Well-off are winners in Ohio tax plan

June 26, 2015

Well-off are winners in Ohio tax plan

June 26, 2015

Contact: Zach Schiller, 216.361.9801

The tax plan in the Ohio state budget bill soon to land on Gov. Kasich’s desk will reward Ohio’s most affluent with average annual tax cuts of more than $10,000 a year, while the poorest fifth Ohioans will pay slightly more as a group. That is the conclusion of a new analysis for Policy Matters Ohio by the Institute on Taxation and Economic Policy (ITEP).

The tax plan in the Ohio state budget bill soon to land on Gov. Kasich’s desk will reward Ohio’s most affluent with average annual tax cuts of more than $10,000 a year, while the poorest fifth Ohioans will pay slightly more as a group. That is the conclusion of a new analysis for Policy Matters Ohio by the Institute on Taxation and Economic Policy (ITEP).A conference committee met earlier this week and finalized the budget bill, including key points from the Senate tax plan. It made some tweaks, such as phasing in a big expansion of a tax break on business profits and slightly reducing the increase in the cigarette tax.

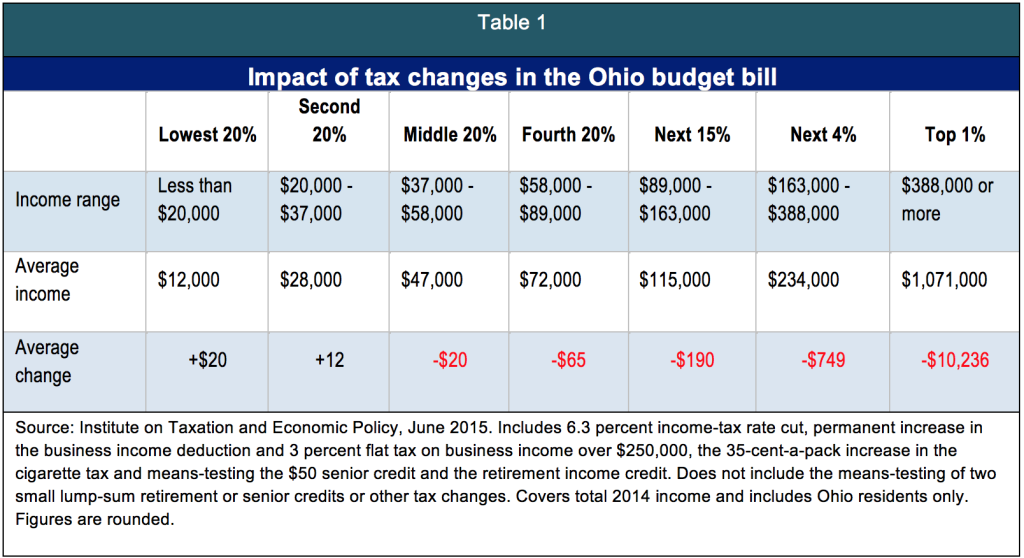

The new analysis found that Ohio residents in the top 1 percent of the income spectrum, who made at least $388,000 last year, would receive half of the total income-tax cuts under the bill agreed upon by the conference committee. This group on average would see an annual tax cut of $10,236, including other tax increases in the plan. The middle fifth of taxpayers, who made between $37,000 and $58,000, would see an average cut of just $20. The bottom fifth of taxpayers, who made less than $20,000 last year, would see an average increase of $20.

Unlike tax changes in each of the last two years, there are no special features in this tax plan specifically aimed at lowering taxes for low- and moderate-income Ohioans. The state and local tax system is skewed against less affluent residents, who pay more of their income in such taxes than the wealthy do. The conference committee tax plan would further reinforce that.

The biggest element in the tax plan is a 6.3 percent across-the-board income-tax rate cut. This would cost more than $1.2 billion over the biennium, according to the Legislative Service Commission. It also includes an expansion of the existing tax break for business income to exempt such income up to $250,000 and tax additional business income at a 3 percent flat rate, an increase in the cigarette tax by 35 cents, to $1.60 a pack, and the limitation of four senior or retirement credits to those with incomes below $100,000. The bill does not increase the tax on other tobacco products, as the Senate bill would have, nor does it means-test the income-tax exemption for Social Security income, as the House had done in its version.

ITEP reviewed the two major income-tax cuts, the cigarette tax increase, and the means-testing of the senior and retirement income credits. The analysis reflects the fully phased-in business-income tax cut; under the tax plan, 75 percent of the first $250,000 in business income would be exempt from taxation in 2015, and the full 100 percent starting in 2016. The ITEP review does not include the means-testing of two small lump-sum retirement or senior credits or other tax changes.

Table 1 below details how the tax plan would affect Ohio residents at different income levels.

The 35-cent cigarette tax increase is worthwhile because of the demonstrated improvement of higher tobacco taxes on public health. However, this increase falls most heavily on the lowest-income Ohioans. Cigarette taxes are charged per unit, not based on price, and lower-income individuals are more likely to smoke. Of course, only cigarette smokers will pay this added tax. However, even excluding the cigarette tax boost, the proposal remains highly rewarding to Ohio’s most affluent, while providing meager benefits to most Ohioans. The bottom four-fifths of Ohio residents would receive just 15 percent of the tax cuts. Even those making between $58,000 and $89,000 would only receive an average annual benefit of $94.

Current law allows owners of businesses who pay individual income tax on their profits to deduct half of the first $250,000 in such income; the level had been set at 75 percent for last year only. Many have not bothered to claim the deduction, and despite claims it would bolster the economy, Ohio’s job gains have still lagged behind the nation’s since the existing deduction was approved two years ago (See “Testimony to the Senate Finance Committee on House Bill 64,” Policy Matters Ohio, June 9, 2015, at http://www.policymattersohio.org/senate-testimony-june2015). This expanded break is estimated to cost $793 million over the two-year budget period.

Legislators excised from the final bill certain tax breaks that had been approved by the Senate, such as one for forklift trucks and another for golf courses. However, they still include others, such as a special break in the state’s main business tax for companies operating at a New Albany business park.

A committee to study the tax system first included in the House bill saw its mission broadened so that it will review all state tax credits, and specifically the historic preservation tax credit. The state should certainly evaluate tax credits, most of which have never been reviewed, but it should do so on a permanent basis, and look also at other exemptions in the tax code, not just credits. Though it could still be strengthened, House Bill 9, unanimously approved by the House on Wednesday, provides for such a committee.

The tax study committee also is to produce recommendations on the severance tax by Oct. 1, and later on how to transition to a flat 3.5 percent or 3.75 percent income tax by 2018. A stronger severance tax is long overdue, but most Ohioans would pay more under those proposed flat income taxes, which would further reward the rich (See “Ohio flat tax mandate is unwise, unwarranted,” Policy Matters Ohio, June 22, 2015, at http://www.policymattersohio.org/flattax-june2015). Prescribing a move to specific rates prejudges what the committee will find in its study. Governor Kasich should veto that part of the committee’s assignment.

“Ohio continues to cut the tax that favors most residents, the only one based on the ability to pay,” said Zach Schiller, Policy Matters Ohio research director. “Ironically, the income-tax cuts are based in part on favorable revenue trends in the income tax. Reducing the income tax undercuts the state’s financial sustainability, as we saw during and after the recession, when previous income-tax cuts helped contribute to major revenue shortfalls. Instead of such cuts, we should be restoring aid to local governments and investing in needed public services, such as education, public transportation and protecting our elderly and children.”

###

Policy Matters Ohio is a nonprofit, nonpartisan state policy research institute with offices in Cleveland and Columbus. The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization based in Washington, D.C. that works on federal, state, and local tax policy issues. ITEP’s Microsimulation Tax Model allows it to measure the distributional consequences of federal and state tax laws and proposed changes in them, both nationally and on a state-by-state basis. We are grateful to the Saint Luke’s Foundation, the George Gund Foundation, the Ford Foundation, and the Center on Budget and Policy Priorities for funding that enables us to do this analysis.Tags

2015ITEPRevenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22