burst of oil and gas industry activity in Ohio.

Deductions from the tax base for fracked wells

The 2.5 percent severance tax proposed under HB 375 would be levied on the value of gross receipts of oil or gas at the first sale, when ownership or title of the product first changes hands. Deductions are allowed, including fees paid or costs incurred or accrued for processing, gathering, transporting, fractionating, stabilizing, compressing, dehydrating, shrinkage, brokering, delivering, and market access for such oil and gas. The definitions also specify what may not be deducted, including: fees paid or costs incurred or accrued for oil and gas lease acquisitions, geophysical and geologic services, well site preparation, well drilling, well completion services, related tangible or intangible drilling costs, natural gas storage services, general merchandising, and lease operating costs for the production of oil and gas at the wellhead. Deductions may be taken by either the severer or an affiliate.[7]

Commercial activity tax exclusion

Whether organized as a “C-corporation” or a pass through entity (PTE), owners of horizontal wells have options to avoid tax liability related to the Commercial Activity Tax (CAT), Ohio’s basic business tax. Those who pay both the severance tax and the personal income tax (i.e. a “PTE”) are exempted from paying the CAT. The C-corporation may also reduce or avoid CAT liability by using whatever it pays in CAT as a credit against the severance tax it pays.

Personal income tax credit for royalty owners and PTE’s

The bill authorizes a taxpayer directly holding a royalty interest in a well that is producing oil or gas to claim a nonrefundable tax credit against the personal income tax. The value of the credit equals the amount of oil and gas severance tax paid, multiplied by the lesser of 12.5% or the proportion of oil and gas severance tax by which the taxpayer's royalty payments are reduced or for which the taxpayer is contractually required to pay the well owner. Taxpayers with ownership or a pass-through entity that has a royalty interest may also claim the credit.

Tax breaks reduce collections of HB 375

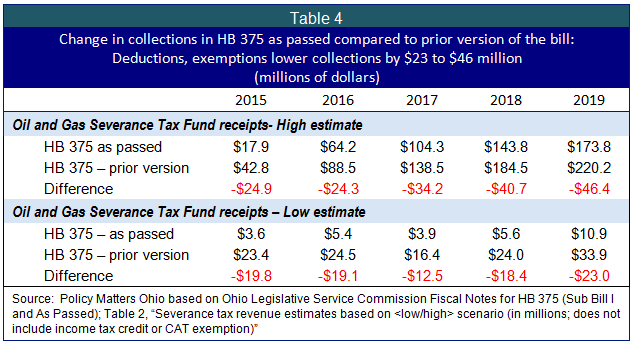

House Bill 375 as passed by the House had several policy changes relative to the prior version heard by the House Ways and Means Committee. Many of these changes created new deductions and exemptions, reducing projected collections in the version of the bill as passed by $23 million to $46 million compared to the first substitute bill (Table 4).[8]

HB 375 as passed collects less by FY 2019 than the prior version primarily because of the increase in the tax holiday, the deduction of royalties prior to the tax holiday (which boosts the value of the tax holiday by 17.5 percent) and the deductions allowed from the base before the first sale of the product.[9]

Administration of House Bill 375

The Ohio Department of Taxation estimates administration of the tax structure in HB 375 could cost up to $2 million.[10] Deductions may be accounted for by the severer or an affiliate. Tax credits may be taken by an owner, or by the owner of an entity with a royalty interest. Tax returns do not have to include documentation of severance tax paid, although the Ohio Department of Taxation could request reports. If a return is challenged, internal transactions or regional transactions are considered before a posted price may be used as a benchmark. Verifying the base and taxes owed and paid could become administratively complex.

Conclusions

House Bill 375 as passed by the house is too small, the rate too low and the base too eroded by tax breaks and deductions to provide a fair share of the value of Ohio’s oil and gas for the people of the state and communities impacted by the growth of the industry.

Recommendations:

- Subject all oil and gas extracted in Ohio to a single severance tax, based on value as defined by the Kasich Administration in HB 472, but with no deductions or exemptions from the base.

- Make the rate of the severance tax no less than 5 percent on the value of the oil and gas severed from the ground.

- Add a 2.5 percent fee to finance a permanent fund for long-term redevelopment of impacted communities and to provide a backstop in case of environmental disaster, which may take an up-front state response (the industry must pay for environmental damage, but up-front costs fall to the public sector).

- Grant no tax holidays for cost recovery. Horizontal drilling is the way drilling is done in shale formations. This is no longer a high-cost, experimental technique.

- Do not exclude this industry from the Commercial Activity Tax (CAT), the basic business tax in Ohio. There is no precedent for granting the oil and gas industry this special benefit. The oil and gas industry has been subject to and compliant with the CAT (and the corporate franchise tax before it) while it also paid the existing severance tax.

- Narrowly target and create a sunset date for any tax credits for homeowners or farmers. This will encourage re-negotiation of leases to eliminate severance tax liability of the lessor. The need for the exemption will cease with better lease terms.

- Designate 25 percent of funds to local government, to defray external costs of drilling.

- Include funding for communities without wells, but affected by impact of the oil and gas industry in terms of wear and tear on roads and bridges from trucks and traffic; soaring costs of housing, police, medical and other emergency response; construction of pipelines and costs and impacts associated with disposal of fracking fluids and other waste.

- Do not use funds for income tax cuts. The size of possible tax cuts to the average family is negligible. Ohio needs investment to assist impacted communities, make college affordable, restore local government funding and rebuild schools.

[1] Joe Vardon and Jim Siegel, “Kasich threatens to veto ‘puny’ fracking tax bill,” The Columbus Dispatch, January 31, 2014 at http://www.dispatch.com/content/stories/local/2014/01/30/kasich-threatens-to-veto-fracking-bill.html

[2] Testimony to the 130th Ohio General Assembly’s House Ways and Means Committee January 22, 2014 at http://www.ohiohouse.gov/committee/ways-and-means

[3] See testimony in 130th Ohio General Assembly House Ways & Means Committee, May 7, 2014 at http://www.ohiohouse.gov/committee/ways-and-means

[4] Amanda Woodrum, “Fracking in Carroll County, Ohio: An Impact Assessment, Policy Matters Ohio, April 2014 at http://www.policymattersohio.org/fracking-apr2014

[5] Legislative Service Commission, fiscal note on HB 375 as passed by the House (Table 6. Potential GRF impact of PIT credit and CAT exclusion (in millions) , May 23, 3014 at http://www.lsc.state.oh.us/fiscal/fiscalnotes/130ga/hb0375hp.pdf

[6] Emailed communication from Russ Keller of the Ohio Legislative Service Commission, May 19, 2014.

[7] There is some speculation that this mirrors the more specific provisions of the Texas statute for natural gas. The Texas provisions for natural gas have some elements of greater specificity. Further, a century of case law has honed definitions. http://www.statutes.legis.state.tx.us/Docs/TX/htm/TX.201.htm http://www.statutes.legis.state.tx.us/Docs/TX/htm/TX.202.htm

[8] Legislative Service Commission, First Fiscal Note on HB 375 of February 19, 2014.

[9] E-mailed communication from Russ Keller of the Ohio Legislative Service Commission, May 19, 2014.

[10] LSC Fiscal note (“as passed”)

Tags

2014EnergyFrackingRevenue & BudgetSeverance TaxTax PolicyWendy PattonPhoto Gallery

1 of 22