Seven Ohio free tax coalitions receive $396,000

November 22, 2011

Seven Ohio free tax coalitions receive $396,000

November 22, 2011

For immediate release

Contact David Rothstein at 216.361.9801 Download PDF (4 pages)

For thousands of low- and moderate-income Ohioans, free tax preparation assistance is increasingly available this tax season. Seven Ohio coalitions, with dozens of free tax sites, received grants from the Internal Revenue Service to participate in the Volunteer Income Tax Assistance (VITA) program. The VITA program provides free tax preparation for low-income and underserved families through trained and certified volunteers. Other free tax preparation efforts include The Ohio Benefit Bank™ and certain tax clinics that together prepare more than 100,000 tax returns in Ohio. The seven grantees received more than $396,000 to expand their free tax preparation services in the communities they serve.

Free tax preparation allows families making about $50,000 or less to receive and keep all of their refund while ensuring proper federal and state tax filing. Paid tax preparation can be expensive, particularly for families living at or below the poverty level. Many economic and social programs are administered through the tax system, making free tax preparation crucial for working families.

Much of the focus of free tax preparation includes helping families to claim the Earned Income Tax Credit (EITC), a refundable tax credit that helps families pay for basic needs. The EITC is the largest national poverty relief program for low- and middle-income families. Its popularity stems from its emphasis on work, its simplicity, and its ability to assist children in low- and moderate-income families. Working families and policymakers praise the EITC because it is refundable – if the credit exceeds the amount owed by the taxpayer, the taxpayer receives a refund for the difference. In 2010, the EITC provided more than 950,000 Ohio families with total refunds of $2.1 billion, an average of $2,100 per claiming family.[1]

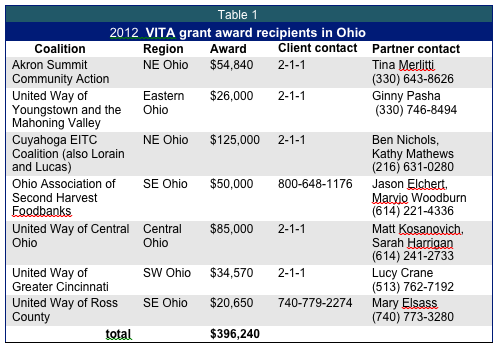

Each tax coalition sets income eligibility for free tax preparation. For the VITA program, limits are generally $49,000; the Ohio Benefit Bank™ sets its limit at $60,000. Table 1 lists the seven grant recipients with contact information.

[1] Internal Revenue Service, “EITC State Statistics at-a-Glance for Tax Year 2010.” http://www.eitc.irs.gov/central/eitcstats/ (updated 10/13/2011).

Tags

2011Consumer ProtectionDavid RothsteinEITCOhio Income TaxPhoto Gallery

1 of 22