Scioto County

Posted November 08, 2012 in Press Releases

State OverviewDownload PDFImpact of 2012-13 state budget (HB 153)

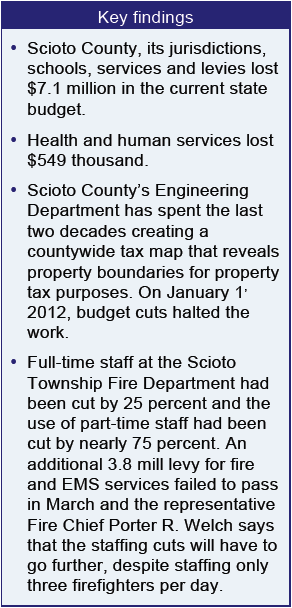

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Scioto County?

Ohio’s budget for 2012 and 2013 cut local government aid by a billion dollars. This means cuts in services we depend on, from road repair and emergency services to crossing guards, senior transportation and child protective services. What are the implications for Scioto County?

The state cut the Local Government Fund to the county, forcing Scioto County to make cuts to jurisdictions within the county. The state also cut direct funding to municipalities, and slashed reimbursements for taxes it had eliminated, taxes that businesses and utilities had paid to local governments. School districts and the public library fund were also cut. Losses in calendar years 2012 and 2013, compared to 2010 and 2011, include, among others:

- Public Library Fund.......................... -$161 thousand

- Schools......................................... -$3.0 million

- County operations............................ -$1.8 million (including LGF for townships)

- New Boston Corp............................. -$299 thousand

- Portsmouth..................................... -$1.2 million

- Scioto County Joint Ambulance.......... -$21 thousand

Loss to health and human service levies:

- County mental health/developmental disabilities... -$430 thousand

- County children’s services................................ -$93 thousand

- County senior services.................................... -$26 thousand

Notes and quotes

The Scioto Township Fire Department’s budget was reduced by 56 percent from 2011 to 2012. As a result, the department had to cut full time staff by 25 percent and part-time staff by 75 percent. The number of fire fighters on duty at any given moment has been reduced from six to three. These cuts were due largely to the privatization of emergency services at a local correctional facility. From Lucas, Matt, “Scioto Township levy fails on second try,” Circleville Today, March 7, 2012 http://tinyurl.com/93phfuz.

“We’ve cut staffing to the bare bones at this point. Employees have already taken concessions … Unfortunately, these will have to go farther.”