State of Ohio Tax policy

January 31, 2013

State of Ohio Tax policy

January 31, 2013

Ohio’s state tax system, like those of most states, depends heavily on two major taxes: the personal income tax, and the sales and use tax. These two taxes together account for well over four-fifths of the state’s General Revenue Fund tax revenue.[64]

The income tax – the only major tax based on the ability to pay, and the single largest source of state revenue – needs bolstering. If Ohio is to pay for the education and health care that will produce the workforce of the future, or any of the services that underpin a good quality of life and a strong safety net, it needs a strong income tax.[65] Unfortunately, however, this tax has been weakened over the past decade, and is about to experience another attack. Gov. Kasich has made clear that he intends to propose a major reduction in the income tax under the illusion that this will help Ohio’s economy.

We have seen already what such cuts will do. Since June 2005, when a 21 percent phased-in cut in the income tax was approved, Ohio’s economy has seriously underperformed the nation’s. The number of jobs has fallen by nearly 230,000 or a loss of 4.2 percent, compared to a national gain of 414,000, or 0.3 percent. Ohio’s personal income has shrunk compared to the national average. Relative gains in Ohio over the past year or so have not erased the overall pattern – and this is no surprise. Since state tax cuts must be matched by spending reductions that cost jobs and economic growth, it’s unrealistic to expect that they will produce major economic gains.[66]

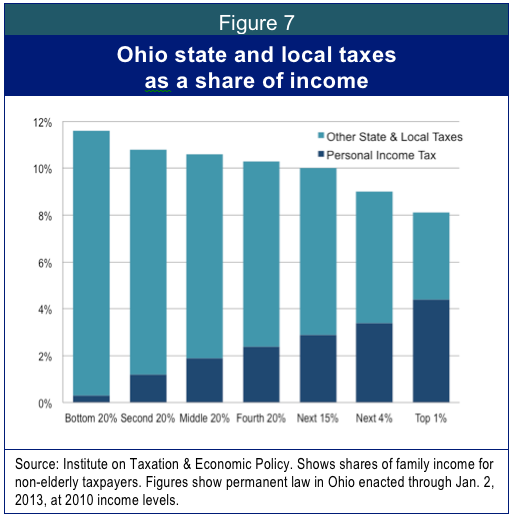

The last income-tax cut on average provided a tax reduction of more than $9,500 a year for the top one percent of Ohioans with income over $308,000 in 2011, while providing just $181 to the middle fifth of taxpayers earning between $32,000 and $49,000 and a mere $19 to the bottom fifth of income earners.[67] The same distribution can be expected of other proposed cuts. Even with the income tax, the state and local tax system is slanted against low- and middle-income Ohioans, who pay a larger share of their income than do more affluent Ohioans. Figure 7 shows how much Ohioans of different income levels pay in state and local taxes as a share of their income, and how the income tax contributes to a fairer tax system.

The share of state and local taxes paid by Ohio businesses compared to that paid by individuals has shrunk over the last generation.[68] Ohio is now one of only six states in the country without a tax on corporate profits. Instead, we have a Commercial Activity Tax (CAT) on “gross receipts,” or what businesses located anywhere sell in Ohio. This tax replaced two others: our corporate income tax, and a local tax on machinery, equipment, inventory and other tangible property. The CAT is a broader tax than those it replaced, covering most industries and different forms of business organizations. Critically, however, it was designed to bring in far less revenue than the taxes it replaced – and that indeed is what it has done.[69] Overall, the state is losing about $2.5 billion a year in revenue from this change, the income-tax cuts and other elements of the tax overhaul of 2005.[70]

Recent tax policy

While the last two years have not seen an overhaul approaching the one approved in 2005, Ohio’s tax system has undergone other major changes recently. Overall, the trend has been for tax cuts, a continuation of the trend reducing taxes on the most affluent, and more exemptions and credits.

In January 2011, the last of five increments of the 2005 personal income-tax cuts took effect as scheduled, a cut that went largely to Ohio’s most affluent residents, while costing the state $400 million a year in revenue.

Later that year, the General Assembly repealed the estate tax, which in FY 2012 produced $302.1 million for local governments, in addition to the $72.1 million that went to the state’s General Revenue Fund.[71] The loss of this revenue comes on top of huge reductions local governments already have seen in state aid. [72]

Since just 8 percent of Ohio estates have had to pay the estate tax, the repeal will only benefit a tiny share of Ohioans. Cities such as Cincinnati, which received an average of $15 million a year from the estate tax between 2005 and 2010, will have to cut services or find other sources of revenue.[73]

New tax breaks have proliferated over the past two years. One of the largest was a new personal income-tax credit worth $100 million over two years on investments in “small business enterprises” that was dropped into the last budget in conference committee without public review. Other new tax breaks range from a tax credit for companies with home-based employees to a sales-tax exemption for builders of enclosures for captive deer (dubbed ‘the Bambi exemption’ by one Statehouse observer).[74] Despite hearings in both houses, legislation introduced by Republicans and Democrats, approval of a review mechanism in the Senate version of the last budget, and calls for review from the business community and policy groups from all sides of the political spectrum, Ohio has not moved forward to publicly review the exemptions and credits that litter the state tax code.

A new bank tax approved by the General Assembly last month closes some major loopholes in the old, ungainly tax structure, but ill-advisedly passes the revenue gains from cutting such tax avoidance right back to the banks.[75] This includes a special low rate for big banks, many of which have engaged in the tax avoidance the bill was designed to prevent. The legislature also reduced the revenue the tax would generate, when the industry should be paying more in line with its share of the economy.[76] Further, legislators added in exemptions to the new tax. In short, what could have been a major improvement in the tax system was badly misdirected.

State and localities have begun receiving proceeds of casino taxes and those paid by racetrack owners who operate video lottery terminals. However, casino taxes are producing less revenue than originally projected – and don’t come close to making up for the cuts that local governments experienced in the current budget.[77]

One of the biggest developments in Ohio taxes is one that didn’t happen: The General Assembly refused to approve Gov. Kasich’s proposal to boost the severance tax on oil and gas and use the proceeds for an income-tax cut (one that on average would have provided $42 for middle-income taxpayers, less than the cost of a tank of gas). However, a new form of that is likely to resurface shortly.

Oil and gas severance tax

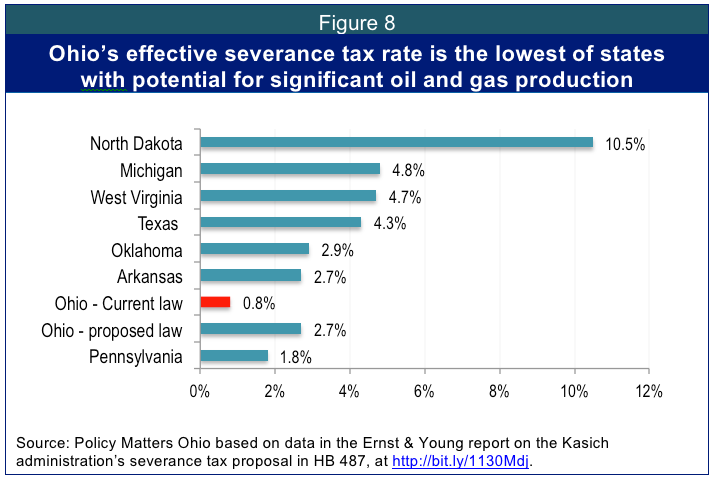

Ernst & Young’s analysis of the Kasich Administration’s severance tax proposal found the effective rate of Ohio’s current severance tax lowest of all states with major production potential through hydrofracturing techniques.[78] The severance tax proposal of the Kasich administration last year would still have left Ohio near the bottom of the rankings. (Figure 8)

Based on the administration’s projections last spring, the governor’s proposal could bring in as much as a billion dollars in revenues over four years. However, a higher rate than the 4 percent he proposed would be similar to the rates in North Dakota, West Virginia and Texas, all of which have thriving oil and gas industries. A 5 percent tax on oil and all forms of natural gas (liquid or dry), without the loopholes built into the governor’s proposal, could raise up to $1.8 billion over four years. At 7.5 percent on all production out of the well, with no loopholes, up to $2.7 billion could be raised.[79]

This is not enough to restore local funding for health and human service levies, school districts or communities. But it is a start, and it is important, for fairness and stability, that businesses pay their fair share of taxes. Long-term impacts of new drilling techniques – hydraulic fracturing – in Ohio’s particular geology, and in populated and agricultural areas, are not yet well proven. An adequate severance tax is needed to fund a sufficient risk management strategy to address unknown, long-term effects on health, the environment, and property.

The Governor originally proposed using severance tax revenues for an income tax cut. Based on analysis of last year’s proposal, such a tax cut might bring a family earning median income $42 annually, but top earners might see more than two thousand.[80] Trading severance-tax revenues for personal-income tax revenues is a bad idea because of Ohio’s needs, some of which are enumerated above. We can ill-afford to use new revenues for a tax cut that will go largely to the most well-off Ohioans.

Tax expenditures

Governor Kasich has indicated that he will propose certain reductions in tax expenditures (exemptions, credits and deductions) in the tax code to pay for an income-tax cut. Tax expenditures indeed need a careful review. According to the state’s last tax expenditure report, 128 such tax expenditures are costing more than $7 billion a year.[81] While some of these are productive, others are special-interest giveaways. This includes the sales-tax exemption for pollution-control equipment that is mandated, the sales-tax cap for purchases of time-shares in jet aircraft, the write-off that big companies that lost money years ago can take against the Commercial Activity Tax, and numerous others.[82] Reviewing and eliminating non-productive tax loopholes is a good policy goal, but pairing this with erosion of the income tax code is not.

Ohio is sometimes mistakenly portrayed as a high-tax state. That is incorrect. Altogether, state and local taxes per capita in Ohio amounted to $3,762 in Fiscal Year 2010, less than the national average of $4,105. Such taxes amounted to 10.8 percent of personal income, compared to the national average of 10.7 percent.[83] Tax levels are fairly similar across most states.

While General Revenue Fund tax revenues are increasing to what is projected to be a new high in the current fiscal year, much of this increase has reflected the seizure of funds that had previously gone to schools, local governments and libraries. As noted earlier, calculations by Howard Fleeter for the Education Tax Policy Institute demonstrate that state tax revenue even now has not fully made up the reductions from the 2005 tax cuts and the economic downturn. Moreover, these numbers do not adjust for inflation, so real state tax revenue remains well below what it was in 2006. Ohio needs more tax revenue to pay for public services. We cannot be a successful state when schools are slicing courses and teachers, streetlights are being dimmed, parks aren’t being repaired, and mental health services are provided only to those in crisis situations, as is now true in Washington County, to cite one example.[84] We need to keep police on the beat, firehouses open, and teachers in the classroom.

Further, we need to see more equity in our overall state tax system. The lowest-income Ohioans pay a larger share of their income in state and local taxes than the most affluent. Twenty-four states have a mechanism to equalize this kind of inequity – a state-level earned income tax credit.

The federal Earned Income Tax Credit (EITC) is the nation’s largest poverty relief program for working families. Created by President Gerald Ford in 1975 and expanded under every presidential administration since, the EITC is lauded for its direct impact in lifting families with children above the poverty line, making work pay, and sending federal dollars to local communities. A modest Ohio EITC program, set at 10 percent of the federal credit, would provide the average recipient $221 and would cost the state $210 million per year. A slightly more generous credit, set at 20 percent of the federal credit as in many states, would cost about $420 million per year and would provide families with an average of $442 annually.

A state EITC program enables families to work and build assets while reducing the impact of regressive income tax changes. A state EITC makes sense because recent changes to the personal income tax have provided greater tax reductions for higher-income earners than they have for lower- and middle-income families.

Most Ohioans, those of middle and low incomes, have seen wage stagnation, reduced services and little tax reduction. But Ohio’s highest earners have seen their real income increase and their state taxes drop substantially. Given the deepening fiscal crisis in schools, local governments and local human services, top earners should pay more to restore adequacy, fairness and efficiency to Ohio’s tax structure. So should businesses, which benefited significantly from the 2005 tax overhaul. Ohio should review all tax expenditures, sunset those that are not productive, and eliminate wasteful exemptions. Oil and gas companies that will extract a one-time resource from Ohio should pay what they do in other states, instead of the pittance they do now.[85] General business taxes should be readjusted so that companies pay a larger share of the tax load, as they did decades ago when Ohio’s economy was stronger than it is today. In short, Ohio needs to revamp its tax system to provide adequate revenues for the services Ohio’s people need.

Other sections:Executive summaryIntroductionBudget baselinePrivatizationLocal governmentK-12 educationHigher educationHealth and human servicesWorkforce and trainingSummary and recommendations

[64] Of course, the property tax is a major source of revenue at the local level.

[65] For more detail on the income tax, see Zach Schiller, “Ohio Needs a Strong Income Tax,” Policy Matters Ohio, March 2012, at www.policymattersohio.org/strong-income-tax-feb2012.

[66] Fisher, Peter, with Greg LeRoy and Phil Mattera. “Selling Snake Oil to the States: the American Legislative Exchange Council’s Flawed Prescriptions for Prosperity.” A joint publication of Good Jobs First and the Iowa Policy Project, November 2012, Chapter 3, available at www.goodjobsfirst.org/snakeoiltothestates.

[67] Institute on Taxation and Economic Policy, Ohio Income Tax Analysis, Ohio residents, 2011 income levels, Aug. 2012.

[68] Schiller, Zach, “Business Tax Revamp: A Deficit in the Making,” Policy Matters Ohio, January 2009, at www.policymattersohio.org/business-tax-revamp-a-deficit-in-the-making

[69] Ibid

[70] Church, Frederick, “Understanding the Commercial Activity Tax in the Context of the 2005 Tax Reform Package,” Testimony to the Legislative Study Committee on Ohio’s Tax Structure, Aug. 24, 2011, p. 21

[71] Ohio Department of Taxation, “2011 Brief Summary of Ohio’s Taxes,” p. 33, available at http://1.usa.gov/127dv3A.

[72]Patton, Wendy, and Tim Krueger, “Intensifying Impact: State Budget Cuts Deepen Pain for Ohio Communities,” Policy Matters Ohio, November 2012, available at www.policymattersohio.org/county-budgets-nov2012.

[73] Ohio Dept. of Taxation, Tax Data Series, Estate Tax, at ww.tax.ohio.gov/government/distribution_estate_tax.aspx.

[74] See “New Tax Breaks in the Ohio State Budget,” Policy Matters Ohio, July 2011, at http://bit.ly/OJwPtF and “Multiplying Ohio Tax Breaks: Exemptions grow even as talk increases of reining them in,” Policy Matters Ohio, Aug. 2012, at www.policymattersohio.org/tax-breaks-aug2012.

[75] Schiller, Zach, “The Bank Tax Shuffle: House Weakens HB 510, Adds Exemptions,” Policy Matters Ohio, June 2012, at www.policymattersohio.org/bank-tax-jun2012.

[76] See Schiller, Zach, “Bank tax cuts loopholes, reduces rates: Proposal also provides unneeded help to big banks,” Policy Matters Ohio, April 2012, at www.policymattersohio.org/bank-tax-april2012.

[77] Schiller, Zach, et.al, “No Windfall: Casino taxes won’t make up cuts to local governments,” (p.6), Policy Matters Ohio, October 2012 at www.policymattersohio.org/casino-taxes-oct2012.

[78] Ernst & Young, “Analysis of Ohio Severance Tax Provisions of H.B. 487,” Prepared for the Ohio Business Roundtable, May 15, 2012 at http://bit.ly/1130Mdj.

[79] Patton, Wendy, “Taxing Fracking: Proposals for Ohio’s severance tax,” May 2012, online at http://bit.ly/M0HXEu.

[80] Schiller, Zach, “Income tax cut would favor the affluent: Middle-class Ohioans wouldn’t get enough for a tank of gas,” Policy Matters Ohio, March 2012 at www.policymattersohio.org/tax-cut-impact-march2012.

[81] State of Ohio, The Executive Budget, Fiscal Years 2012 and 2013, Book Two: The Tax Expenditure Report, Prepared by the Ohio Department of Taxation, Joe Testa, Tax Commissioner, at http://1.usa.gov/14siRG0.

[82] See Schiller, Zach, “$7 Billion in Tax Breaks and Nobody’s Watching,” Policy Matters Ohio, March 2011, available at www.policymattersohio.org/7-billion-in-ohio-tax-breaks-and-nobody%e2%80%99s-watching.

[83] Federation of Tax Administrators, State and Local Tax Burdens, at http://www.taxadmin.org/fta/rate/10stl_pi.html.

[84] Bevins, Evan, “Ohio report outlines impact of budget cuts,” The Marietta Times, Dec. 25, 2012, available at http://bit.ly/XPKUc5.

[85] Patton, Wendy, “Taxing Fracking: Proposals for Ohio’s Severance Tax,” Policy Matters Ohio, May 2012, available at www.policymattersohio.org/taxing-fracking-may2012.

Photo Gallery

1 of 22