Testimony: More tax cuts not in Ohio's best interest

June 09, 2015

Testimony: More tax cuts not in Ohio's best interest

June 09, 2015

Lawmakers should invest in Ohio, not give away more unneeded tax cuts, Policy Matters tells senators.

Contact: Zach Schiller, 216.361.9801

By Zach Schiller and Wendy Patton

Good morning, Chairman Oelslager, Ranking Member Skindell and members of the committee. My name is Zach Schiller and I am research director at Policy Matters Ohio, a nonprofit, nonpartisan organization with the mission of creating a more prosperous, equitable, sustainable and inclusive Ohio. Thank you for the opportunity to testify today regarding House Bill 64.

More income-tax cuts are not the prescription for prosperity in Ohio. A decade of tax cuts has further shifted the weight of state and local taxes from the rich to middle and lower-income families, but it has not boosted the economy. Ohio still lags the nation in job creation. Ohio would get a better return on investment by improving communities, building opportunities for children and creating the infrastructure needed by businesses and individuals alike.As we prepared this testimony, many key elements of the bill were not clear. Some improvements have been made, such as the addition of more need-based aid for college students and the restoration for two of the three critical components of maternal health care for women between 138 percent and 200 percent of the federal poverty line. However, Ohio has many other important needs. We need to restore aid to local governments far more than the amounts outlined in the Senate bill. We need to assist more families to pay for childcare, helping many to work. We have tens of thousands of vacant homes that need to be demolished or rehabilitated. Our support for public transit ranks below that of South Dakota and needs a substantial boost. Protective services for elders and children, never adequately funded by the state, will see ongoing loss through elimination of tax reimbursements to local levies. Funding needs of food pantries, strained as Kasich administration policies have narrowed eligibility for food stamps, have not been met. These are just a few of our unmet needs, some of which were described in this report: We will examine more closely how the bill deals with these and other priorities.

Infant mortality is the international indicator of the well-being of a nation or a people. Ohio’s infant mortality rate is among the highest in the nation. We applaud you for maintaining current Medicaid eligibility levels for maternal health in pregnancy care and breast and cervical cancer treatment. The third critical prong of this strategy to reduce infant mortality, family planning, has not been restored to the current eligibility level of 200 percent of poverty. Ohio needs the full, comprehensive, tripartite strategy used internationally for reducing infant mortality until the rate of all neighborhoods in Ohio reflect a first-world status.

As we submit written testimony on June 8th, lack of written documentation prevents us from clearly understanding how the Senate bill will affect the earlier extension of Medicaid for low-income Ohioans who do not get health care insurance through their employers. That extension meant that last year, a half-million Ohioans who gained access to health care are now leading more healthy and productive lives. It is critically important for individuals, families, employers, communities and a major employment sector – the health care sector – that the extension continue. Senator Burke’s comments on a proposed Medicaid waiver with premiums and co-pays seemed to indicate continuing support, but the proposed added charges can be expected to lower participation and reduce the promise of cost control and better health.

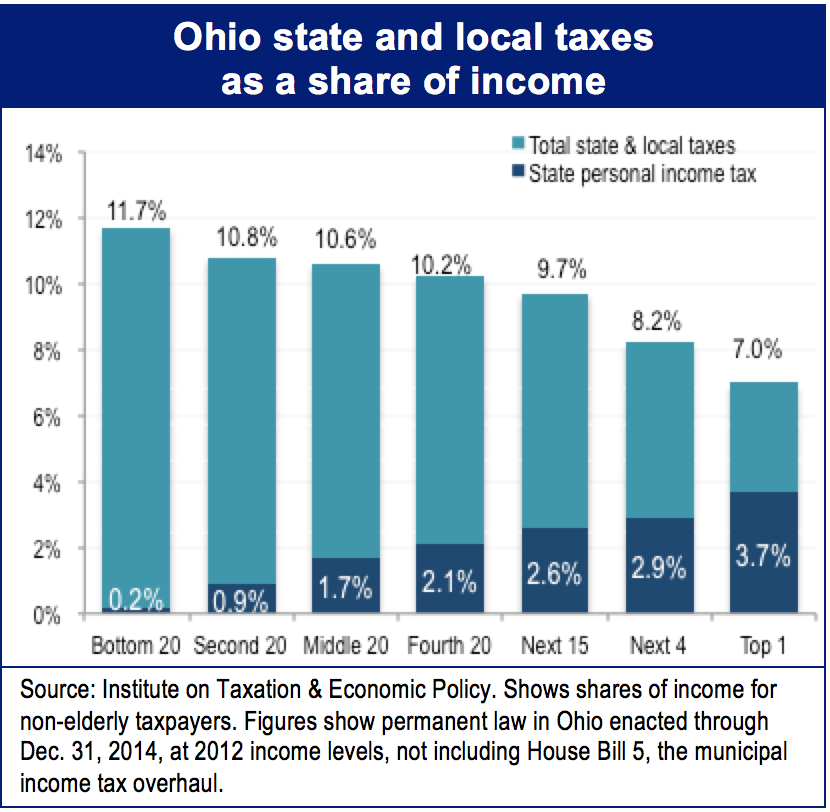

Our state and local tax system is weighted against low- and middle-income Ohioans. The chart below shows how much non-elderly tax filers in different income groups pay in such taxes as a share of their income. It also indicates how the personal income tax fits in. As you can see, the top 1 percent, who made at least $356,000 in 2012, pay just 7.0 percent of their income in state and local income, property, sales and excise taxes. By contrast, the lowest fifth, who make less than $18,000, on average pay 11.7 percent (a full description of the data is available here).

As you can see, cutting Ohio’s personal income tax will benefit low-income Ohioans very little. Reducing that tax further with across-the board cuts and business-income tax reductions will skew the tax system even more against lower- and middle-income Ohioans. These data are based on an analysis by the Institute on Taxation and Economic Policy (ITEP), a nonprofit research group in Washington, D.C., that has a model of the tax system.

Facts do not support the expansion of the business-income deduction and proposed flat tax in the substitute bill. If the existing deduction is so crucial, why have so many business owners ignored it? Scattering this deduction among business owners may feel good, but it has not resulted in job gains. In the first three quarters of last year, the number of employees added by new businesses adding employees for the first time was below the same period in 2012 or 2013, and down 29 percent from that period in 2004, a decade earlier. In the 22 months between June 2013 (when this tax break was approved) and April 2015, U.S. percentage job growth accelerated compared to the previous 22 months; in Ohio, it was down a hair. Where are the jobs?

A number of the tax measures you have been considering are worthy of consideration. Raising the tobacco tax is an appropriate measure to improve public health. The severance tax needs to be increased to help communities affected by fracking and ensure that Ohio is receiving adequate compensation for the depletion of one-time natural resources. We hope you will find a way to approve a meaningful boost in that tax without the loopholes included in some versions previously considered. Means-testing the Social Security deduction and retirement and senior credits would make the tax system fairer and preserve revenue as the population ages. We urge that you include that in the Senate bill, along with a provision to make the state Earned Income Tax Credit refundable. As a nonrefundable credit unlike the federal EITC, our state credit only helps a small share of the poorest working Ohioans.

These and other measures to improve Ohio’s tax system should be considered on their own. Tax increases like the proposed increase in the cigarette tax should not pay for unneeded income tax rate cuts and expanded tax breaks for business income. Robert Lapp of the Manufacturing Policy Alliance told the House Ways & Means Committee, “…when the companies represented by the MPA look to expand or add new facilities to meet growth demands, the personal income tax is NOT one of the critical factors considered when making a final site selection.” MPA members include some of the largest and best-known manufacturers in Ohio, such as General Electric, Ford Motor Co. and Timken Co. It is worth taking note of this message.

Thank you very much for the opportunity to testify.

###

Policy Matters Ohio is a nonprofit, non-partisan research institute

with offices in Cleveland and Columbus.

Tags

2015Ohio Income TaxRevenue & BudgetTax ExpendituresTax PolicyWendy PattonZach SchillerPhoto Gallery

1 of 22