Testimony: Income tax cuts not a prescription for prosperity

March 24, 2015

Testimony: Income tax cuts not a prescription for prosperity

March 24, 2015

Contact: Zach Schiller, 216.361.9801

Wendy Patton, 614.221.4505

Testimony to the House Finance Committee

Good morning, Chairman Smith, Ranking Member Driehaus and members of the committee. My name is Zach Schiller and I am research director at Policy Matters Ohio, a nonprofit, nonpartisan organization with the mission of creating a more prosperous, equitable, sustainable and inclusive Ohio. Thank you for the opportunity to testify today regarding House Bill 64.More income-tax cuts are not the prescription for prosperity in Ohio. A decade of tax cuts has further shifted the weight of state and local taxes from the rich to middle and lower-income families, but it has not boosted the economy. Ohio still lags the nation in job creation and income growth. Ohio would get a better return on investment by improving communities, building opportunities for children and creating the infrastructure needed by businesses and individuals alike.

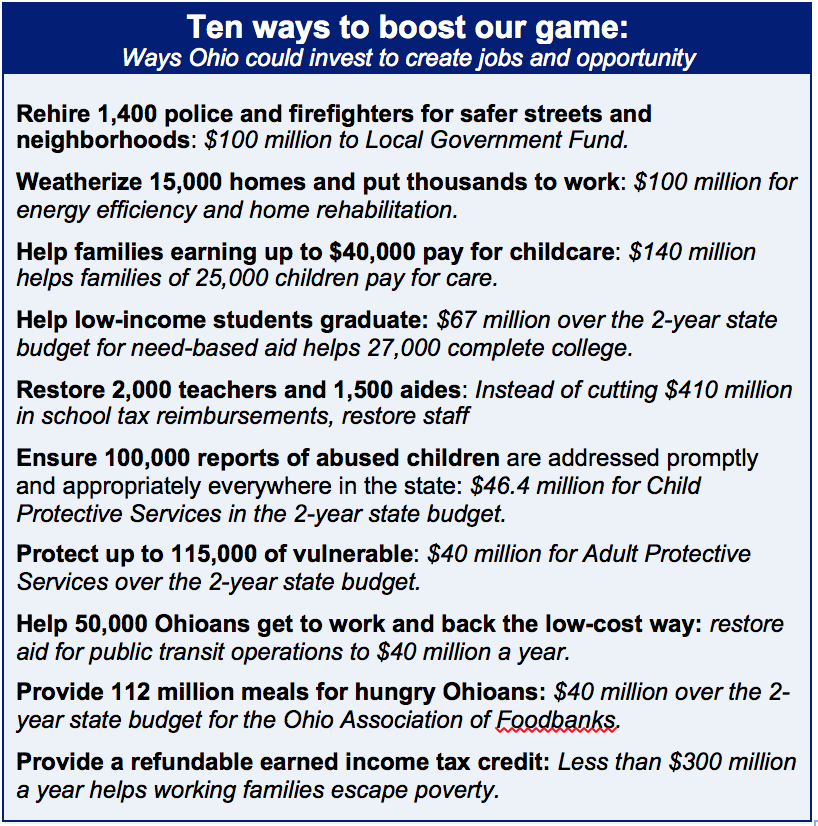

We need to restore aid to local governments. We need to help more of our young people to afford to go to college. We need to assist more families to pay for childcare, helping many to work. We languish near the bottom among states in public health indicators. Our support for public transit ranks below that of South Dakota and needs a substantial boost. These are just a few of our unmet needs. Listed below are some investments – far from a comprehensive list – that could benefit all Ohioans (Further description and notes on how the estimates were calculated are included in this report: http://www.policymattersohio.org/invest-march2015).

While there are a number of positive elements in Gov. Kasich’s tax proposal, such as raising the severance tax, cutting some unnecessary tax breaks and reviewing tax exemptions and credits, further slashing income taxes is not in Ohio’s interest. It detracts from Ohio’s fiscal stability; sales-tax revenues don’t grow as fast as those from the income tax, so the revenue raised today from a boost in the sales-tax rate won’t make up for the same amount of income tax over the long term. Income-tax cuts also are unlikely to result in accelerated job creation. We have not seen greater job gains after previous Ohio income tax cuts and there is no reason to expect a different result this time.

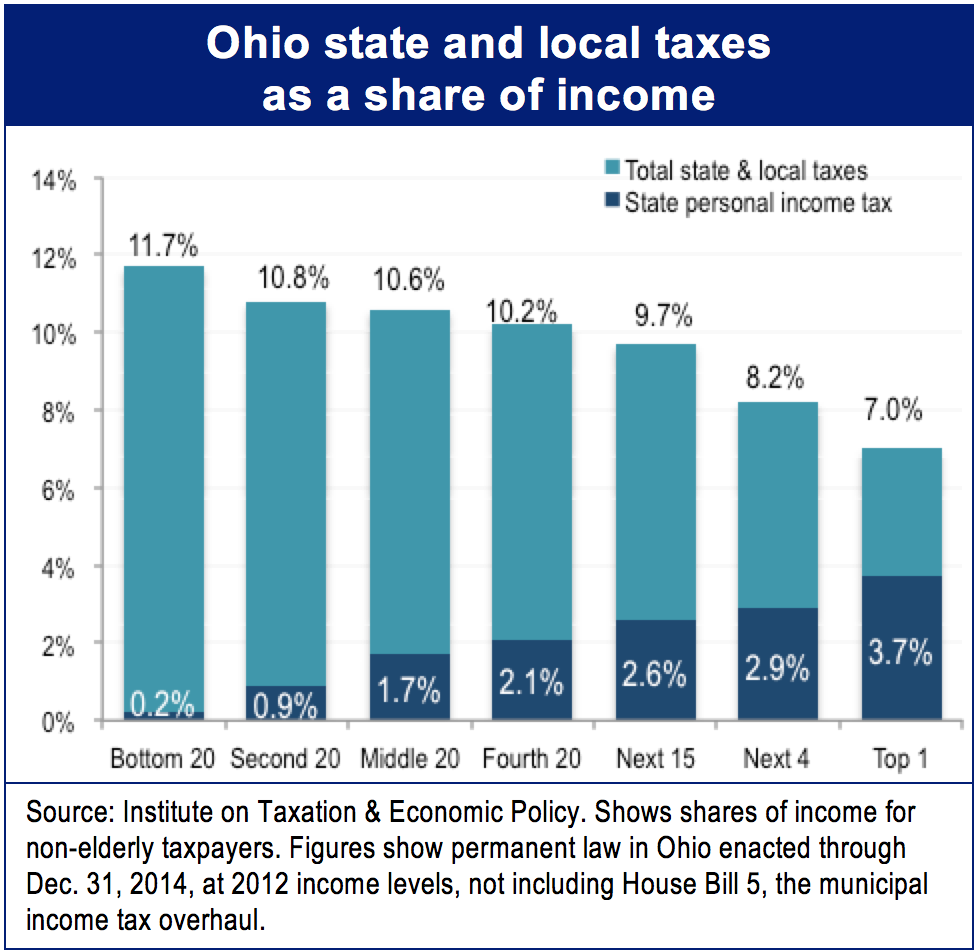

Our state and local tax system is weighted against low- and middle-income Ohioans. The chart below shows how much non-elderly tax filers in different income groups pay in such taxes as a share of their income. It also indicates how the personal income tax fits in. As you can see, the top 1 percent, who made at least $356,000 in 2012, pay just 7.0 percent of their income in state and local income, property, sales and excise taxes. By contrast, the lowest fifth, who make less than $18,000, on average pay 11.7 percent (a full description of the data is available at http://www.policymattersohio.org/tax-report-jan2015).

Ohio’s personal income tax is the one major tax that is based on ability to pay. You can see that cutting that tax will benefit low-income Ohioans very little. Reducing the income tax further will skew the tax system even more against lower- and middle-income Ohioans.

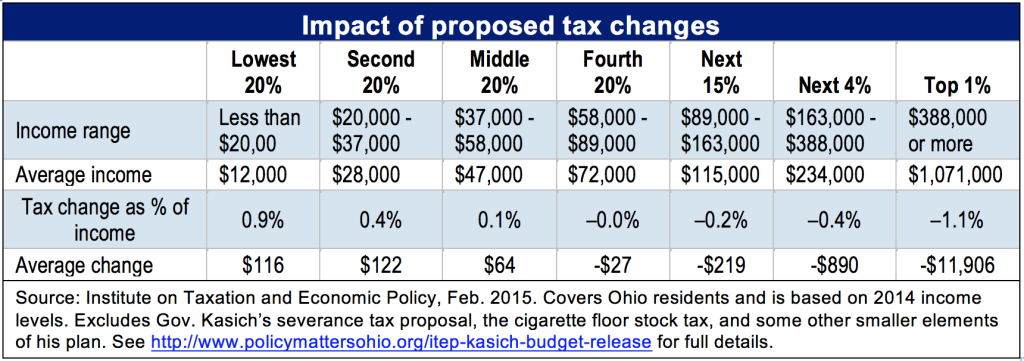

These data are based on an analysis by the Institute on Taxation and Economic Policy, a nonprofit research group in Washington, D.C., that has a model of the tax system. At our request, ITEP also examined Gov. Kasich’s tax proposal. Its review included all the biggest ongoing elements of the proposal except the severance tax. Please note that this analysis is not directly comparable to the one mentioned above because it is based on 2014 income levels and takes in all Ohio residents.

The bottom three-fifths of Ohioans would pay more as a group under the governor’s plan, as most of the increases like the sales-tax rate boost would fall more heavily on those with low or middle incomes. Even excluding the proposed increases in the cigarette and tobacco taxes, the proposal remains highly rewarding to Ohio’s most affluent, while costing more on average for the bottom two-fifths of Ohio residents.

The numbers shown represent the average change for people in each income group. Individual taxpayers may do better or worse. There is little doubt that many Ohioans will see income tax cuts under the governor’s proposal. However, fundamentally, this tax plan redistributes income from poor and middle-class Ohioans to the affluent. We should not embrace that policy.

As part of his testimony, Commissioner Testa provided examples of hypothetical taxpayers and how much they would pay in income and sales taxes in 2016 compared to 2011. Later, the department provided information reviewing the impact of the governor’s proposal for some of these same taxpayers. Unfortunately, even the latter information does not provide a full picture of how the governor’s proposal would affect taxpayers. It excludes most of the tax increases that are a part of the proposal, such as the boost in the Commercial Activity Tax, most of the expanded base of the sales tax and corresponding increase in local sales tax, and other elements of the plan. This is why it paints a much rosier picture than the data presented above.

The proposed increases in the personal exemption would benefit a significant number of Ohioans, especially middle- and upper-middle-income taxpayers, who would receive most of that tax cut. But increasing the exemption does not make this a good tax plan for low-income Ohioans. One million Ohioans, or one in five tax filers, do not pay income tax. They will lose out under the plan—and many more will do the same. This is not because they don’t contribute; as a group, the poorest fifth of Ohioans pays more in taxes as a share of their income than others do. As shown in the first chart in this testimony, they pay a disproportionate share of their income in other taxes: sales, excise and property taxes, which are flat taxes.

A number of the tax measures that Gov. Kasich has proposed are worthy of consideration. As Commissioner Testa has said, raising the Commercial Activity Tax is appropriate, given the big tax cuts that Ohio businesses received earlier. The severance tax needs to be increased to help communities affected by fracking and ensure that Ohio is receiving adequate compensation for the depletion of one-time resources. However, these and other measures to improve Ohio’s tax system should be considered on their own, not to pay for unneeded income tax rate cuts and the business-income tax exemption.

Thank you very much for the opportunity to testify. I would be pleased to answer any questions you may have.

###

Policy Matters Ohio is a nonprofit, non-partisan research institute

with offices in Cleveland and Columbus.

Tags

2015Ohio Income TaxRevenue & BudgetTax PolicyWendy PattonZach SchillerPhoto Gallery

1 of 22