Income inequality in Ohio is sharp and growing

Posted February 19, 2014 in Press Releases

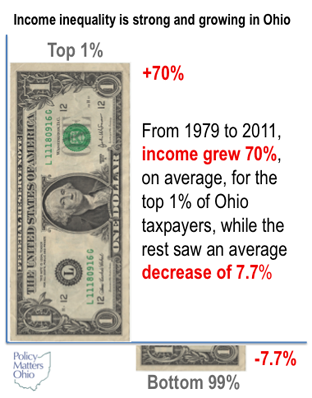

For immediate releaseContact Zach Schiller, 216.361.9801Download Ohio Facts (1 pg)Download full report (31 pp)Inflation-adjusted incomes of the top 1 percent of Ohio taxpayers grew 70 percent between 1979 and 2011, but the average real income for the rest fell 7.7 percent. The average real income of Ohioans in the top 1 percent grew by 111.2 percent between 1979 and 2007, nearly 10 times as much as that of the other 99 percent. During that period ending before the recent recession, the top 1 percent captured almost half of the income gains.

New study shows gains of top 1 percent overshadow the rest

The widening income inequality that has hit the United States in recent decades has not spared Ohio, according to a new state-by-state analysis. The Increasingly Unequal States of America, a study by Estelle Sommeiller and Mark Price for the Economic Analysis Research Network, estimates income trends by state of the top 1 percent and the bottom 99 percent of taxpayers from 1917 through 2011.

The widening income inequality that has hit the United States in recent decades has not spared Ohio, according to a new state-by-state analysis. The Increasingly Unequal States of America, a study by Estelle Sommeiller and Mark Price for the Economic Analysis Research Network, estimates income trends by state of the top 1 percent and the bottom 99 percent of taxpayers from 1917 through 2011.

Their findings for Ohio include:

- Inflation-adjusted incomes of the top 1 percent in Ohio grew 70 percent between 1979 and 2011, but the average real income for the rest fell 7.7 percent.

- The average real income of Ohioans in the top 1 percent grew by 111.2 percent between 1979 and 2007, nearly 10 times as much as that of the other 99 percent. During that period ending before the recent recession, the top 1 percent captured almost half of the income gains.

- As in other states, inequality in Ohio narrowed between 1928 and the mid-1970s, but has widened since then.

- Comparing the total gain for the two groups, all real income gains between 2009 and 2011 went to the top 1 percent versus the other 99 percent.

While income inequality in Ohio is sharp and growing, it is not as extreme as in states like New York and Connecticut, nor has it grown as much as the national average. In 2011, the average income of the top 1 percent in Ohio was 18.1 times as great as the average for the bottom 99 percent, below the U.S. average of 24.4. Ohio’s neighboring states show a similar pattern.

The recession hit Ohio incomes across the board, temporarily reducing some of the gap between the top 1 percent and everyone else. But lopsided growth resumed with the economic recovery: Between 2009 and 2011, the last year of data for the study, the bottom 99 percent of Ohioans saw real income go down while the top 1 percent showed a 14.8 percent increase.

The new paper follows up on work of Thomas Piketty and Emmanuel Saez, who generated widely cited findings on the incomes of the 1 percent for the United States as a whole. It relies on tax data reported by the Internal Revenue Service.

###

Increasingly Unequal States of America: Income Inequality by State

(Release for national report)

All 50 states have experienced widening income inequality in recent decades, finds a new report published by EPI for the Economic Analysis and Research Network (EARN). In The Increasingly Unequal States of America: Income Inequality by State, Estelle Sommeiller, and Mark Price conduct a state-level analysis of income trends from 1917-2011. They show that between 1979 and 2007 states reflected the national pattern of extreme income inequality growth, with the top 1 percent of taxpayers capturing 53.9 percent of all income growth. The average income of the bottom 99 percent of U.S. taxpayers grew by 18.9 percent, while the average income of the top 1 percent grew over 10 times as much