Ohio can design a leading prepaid debit card for state tax refunds

October 24, 2012

Ohio can design a leading prepaid debit card for state tax refunds

October 24, 2012

Download reportPolicy Matters has identified 12 principles that will help Ohio set up a smart structure and appropriately regulate fees associated with a prepaid debit card.

New approach can save millions, help under-banked families

Over the last few years, state governments have begun issuing prepaid debit cards rather than paper checks for government payments to individuals. Unemployment compensation, supplemental food assistance (referred to as SNAP or food stamps), and most recently, tax refunds, are being provided by direct deposit or loaded onto prepaid debit cards.[1] These electronic transfers and debit cards increase efficiency of payment and decrease state costs compared to paper checks, which fewer states are providing. The first type of transfer, direct deposit, provides a safe, reliable and convenient method of payment for taxpayers with bank accounts. The other electronic option, prepaid debit cards, can help unbanked clients if states get the fees and accessibility right.

Ohio is considering legislation, Senate Bill 365, that would allow the state to issue a prepaid debit card as an option for those who do not receive direct deposit for their state tax refund. The state can save money by issuing the cards, but it is essential that Ohio set up a smart structure and appropriately regulate fees associated with the card.[2] Getting these details right will ensure that Ohio families and communities fully benefit from tax refunds. This brief provides lessons Ohio can learn from experiences in other states and with existing cards here. According to the Department of Taxation, nearly 40 percent of those receiving state tax refunds – 1.4 million Ohioans – opted for a paper check and not direct deposit. Given the numbers of paper check filers, it is imperative that Ohio offers a prepaid debit card that is safe, transparent, and easy to use.

12 principles for prepaid debit cards for tax refunds

Policy Matters has identified 12 principles that will help make sure that Ohioans benefit from a fair and safe prepaid debit card for tax refunds. State policymakers should:

Policy Matters has identified 12 principles that will help make sure that Ohioans benefit from a fair and safe prepaid debit card for tax refunds. State policymakers should:

- Create an open and transparent process for firms bidding to provide the card to ensure that the best card for consumers, and the state, emerges;

- Heavily promote direct deposit as the safest and least costly option;

- Allow a hardship waiver that allows a paper check for Ohioans who are elderly or have disabilities;

- Allow taxpayers receiving prepaid debit cards access to their full refund, at least once, without additional ATM costs;

- Require that card issuers provide simple, easy-to-read disclosure of all fees and conditions on paper, both before and after the card is issued;

- Require clear, concise instructions on card use that identify free locations and methods for withdrawing funds from the card;

- Prohibit fees at in-network ATMs and favor larger ATM networks;

- Forbid overdraft fees or lines of credit, which are expensive and detract from the purpose of the card;

- Forbid point-of-sale fees for using the card to make purchases in stores;

- Forbid fees for getting checking account balances via an automated telephone system and at other electronic options such as ATMs;

- Require that the funds on the card not expire for at least one calendar year and prohibit fees for balances that remain active from month-to-month;

- Provide for one free replacement card in case of loss of original.

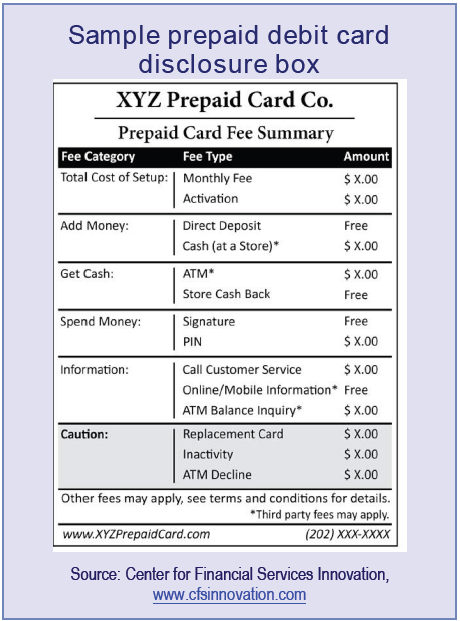

One remedy for the concerns regarding price and transparency is the prepaid debit card box designed by the nonprofit research group, Center for Financial Services Innovation (CFSI). This box, displayed at right, allows consumers to understand and compare the true costs of a debit card. By reviewing the fees upfront, customers can compare the costs of the prepaid card with other financial options. Making this kind of comparison available to Ohioans would allow them to compare the costs of having their state tax refund being directly deposited versus being put on a prepaid debit card.

We recommend that Ohio adopt these 12 principles and require a box like the one pioneered by CFSI. The result will be a safer approach that works better for Ohio families and communities.

[1] Karen Harris. “Tax Refunds Issued on Prepaid Cards take a toll on Consumers,” (February, 2012) Shriver Center: http://tinyurl.com/8q22yfv.

[2] See Ryan Holeywell, “Debit Cards Replace Paper Tax Refunds in Some States,” Governing” (June, 2012): http://tinyurl.com/8pzjjsx, and Barbara Hoberhock “Tax Refund Card Draws Criticism,” Tulsa World (June 11, 2012): http://tinyurl.com/8onog4z.

Tags

2012Basic NeedsConsumer ProtectionDavid RothsteinPhoto Gallery

1 of 22