Meigs County

Posted November 05, 2012 in Press Releases

State OverviewDownload PDFImpact of the 2012-13 state budget (HB 153)

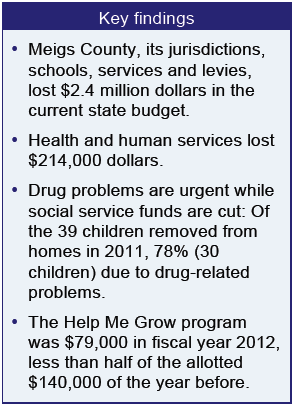

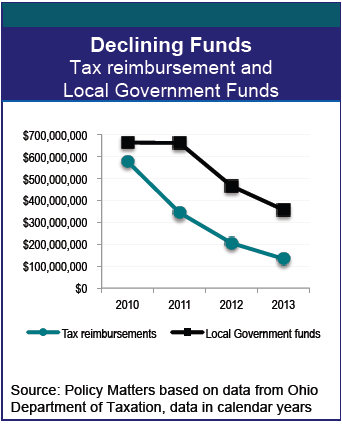

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Meigs County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Meigs County?

The state cut the Local Government Fund to the county, forcing Meigs County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund............ -$46 thousand

- Schools........................... -$1.7 million

- County operations............. -$698 thousand (includes county undivided fund)

- Letart Township................ -$20 thousand

- Middleport....................... -$22 thousand

- Pomeroy......................... -$42 thousand

Loss to health and human service levies

- County mental health/ Developmental disabilities......... -$158 thousand

- County seniors services.......................................... -$37 thousand

- County health services............................................ -$18 thousand

Note and Quotes

The Meigs County Library saw a 33.5 percent budget cut from 2007 to 2012. This resulted in cuts to both staff and hours of operation at all four branches. The library laid off five full-time and five part-time employees in 2009. From “Library hoping to maintain services with help of tax levy,” Daily Sentinel, February 7, 2012. http://tinyurl.com/9hfya5s.

The Meigs County Library saw a 33.5 percent budget cut from 2007 to 2012. This resulted in cuts to both staff and hours of operation at all four branches. The library laid off five full-time and five part-time employees in 2009. From “Library hoping to maintain services with help of tax levy,” Daily Sentinel, February 7, 2012. http://tinyurl.com/9hfya5s.

“Before, we [children’s services] had a staff of 10. Right now, we’re hiring one person, which will put us at 6. We’ve lost case workers, unit support workers…it makes it difficult to do everything.”