Wealthy not paying fair share of state and local taxes

April 11, 2016

Wealthy not paying fair share of state and local taxes

April 11, 2016

State and local taxes support schools, fix potholes, keep the snow plowed, the justice system running and the water clean. Economic prosperity depends on these public services. The wealthiest families benefit amply from our communities and state. But are they paying their fair share for these benefits? New data says they are not.

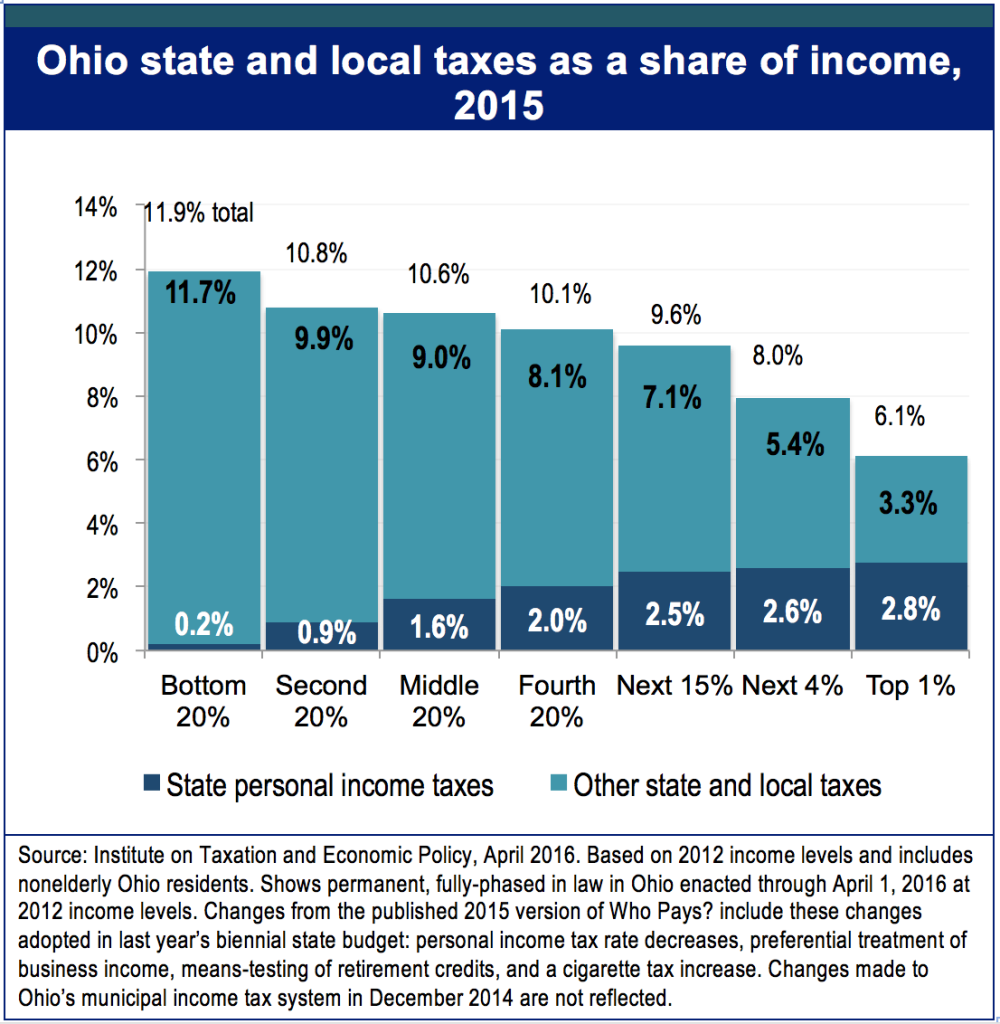

In 2015, average tax filers in Ohio in the bottom fifth of the income scale paid just about twice the percentage of their income in state and local taxes as the richest 1 percent (see figure to the right). That’s according to new data provided to Policy Matters Ohio by the Institute on Taxation and Economic Policy, a national research group with a sophisticated model of the tax system.

But as tax filing day approaches, consider this: The only element that keeps the tax structure from being even more stacked against poor and middle-income Ohioans is the state personal income tax (dark blue bars). While the poorest pay very little in state income taxes, almost half of what the richest pay is in state income tax.

Ohio’s state personal income tax is based on how much money you earn, or your ability to pay. Ohio’s income tax starts at a rate of about half of 1 percent on taxable nonbusiness income up to $5,200, increases to almost 1 percent on income up to $10,400, phasing up to the highest rate of nearly 5 percent on income over $208,500. Credits and exemptions mean in addition that a single taxpayer does not pay income tax on income under $12,200.

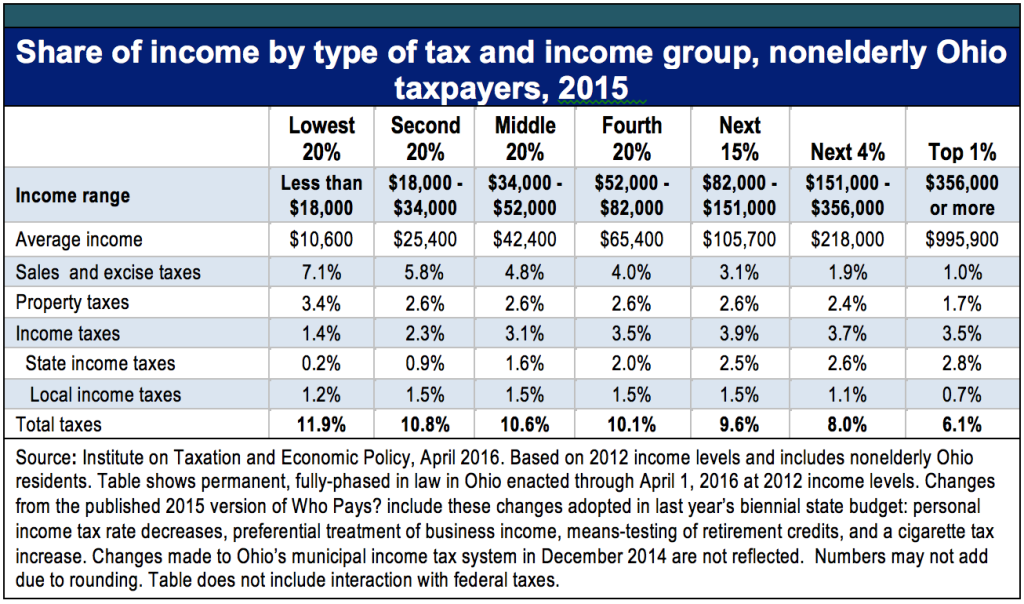

The figure above illustrates how the state income tax keeps things from being even more slanted against poor and middle-income Ohioans. The table to the right gives the numbers. The state personal income tax accounts for just 0.2 percent of the income of the average tax filer in the lowest fifth and less than 2 percent of those in the middle. While the share of total income paid in sales and property taxes falls as income rises, Ohio’s progressive income tax increases at higher income levels, providing needed balance to the system.

The figure above illustrates how the state income tax keeps things from being even more slanted against poor and middle-income Ohioans. The table to the right gives the numbers. The state personal income tax accounts for just 0.2 percent of the income of the average tax filer in the lowest fifth and less than 2 percent of those in the middle. While the share of total income paid in sales and property taxes falls as income rises, Ohio’s progressive income tax increases at higher income levels, providing needed balance to the system.

Ohio has cut the state personal income tax by more than $3 billion a year in a series of steps since 2005. This provides a windfall to the wealthiest and makes our overall tax structure less fair. Last year’s budget bill created a tax study commission that is supposed to come up with recommendations for turning the state income tax into a flat-rate tax, like the sales tax or the property tax. This would increase rates for most Ohioans while bringing them down for the most affluent, further tilting the tax system. It’s a move in the wrong direction.

Taxes pay for things we all need and wealthy people share in the benefits – often to an even greater degree. The share of income they devote to public services should be at least as much or more than families of more modest means. Ohio’s legislators should protect and strengthen the state income tax and study ways to make it more fair, not less.

-- Wendy Patton

Wendy is Policy Matters senior project director.

Tags

2016Revenue & BudgetTax PolicyWendy PattonPhoto Gallery

1 of 22